SF East Bay Real Estate Market Update

December 31, 2019

Here are some highlights for the 39 East Bay Cities that I track:

Affordability, increasing inventory, reduced sales, considerations of moving out of the Bay Area, possibility of recession, are all topics of interest in a market in transition. Properties are staying on the market longer, we’re seeing fewer offers than before, more price reductions and some incentives now being offered, in effect, all favoring buyers. Yet indecision has many buyers on the fence with a wait and see attitude despite having more choices. The gap between buyer and seller expectations has increased. A softening of the market has many sellers still holding out for top dollar, while buyers seeing a bit of leverage for the first time in years are now looking to possibly take advantage.

The two numbers that stand out at the end of December is the huge drop in inventory that took place and the percentage of homes that are now sitting. This is the time of year when things begin to slow down. However, it happened earlier this year starting in November. Buyers are hesitant on doing much when we start to reach the holiday season and they tend to shelve their search until the beginning of the new year. Sellers are aware that with less activity comes fewer buyers. If they haven’t already listed their property by now, considerations on delaying until the spring comes into play. We see fewer listings come onto the market in December, and inventory comes down. It’s also a time for possible bargains. However, there’s been less to look at. Many sellers who “have to” sell will stay the course and soften their expectations.

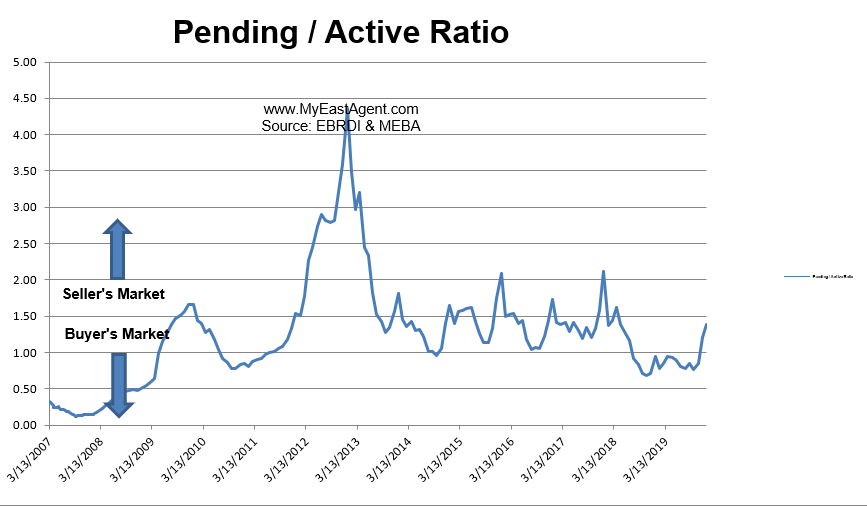

- Here’s where we stand as of the end of December. Following a huge decrease of inventory in November, we again experienced another big drop in December. Inventory is down 59% in the last 2 months, now sitting at an 18 day supply of homes for sale. This is far less than what we saw last year at this time of 27 days. Pendings decreased again, primarily due to the lack of new inventory coming onto the market but it’s similar to where we were last year. The pending/active ratio increased again to 1.39. This is well above where we were last year at the end December of .94. The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (less inventory with more pendings) favors sellers. A number below 1 favors buyers. The last two months have been into positive territory with a ratio of over 1 for the first time since June 2018. It signals that we may be setting up for a stronger seller’s market in the spring.

- 71% of the homes listed are now “sitting” for 30 days or longer, while 46% have stayed on the market for 60 days or longer. This is fairly normal for this time of year and similar to what we saw last year (with then 74% remaining active over 30 days and 47% remaining active over 60 days). However, these percentages can be somewhat misleading. Many of the homes that have not been selling remain on the market while fewer newer homes are coming onto market because of Holiday concerns. That’s why the percentage of sitting homes goes way up.

- The “distressed” market, (foreclosures and short sales) are no longer a factor representing less than .05% of the market.

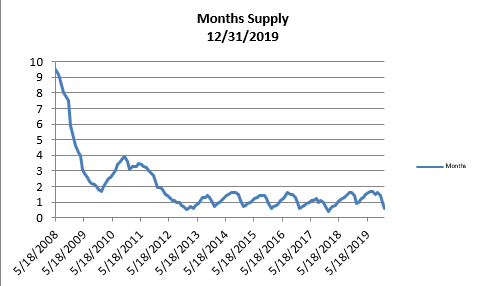

- The month’s supply for the combined 39 city area is 18 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years. Supply is less when compared to last year at this time, of 27 days.

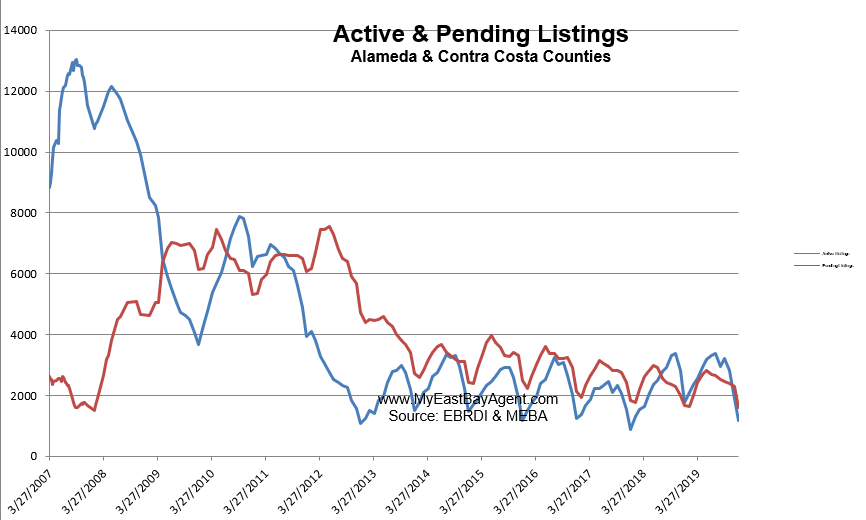

- Our inventory for the East Bay (the 39 cities tracked) is now at 1,163 homes actively for sale. This is fewer than what we saw last year at this time, of 1,765. This is the lowest number that we’ve seen since December 0f 2017. We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales decreased to 1,616, about what we saw last year at this time of 1,629.

- Our Pending/Active Ratio is 139. Last year at this time it was .94

- Sales over the last 3 months, on average, are 2.0% over the asking price for this area, slightly lower than what we saw last year at this time, of 2.2%.

Recent News

Editorial: The Bay Area housing market has finally priced everyone out

By San Francisco Chronicle Editorial Board, January 6, 2020

Has the Bay Area housing market finally priced itself out of reach for, well, everyone?

According to a new survey of more than 100 economists and real estate experts, the answer is yes.

The panelists, who assessed the nation’s housing markets as part of a price expectations survey for the real estate website Zillow, said they expected the nation’s hottest real estate markets in 2020 to be in the South. Austin, Texas, took the top honor — a whopping 83% of experts believe it will outperform the national average of 2.8% housing price growth in 2020.

As for the nation’s worst real estate market in 2020?

The winner of that unfortunate designation is the Bay Area. San Francisco was at the top of the list for expected underperformers — 64% of experts believe it will underperform in 2020. It was closely trailed by San Jose: 61% of experts believe that city’s housing market will underperform.

A large proportion of those experts believed that the Bay Area will not just underperform, but actually see declining home values: 57% expect home values to fall in San Francisco, and about half expect the same for San Jose.

After the last several years of torrential real estate growth, underperforming or even falling home values in the Bay Area wouldn’t necessarily be a bad thing.

High home prices have placed homeownership out of reach for all but the wealthiest in the Bay Area. They also influence the cost of rent, which has grown far faster than the average Bay Area resident’s wages.

They affect construction and development costs, too. The Bay Area experienced 6.7% growth in construction costs in 2018: According to Turner & Townsend’s 2019 survey of international construction markets, San Francisco was the world’s most expensive place to build.

Local housing prices flattened out last year, and construction costs slowed, too. The question is, will the Bay Area experience slower growth for the right reasons?

Unfortunately, the answer is no.

In a well-functioning housing market, housing prices would be falling because increases in demand would result in increases in new construction.

In the Bay Area, a major reason for the slowdown is that people are leaving — and taking their need for housing with them.

According to the state Department of Finance, California lost about 197,600 people to net domestic migration during the year that ended July 1. It’s no accident that Texas, one of the states to which California is losing the most residents, has historically had ample housing development at a much lower cost.

Losing these residents means losing their ideas, energy and contributions to the economy. High housing prices have also meant that fewer people can move here, where they’d have access to the Bay Area’s specialized jobs and markets — a situation that has exacerbated income inequality and will eventually eat away at our relative economic advantages.

The Bay Area housing market may also be suffering from the Trump administration’s ill-considered cap on state and local tax deductions, which have disproportionately affected home price appreciation in states with higher property taxes and mortgage interest deductions.

In both instances, flattening or even declining home prices in the Bay Area are the result of flawed public policy and unnecessary restrictions on growth. Without solutions, a pause in home appreciation might give the Bay Area a breather — but we’ll still be stuck with the problems that brought us to this place.

Bay Area will be nation’s coolest housing market in 2020, survey says

By Kathleen Pender, SF Chronice, Jan. 2, 2020

Austin, Texas, is expected to be the nation’s hottest housing market this year and the Bay Area the coolest, according to economists and real estate experts surveyed for real estate website Zillow.

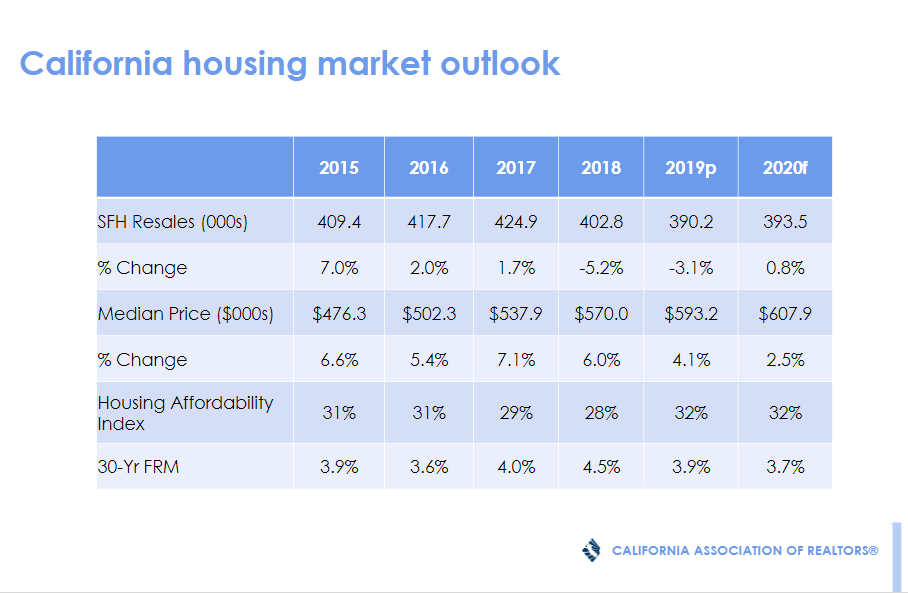

On average, the panelists said they expect U.S. home prices to grow by 2.8% in 2020.

Of the 25 large markets included in the survey, the Texas capital earned the top score: 83% expect it to outperform the national average vs. 7% who think it will underperform, for a net score of 76. The hottest markets after Austin were Charlotte, Atlanta and Nashville, with scores of 59, 51 and 49, respectively, Zillow said in the report.

The San Francisco Bay Area earned the lowest score of negative 40; only 24% said it will outperform versus 64% who think it will underperform. The next coolest markets were San Jose (minus 38), Los Angeles (minus 35), Cincinnati (minus 33) and Sacramento (minus 31).

Ken Rosen, chairman of the Fisher Center for Real Estate and Urban Economics at UC Berkeley, agreed that the Bay Area will lag the nation this year.

After three years of huge appreciation, prices in the Bay Area were down or flat in 2019, depending on location, he said. Rosen expects a further correction this year, especially in Silicon Valley. San Francisco and its inner suburbs will be flat or up slightly, and outer suburbs will be flat to slightly down. Overall, he expects the median Bay Area home price will be flat to up or down 2%.

He pointed out that mortgage rates have risen about a quarter- to half-percentage point from their lows in August-September.

Also, the tax law changes that took effect in 2018 have increased the after-tax cost of owning a home. The law capped the previously unlimited itemized deduction for all state and local income, property and sales taxes at $10,000 combined. “Your property tax, even though constrained by Proposition 13, for many people (is) not fully deductible,” Rosen said. “A lot of people felt good because they were protected (from large property tax increases) by Prop. 13. Even with Prop. 13 still in place, many people have tax bills twice as big” as $10,000.

The tax law also limited the mortgage interest deduction to interest on $750,000 in debt, down from $1 million previously.

He added that the trend of people moving outside California to cheaper states “is going to get bigger in the next five years,” because of higher taxes, higher home prices and growing congestion.

California lost an estimated 197,600 people to net domestic migration during the year ended July 1, according to the state Department of Finance. That is the number of people who left California for other states minus the number who moved here from other states. If you include people moving into the state from other countries, California lost 39,500 residents due to net migration. (Births still caused the population to grow since they exceeded deaths.)

Other data show that California is losing the most residents to Texas, Arizona, Nevada and Oregon.

Mike Englund, chief economist with Action Economics, said that “we will have a pretty solid boom” this year in housing nationwide, led by the South. The southeastern quadrant of the U.S., including Texas, accounted for 53.6% of housing starts last year (numbers for December are estimated). Only 8.8% were in the Northeast, 24.8% in the West and 12.8% in the Midwest.

Research firm Pulsenomics conducted the survey for Zillow. More than 100 experts responded, but only 64 answered the question about individual markets.

A separate report, released last month by Fitch Ratings, said that capping the state and local tax or SALT deduction at $10,000 “may have exacerbated slowing home price growth in certain areas,” including California. Fitch rates corporate and government debt, including mortgage-backed and municipal bonds. It’s owned by Hearst, which owns The Chronicle.

Since early 2018, when the so-called SALT cap took effect, “states with higher property taxes have seen acute home price appreciation slowdown and even price declines in several metropolitan areas” including San Francisco, Fitch said.

It compared home-price appreciation in the 10 states whose residents took the highest property tax and mortgage interest deductions on their 2017 tax returns to the 10 states with the lowest tax and interest deductions. In the high-cost, high-tax states (which included California), the average rate of year-over-year price appreciation fell from 6.4% in January 2018 to 2.7% in September 2019. In the low-tax, low-cost states, the appreciation rate rose very slightly, from 3.9% to 4%, over the same period.

There could be other factors to explain steep drop-off in home-price appreciation in high-tax states after the SALT cap took effect, but “you can see there is a pattern there, a trend you cannot ignore,” said Bulin Guo, an associate director with Fitch.

Bold Predictions for 2020: Shrinking Homes and a More Stable Market

By Skylar Olsen, Zillow, on Dec. 9, 2019

With the housing market stabilizing from the drama of the early years of home price recovery and the subsequent slowdown during 2019’s home shopping season, we have a rare moment of calm to reflect on what housing might look like in the year to come.

If current trends hold, then slower means healthier and smaller means more affordable. Yes, we expect a slower market than we’ve become accustomed to the last few years. But don’t mistake this for a buyer-friendly environment – consumers will continue to absorb available inventory and the market will remain competitive in much of the country.

But while the national story is a confident one, housing in some manufacturing-heavy markets may see adversity. The struggle could be even more stark, since similarly affordable housing markets with a more balanced job profile may be 2020’s rising stars.

Here are our bold predictions for the trends and styles that will dominate the housing market in the first year of the next decade.

The United States will NOT enter a recession in 2020

As recently as this summer, half of a panel of economic experts surveyed by Zillow said they expected a recession to come in 2020 – with another third saying they expected the economy to shrink in 2021. Ongoing trade volatility, the potential for some kind of geopolitical crisis to flare up and/or a stock market retreat from record highs were all cited as the most likely potential triggers for the next downturn…

…but it became clear as the year progressed just how resilient the U.S. economy has been to these and other economic headwinds:

- After slowing down late in the summer, consumer spendingperked back up again in October and remains on a steady path.

- Healthy consumer spending is a sign of healthy consumer confidence– which, despite some modest declines lately, still remains at relatively high levels and points to continued growth in the near term.

- Employers continue to add jobsat a decent clip, and the unemployment rate is near record lows – which is helping to push wage growth up.

- After sluggish (at best) growth throughout much of the recovery following the Great Recession, wage growthhas been at or above 3% per year in every month since October 2018.

It’s important to be clear-eyed: The threat to the economy from trade volatility is real, and the manufacturing sector of the economy in particular has been hit hard lately after steadily building orders throughout much of 2018. And the stock market itself, while still testing new highs, is very sensitive to ongoing trade discussions – a reflection of overall investor faith and business leaders’ confidence in their ability to make effective, long-term, strategic decisions. And the potential for a minor conflict in any corner of the globe to become bigger at any time cannot and should not be ignored.

But taken all together, current conditions point to a recipe for continued economic growth, not a recession. Growth itself may be slower than the strong pace we’ve seen at times throughout the recovery, but growth will still occur for at least the next year.

Newly Built Single-Family Homes Will Continue to Shrink

After six years of uninterrupted growth through the early years of the recovery, the square footage of newly built, single-family homes began to shrink in 2016. We expect this downsizing trend to continue in 2020, driven by a confluence of economic and demographic trends.

First, the fine print: Yes, today’s new single-family home is roughly a third larger than it was 30 years ago, up to a median of 2,386 square feet in 2018 from 1,810 in 1988. But it’s also true that between 2015 and 2018 (despite a very slight increase between ’16 and ’17) the typical square footage of those homes fell from 2,467 to 2,386 – the largest such drop since at least 1988, not including the housing crash in the mid-aughts.

There are several 50,000-foot reasons why we expect this gentle downsizing to continue:

- Many of today’s younger, millennial home buyers have expressed a preference for denser, more urban homes that are more walkable to shared amenities.

- Younger buyers are struggling to afford large homes built in prior decades

- Eco-consciousness is also growing broadly.

- Today’s older homeowners are expressing a desire for smaller, less maintenance-heavy and more accessible (read: fewer stairs) homes as they age and move into newer homes. In 2019, 56% of new construction home buyers were 40 or older, according to the 2019 Zillow Group Consumer Housing Trends Report.

- Home builders are constrained by a shortage of buildable land in desirable areas. Prices on key building materials including lumber and steel are increasingly volatile. And competition for skilled construction labor is fierce, pushing wages up.

Each of these trends points to a continuation of this downsizing of new homes – smaller homes are inherently more dense, walkable and affordable; smaller homes are efficient and eco-friendly; smaller homes require less maintenance and are more accessible; smaller homes enable builders to do more with less.

There will always be demand for large, suburban homes on big lots – but on net, we expect attitudes to shift away from that and toward a lifestyle with a smaller footprint.

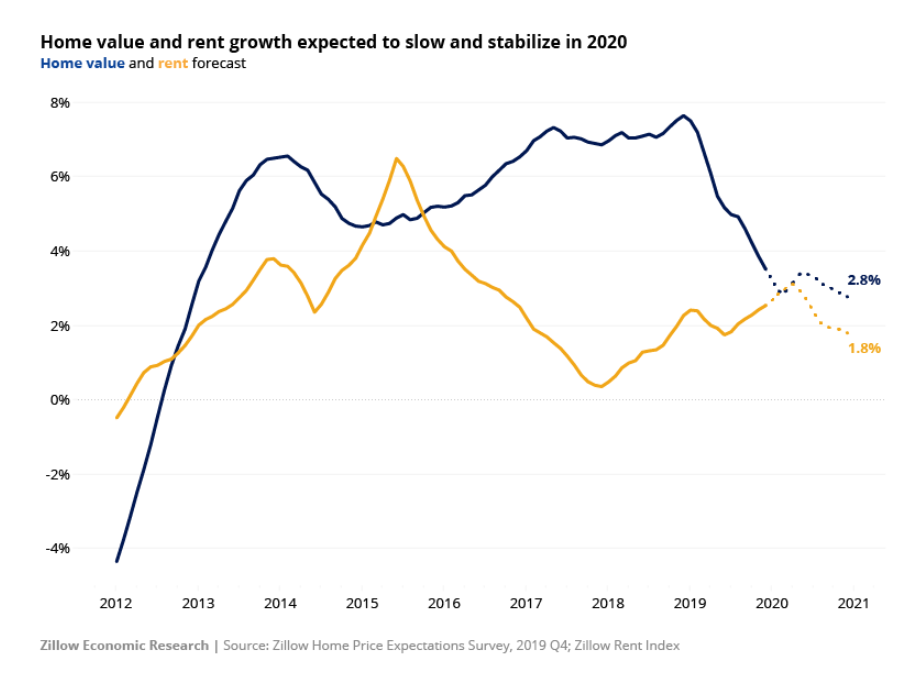

Home Value And Rent Growth Will Be Slower, More Stable and More Sustainable

Since hitting a recent high of 8.3% in December, annual growth in the median U.S. home value has been slower than the month prior in every month so far in 2019 – currently standing at 4.7% in October (the latest month for which data is available as of this writing). At the same time, annual rent growth – while largely stable – has crept up modestly in each month since June.

In 2020, we expect both rent and home value growth to slow somewhat further, stabilizing at a sustainable pace in line with wage growth and inflation and to a level indicative of greater balance between buyers and sellers, tenants and landlords.

The median U.S. home value is expected to end 2020 up 2.8 percent from the end of 2019, according to the Q4 2019 Zillow Home Price Expectations Survey, a quarterly survey of more than 100 economists and experts sponsored by Zillow and conducted by Pulsenomics. That’s down from the average prediction of 3.6% annual growth expected from the same panel by the end of 2019 compared to the end of 2018. Since 1996, the average annual pace of growth in the Zillow Home Value Index is 3.8%, so a slowdown from current levels would still represent a return to long-term norms.

On the rental side, annual rent appreciation has been on the rise since June and currently sits at about 2.3%. We expect this recent uptick in rental growth to continue through the start of 2020 before petering out sometime around the start of Spring. By the end of next year, we expect annual rent growth to fall below two percent, or about a half a percentage point lower than where they currently stand.

By keeping monthly mortgage payments within reach even as home prices rise, continued low mortgage interest rates will help ensure that rent growth doesn’t again reach the highs experienced just a few years ago. Low rates will encourage more renters to pursue homeownership, further boosting overall homeownership rates that have been on the rise since 2016.

Mortgage Rates Will Stay Low, Keeping Housing Demand High

Mortgage rates fell markedly in 2019, and are expected to remain near their current, relatively low levels for the bulk of 2020. Softening GDP growth and investment, continued global weakness due in part to the U.S.-China trade conflict, and below-target inflation will continue to hold rates in check. Barring marked improvements in these indicators, the Fed will have no reason to return to rate hikes.

If low mortgage rates persist, this will keep home purchase demand strong and continue to fuel decent price growth in the nation’s most broadly affordable markets. But low rates won’t be enough to reignite high growth rates in the nation’s highest-priced markets, notably on the West Coast and in the Northeast. In these markets, buyers seem to have hit an affordability ceiling where even low rates can’t bring many homes into the typical first-time buyer’s budget range, especially because low rates don’t help overcome the upfront hurdle of high down payment requirements. In those high-priced markets, buyers will continue to fan out in search of more affordable areas.

Color Will Make a Comeback

Goodbye, Hygge (look it up). Hello, color! Fun will return to home design in the form of bold prints, lively wallpaper and brightly hued walls. After a decade of Scandinavian modern design that dominated retail and social media feeds as Americans embraced neutrals, minimalism and clutter-free living, expect a shift toward playful, creative design. Look for color to be injected in unexpected ways in kitchen cabinetry and appliances, in lighting fixtures and on interior doors and moldings.

Home Sales will climb slightly and slowly

After bottoming out in January 2010 during the depths of the housing crash, overall annual U.S. existing home sales didn’t consistently top 5 million until late 2014. By late 2016, a growing number of first-time home buyers drove the annualized rate of national home sales to bounce around 5.5 million for over a year.

But by spring 2018, things started to turn down again: The seasonalized annual sales rate dropped back to 5 million by December 2018, and the impact of rising mortgage rates and the increasing difficulty in saving for an adequate down payment were the talk of the town. As sales pulled back, available inventory started to swell and what had been aggressive home value appreciation began to slow.

But 2019 brought another swing. Home value growth continued to soften, but mortgage rates came back down, what inventory that had accumulated was quickly scooped up and home sales rebounded.

Looking ahead at 2020, we think home sales will continue to climb, but slowly. Why?

- Although a small fraction of overall sales, new homes sales grew significantly in 2019. That has helped buoybuilder confidence and lead to some of the most robust permit and starts numbers in a long time.

- If builders in 2020 deliver on their promises to build smaller and at more affordable price points, new construction will continue to be attractive to buyers unable to find a match in the competitive and limited existing home market.

- Yes, inventory is tight – but when we say that, we’re really talking about the number of homes available to buy relative to demand from buyers. Sales can remain strong while inventory remains tight – and a sudden jump in the number of sales will result in a corresponding drop in inventory.

- What really matters is the flow of homes onto the market – the turnover or velocity of home sales, not months’ supply or overall level of available inventory, that constrains home sales numbers.

- And we have reason to believe that turnover among a given segment of homeowners will be made more possible now in a way that it wasn’t before. iBuyer business models, like Zillow Offers, are ultimately about lowering sellers’ transaction costs. Economics 101 says that lowering transaction costs and making transactions themselves easier will mean those transactions will happen more often.

Redfin’s 2020 Housing Market Predictions: More buyers + fewer homes = more bidding wars

By Daryl Fairweather, December 4, 2019

We predict the housing market will be more competitive in 2020 as the cooldown that began in the second half of 2018 comes to an end. Charleston and Charlotte will lead the nation in home-price gains, thanks to homebuyers moving in from expensive cities. Hispanic Americans will experience the biggest gains in home equity wealth. Climate change will become a much bigger factor for homebuyers and sellers. Read on for Redfin’s six housing market predictions for 2020.

Prediction #1: Bidding wars will rebound thanks to low mortgage rates and a lack of homes for sale

Low mortgage rates will continue to strengthen homebuying demand, but due to a lack of new homes for sale and homeowners staying put longer, there will be fewer homes on the market in 2020 than in the past five years. More demand and less supply mean bidding wars will rebound in the first quarter. We expect about one in four offers to face bidding wars in 2020 compared to only one in 10 in 2019. This increase in competition will push year-over-year price growth up to 6% in the first half of the year, considerably stronger than the 2% growth seen in the first half of 2019. Supply and demand will become more balanced later in the year as more listings of new and existing homes hit the market, allowing price growth to moderate to 3%.

Prediction #2: 30-year fixed mortgage rates will stabilize at 3.8%

Throughout 2020, 30-year fixed mortgage rates will remain low, hovering around 3.8%. Faced with slowing economic growth, the Federal Reserve will keep interest rates low. Although the housing market is strong, weakness in other sectors, like manufacturing, is pulling down on the economy. Because investors are already bracing for the possibility of a recession, we don’t expect mortgage rates to fall much lower than 3.5% in 2020 even if the economy weakens. And even if the economy strengthens, we expect mortgage rates to stay below 4.1%.

Prediction #3: For the first time, Hispanic Americans will gain more wealth from home equity than white Americans

In the next decade, Hispanic Americans will, for the first time, gain more home equity than white Americans. That’s because the majority of new homeowners are Hispanic, and home values in Hispanic neighborhoods are increasing faster than in white neighborhoods. There are more Hispanic homeowners in Texas than in any other state and Texas cities are likely to experience strong gains in home values over the next decade as people move here from more expensive places like San Francisco and Los Angeles.

Hispanic families will likely benefit from home-equity gains for generations to come. Hispanic Americans could tap their home equity to finance their children’s education or to start businesses. Over time, this will improve economic equality for Hispanic Americans.

Prediction #4: Climate change will become a bigger financial factor for homebuyers and sellers

In 2020, homebuyers and sellers will take the consequences of climate change into account when deciding to buy. The financial costs of climate change are already becoming more tangible as fire and flood insurance premiums rise. “More people are becoming hyper-sensitive to flood insurance and its costs,” said Houston Redfin agent Irma Jalifi. “They’re thinking about how the weather will change over the next decade and whether there will be more historic floods like we’ve experienced recently. I had a buyer back out of a deal because he found out the property required flood insurance.”

Over the next decade, higher insurance premiums in high-risk areas will make housing even less affordable to more people. And in areas with the highest risk, insurers may stop providing insurance altogether, which means it will be nearly impossible to secure a mortgage in those areas.

Prediction #5: Charleston and Charlotte will lead the nation in home price growth

Affordable Southeast cities like Charleston and Charlotte are attracting an increasing number of migrants from expensive cities, which will drive up home price growth in these areas. Charleston saw a 104% annual increase in the number of Redfin users looking to move in, relative to the number of users looking to move, out in the third quarter of 2019, and Charlotte saw a 44% increase. Migrants are attracted to the growing economies of Charleston and Charlotte—Microsoft is spending $23 million to expand its Charlotte campus, and in Charleston, the new Volvo plant is adding thousands of jobs.

“A lot of migrants from up north or out west move to Charleston because it is such a lovely place—out of towners fall in love with our Cypress gardens and world-class beaches,” said Redfin agent and team manager Jacie Paulson. “The fact that we have an international airport means that companies are more willing to allow their remote employees to live here because it is easy to travel back and forth to headquarters. We also have a strong local economy with jobs at Boeing, Volvo, and in the military.”

Prediction #6: More city streets will become car-free

In 2020, we will see more cities favor green modes of transit and actively discourage driving. Some cities already have plans in the works—San Francisco’s Market Street will transform into a car-free corridor in 2020, and New York City drivers will have to pay to drive into the heart of the city beginning in 2021. In cities that become less car-friendly, those that frequently spend time in the city-center will place more value on a commute that doesn’t require a car and move to either the walkable city center or close to public transit. Meanwhile, some people will choose to avoid the city-center altogether and put a higher value on homes in the suburbs where they can work, play and live.

Wildfires cause turmoil in California’s property insurance market

A law passed in 2019 gives the Department of Insurance emergency powers to keep policies in effect in fire-prone areas.

By Ken Sweet and Sarah Skidmore Sell, The Associated Press, December 24, 2019

Kent Michitsch seemed to be running out of traditional options to insure the home he’s lived in for more than 30 years northeast of San Diego as California’s massive property insurance market reels from three consecutive years of destructive wildfires.

Michitsch, 57, has received three non-renewal notices in three years and says he fears a fourth when his homeowners’ policy comes up for renewal the middle of next year if it wasn’t for California lawmakers’ recent intervention in the market.

“It’s constant worry and frustration. You know you’re covered now, but I might have to look for a new policy next year yet again.” Michitsch says he’s never made a claim on his insurance and never had fire damage.

Thousands of homeowners like Michitsch have lost their insurance policies in the last few years as insurers pull out of areas that are at risk of fire damage or stop insuring homes altogether. They’ve been forced to scramble to find coverage from regular insurance providers or to turn as a last resort to a government-sanctioned plan that at the moment only provides fire coverage.

State Farm, the largest insurer in the state, Allstate and other insurers declined to renew roughly 350,000 policies in areas at high risk for wildfires since 2015 the California Department of Insurance said back in August, and the department has gotten “record numbers” of requests this year from insurers to increase the rates they charge property owners. The data also show 33,000 policies were not renewed by insurers in zip codes affected by the major wildfires.

While the insurance industry says the California property insurance market is resilient, state lawmakers and officials have had to scramble to keep the market from grinding to a halt from the unexpected additional risk.

The California Legislature passed a law earlier this year giving the Department of Insurance emergency powers to keep policies in effect for those in fire-prone areas. This month California Insurance Commissioner Ricardo Lara put a one-year moratorium on non-renewals, in hopes that lawmakers, insurance companies and other stakeholders can reach a more substantial solution for the roughly 1 million homeowners in zip codes adjacent to previous wildfires.

“This wildfire insurance crisis has been years in the making, but it is an emergency we must deal with now if we are going to keep the California dream of homeownership from becoming the California nightmare, as an increasing number of homeowners struggle to find coverage,” Lara said in a statement.

The fires of 2017 and 2018 caused a combined $25.3 billion in damages according to the California Department of Insurance. That’s exponentially higher than the previous wildfires in 2015 and 2008, which caused $1.1 billion and $719 million in damages, respectively.

The insurance industry has yet to release an estimate of damages from this year’s wildfire season, but the costs are expected to be high. The most significant wildfire this year was the Kincade Fire, which started October 23 and burned 78,000 acres in Sonoma County. It destroyed 374 buildings and damaged another 60, according to the California Department of Forestry & Fire Protection.

“The wildfires in California will likely make it more difficult for California homeowners to buy insurance,” said Stu Ryland, senior vice president of the Pacific Region at Sedgwick, an insurance claims management company. “Premiums are likely to go up, particularly in areas that are prone to wildfires and in some cases, it may be difficult for consumers to find an insurer willing to write their insurance.”

While some insurers are pulling out and others are reconsidering how they price property insurance, it is still available in one form or another to every homeowner, according to the Insurance Information Institute.

However, those not insurable by regular insurance providers are having to turn to what’s known as the California FAIR Plan, which is a government-sanctioned association of insurers who pool together to cover the highest risk properties. FAIR Plan insurance currently only covers $1.5 million in damages, although Lara has ordered that starting in April 2020 it will cover $3 million in damages. Currently the FAIR Plan only covers fire, not other forms of risk, but California regulators have announced that FAIR Plan insurers can start doing comprehensive coverage.

Earlier this month, the California FAIR Plan Association sued to block those changes, arguing Lara’s order is illegal.

Karl Susman, owner of Susman Insurance Agency in Los Angeles, says the average annual premium on a homeowner policy plus FAIR to cover fire now costs around $2,500 a year, three times higher than it was three years ago.

“These wildfires are not sustainable for these companies. They aren’t going to go bankrupt but they are just going to stop writing policies,” he said.

Susman said he worries that without a longer-term solution the California insurance market will repeat the experience after the 1994 California Northridge earthquake, which caused many insurance carriers to stop offering earthquake insurance. He’s already seen insurance companies limiting their risk to certain zip codes as well.

“I haven’t seen anything like this in the 28 years I’ve been doing this,” he said.

Fortunately, those who still do have insurance have been able to start rebuilding their lives after the fires.

Maggie and Dan London of Santa Rosa lost their home in the massive and fatal Tubbs Fire of 2017. They worked quickly after the fire, filing a claim and reaching out to their contractor that same day. But it took them two years to rebuild and move back in.

Like many who tried to rebuild after the fire, they ran into obstacles — higher costs for labor and materials and ongoing talks with their insurer. All the same, Dan London feels his insurance company has done a fair job. And while they bought their home in 1979, he has not seen a sharp jump in insurance costs over time. The cost to insure their new home is slightly more, but Dan felt it reflects the increased value of the property.

“I was expecting something triple, but it’s not at all,” he said.

California REALTORS® applaud House vote to temporarily repeal SALT deduction limit

LOS ANGELES (Dec. 19) – The CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) today issued the following statement in response to the House passage of H.R. 5377, a bill that temporarily eliminates the cap on state and local tax (SALT) deductions for 2020 and 2021. The Restoring Tax Fairness for States and Localities Act would also increase the cap to $20,000 for married couples for 2019.

“We are pleased that the House has passed a bill to temporarily eliminate the cap on the amount of state and local tax that taxpayers can deduct on their federal tax returns. The combined hit of a reduction in the mortgage interest deduction and current $10,000 SALT cap in the tax law has disproportionately hurt taxpayers and real estate in California,” said C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif.

“Ensuring the tax code incentivizes housing and real estate will continue to be a top priority for REALTORS®, and C.A.R. thanks the many California Congressional members who support easing the double taxation penalty that harms California homeowners.”

Leading the way… ® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States, with more than 200,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

What landlords and tenants need to know about California’s new rent-control law

By Kathleen Pender, SF Chronicle, January 4, 2010

Associations representing tenants and landlords are getting flooded with questions about the statewide rent- and eviction-control law that took effect in California Jan. 1.

The most common one is: “Does this apply to me?”

The answer generally depends on the type of property, its age, whether the owner is a person or business entity and how long a tenant has occupied the unit.

AB1482, the Tenant Protection Act of 2019, limits annual rent increases to 5% plus an inflation rate, or 10% — whichever is less. It also prevents landlords from evicting tenants, even after their fixed-term lease runs out, except for a limited number of “just causes.” An individual property could be exempt from rent control, eviction control, both or neither.

The new law generally does not apply to units that are already subject to a local rent control ordinance. However, a unit could be exempt from a local ordinance but subject to the new state law, said Sasha Harnden, a housing policy advocate with the Western Center on Law and Poverty.

Here are brief answers to common questions. For more details, consult a landlord or tenant association or attorney or read the law online.

Q: What properties are exempt from rent control under AB1482?

A: Any type of rental property that was completed (based on its certificate of occupancy date) within the past 15 years is exempt. Once it turns 15 years old, it becomes subject to rent control, even if it’s in the middle of a lease, unless it qualifies for a different exemption.

The rent cap does not apply to single-family homes and condo units, regardless of age, as long as it meets two tests. It must be “separately alienable,” meaning it can be sold separately from any other dwelling unit. And the owner generally must be a person or revocable trust set up by one. The owner cannot be a real estate investment trust, corporation or limited liability corporation that has at least one corporation as a member.

To get this exemption, the owner must provide a specific notice to the tenant.

A duplex, triplex or larger apartment building is not separately alienable. The law, however, specifically exempts duplexes if the owner lives in one unit during the entire time of the tenancy.

The law does not define a duplex, so it’s unclear whether a single-family home with a detached unit, like a backyard cottage, would qualify as a duplex under this exemption, said Stephanie Shirkey, senior policy and compliance counsel with the California Apartment Association, which represents landlords.

There are also exemptions for “affordable housing” units, where rents are restricted by deed or government agency, and college dorms. There is disagreement as to whether renters with Section 8 vouchers are protected under the state law.

Q: What properties are exempt from eviction control?

A: The properties above that are exempt from rent control are also exempt from the new eviction controls. Two property types are exempt from eviction control, but not rent control: Properties in which a tenant shares a bathroom or kitchen with the owner, and owner-occupied properties (other than duplexes) if the owner rents no more than two units or bedrooms. The latter exemption would cover a home with an accessory dwelling unit or triplex if the owner occupies one unit, Shirkey said.

Q: What notices does a landlord have to provide?

A: Individuals who own a single-family home or condo only get the exemption from rent and eviction control if they give tenants a written notice of their exemption using a specific statement in the law. If the tenancy starts or renews on or after July 1, the notice must be provided in the rental agreement. For existing tenancies, landlords should provide a stand-alone notice as soon as possible. For tenancies that start between now and June 30, landlords can provide a stand-alone notice or put it in the lease, Shirkey said. When the tenancy renews, the notice must be in the lease.

Failing to provide this notice “could be a gotcha” for single-family rentals, Shirkey said.

If a unit is subject to both rent and eviction control under AB1482, the landlord must provide a notice informing the tenant of those protections.

If the unit is subject to neither — because it’s less than 15 years old or an owner-occupied duplex, for example — no notice is required.

Q: What is the rent cap in my area?

A: The cap is 5% plus an inflation rate that varies by region. It takes effect Jan. 1 for all units subject to the rent cap. However, if a landlord increased the rent by more than the allowable amount between March 15, 2019, and Jan. 1, the rent on Jan. 1 must be rolled back to the rent as of March 15, 2019, plus the allowable increase. The landlord does not have to refund any rent paid between March 15, 2019 and Jan. 1 that exceeded the allowable increase.

Q: What is the inflation rate?

A: It’s the annual percentage change in the consumer price index between April 1 of the current year and the previous year.

In four metro areas — San Francisco, Los Angeles, San Diego and Riverside — it’s the annual change reported by the Bureau of Labor Statistics for that area. For the San Francisco area (San Francisco, San Mateo, Marin, Alameda and Contra Costa counties), the inflation rate for last April is 4.01%, so the total allowable rent increase is 9.01%.

For all other areas, it’s the change in the California consumer price index reported by the Department of Industrial Relations. It’s currently 3.34%, for a total cap of 8.34%.

Q: Can an owner raise the rent more than 5% plus inflation to cover capital improvements?

A: No, some local ordinances allow this; the state ‘s does not.

Q: How does eviction control work?

A: Landlords have always been able to evict tenants for not paying the rent, violating the lease, conducting criminal activity on the property or other causes for which the tenants are at fault. That doesn’t change under the new law.

Under previous state law, landlords could also evict tenants for no cause, with the required advance notice, and could choose not to renew a fixed-term lease (unless the unit is subject to local eviction-control laws).

Under the new state law, landlords can only evict tenants who have occupied the unit for a certain length of time for specified “just causes.” These include causes for which the tenant is at fault, and a limited number of causes for which they are not at fault.

These no-fault causes include the owner’s intent to occupy the unit or move in a spouse, domestic partner, children, grandchildren, parents, or grandparents; demolish or to substantially remodel the property; or take the property off the rental market. They can also evict if a government orders it.

Before evicting a tenant, however, the landlord must give the tenant, in writing, the reason for the eviction and whether it’s an at-fault or no-fault cause. For no-fault evictions, the landlord must pay the tenant one month’s rent to cover relocation expenses.

Q: How long does the tenant have to occupy the unit to be protected under the law?

A: Tenants are protected under the rent-control provision as of Jan. 1 no matter how long they’ve occupied it.

Tenants are protected under the eviction provision after they have occupied the unit for at least 12 months. However, if a tenant brings in another adult over 18 (i.e. a roommate) before the original tenant has occupied the unit for at least 24 months, then the tenants are not protected under AB1482 until one of them has been there at least 24 months. “If I have already lived there two years, I can move in a roommate” and still be protected, Harnden said.

Q: Who enforces the new law?

A: The law did not set up an enforcement mechanism, so it’s unclear. Harnden said it could be enforced through legal aid groups that do eviction defense. Parties with a gripe may need to hire a lawyer.

Q: Is there any limit on what a landlord can charge when a tenant moves out?

A: No, the law did not establish vacancy control, so owners of non-exempt units can raise the rent to any amount after a tenant leaves.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link