SF East Bay Real Estate Market Update

January 31, 2020

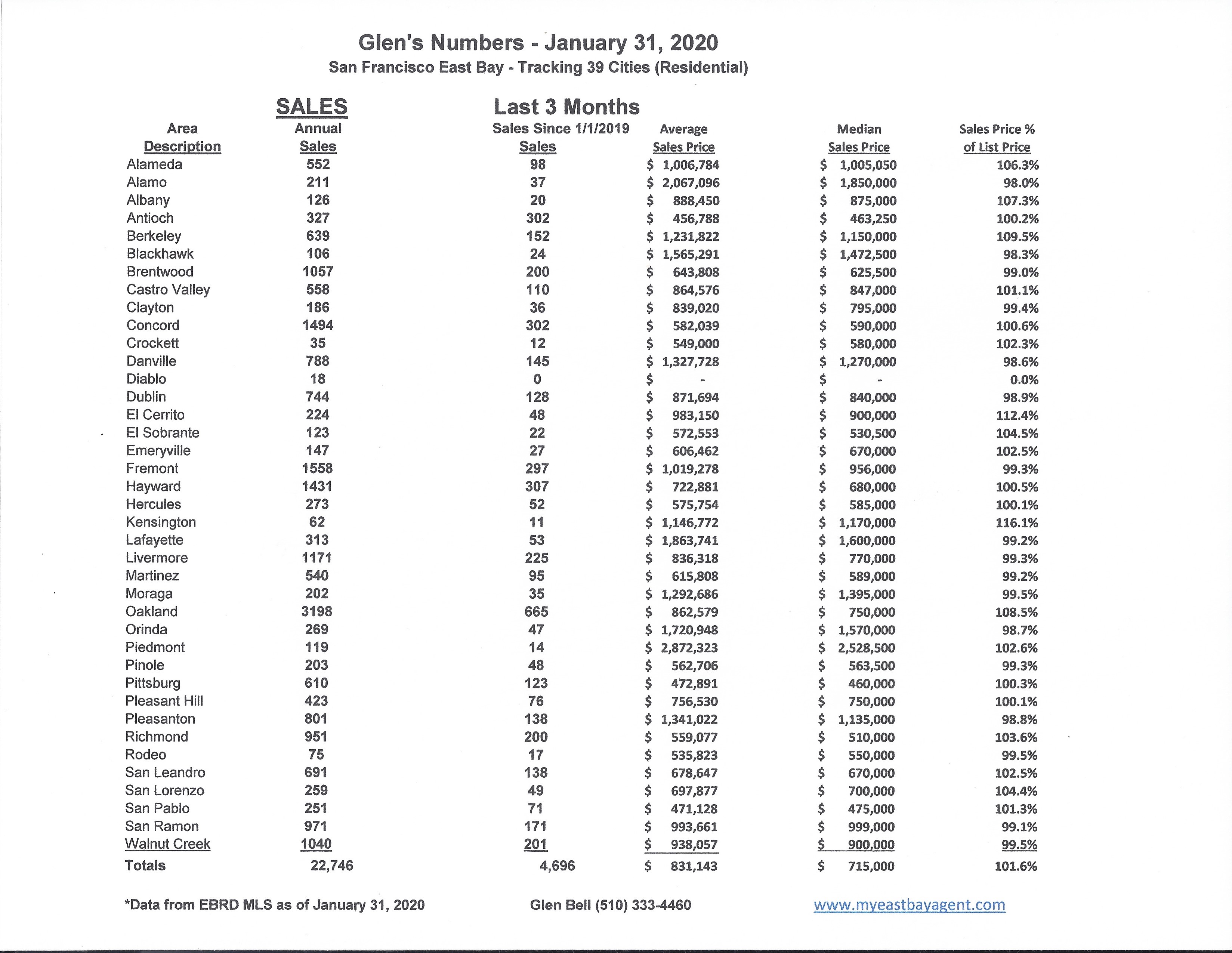

Here are some highlights for the 39 East Bay Cities that I track:

The market has been in transition for some time now. Affordability continues to be a major concern and as a result we’re seeing more and more people consider making the move out of the Bay Area. Properties are staying on the market longer, we’re seeing fewer offers than before, more price reductions and some incentives now being offered, in effect, all favoring buyers. Yet indecision has many buyers on the fence with a wait and see attitude despite having more choices. The gap between buyer and seller expectations has increased. A softening of the market has many sellers still holding out for top dollar, while buyers seeing a bit of leverage for the first time in years are now looking to possibly take advantage.

The seasonal drop in inventory followed our normal pattern during the holidays. We watched the number of homes decrease by nearly 60 % over November and December. Last year was somewhat unusual because we saw a late season start and early season end. Inventory was at its’ 2nd lowest level since I began tracking these 39 cities in 2006, with only 1163 homes for sale at the end of December. Our expectations normally are that new home listings begin to appear on the market as early as mid January with a steady increase of inventory every month through to September, traditionally our high point.

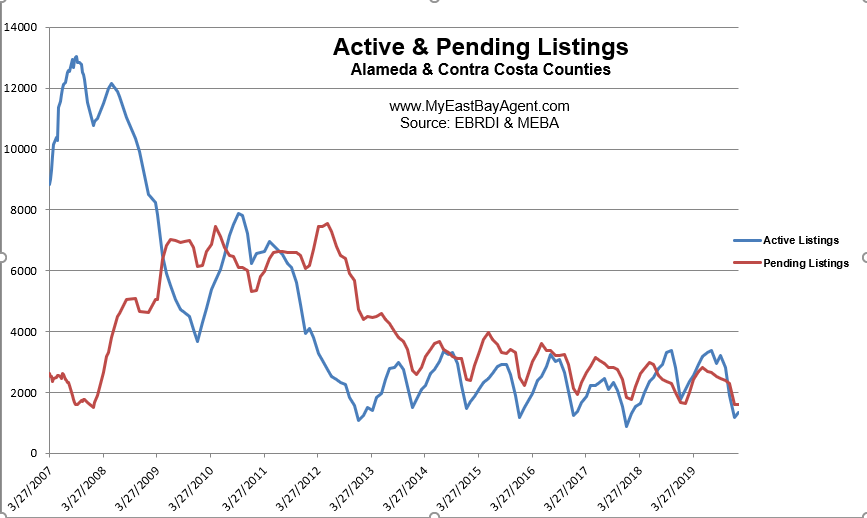

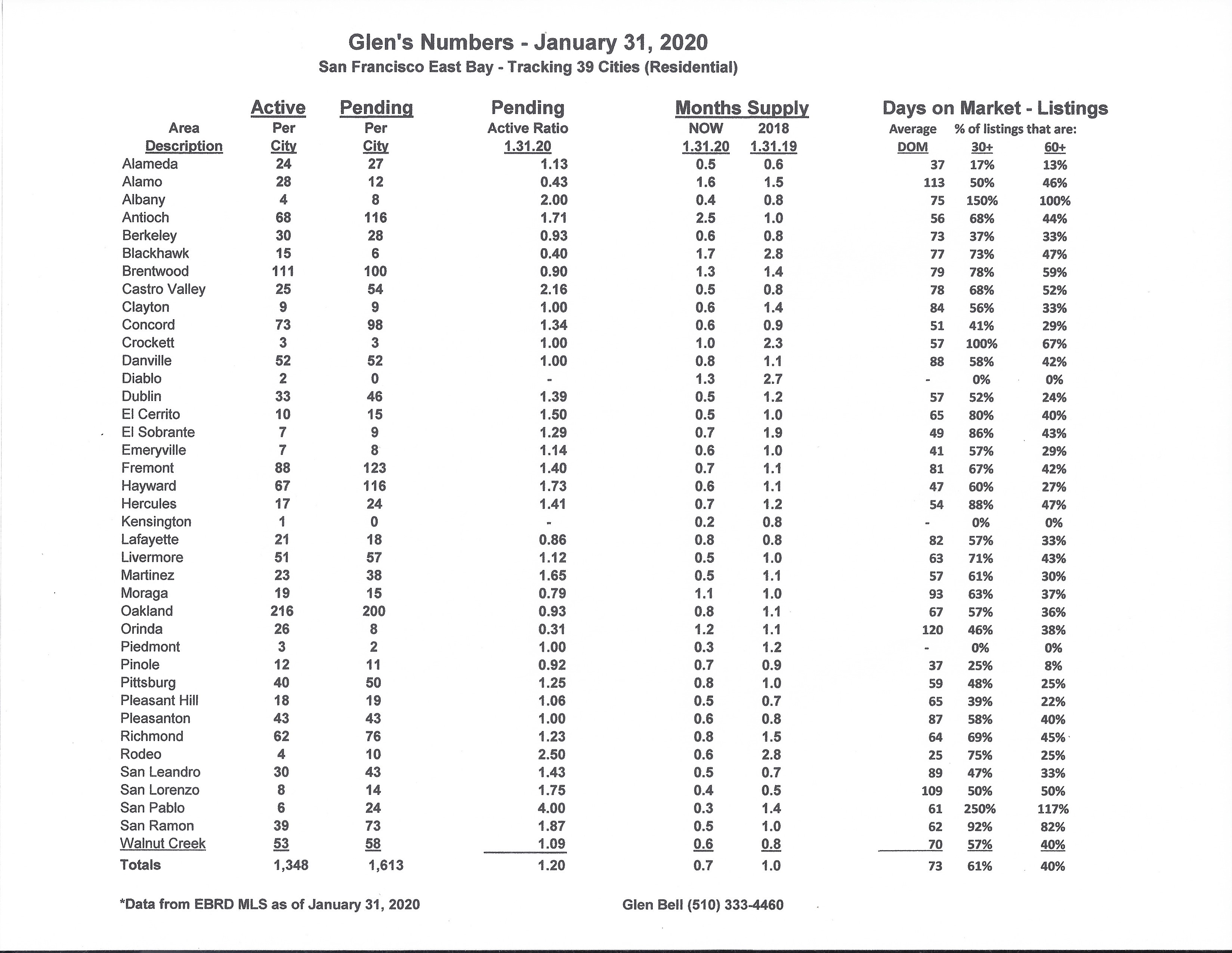

We expected a healthy increase in inventory over January especially since we didn’t see the heavy rains like we did last year. What we saw was a modest increase, of 15.9%. This is 35.75% fewer homes than last year at this time, but more in line with what we experienced in 2018. This represents a 21 day supply of homes, compared to a 30 day supply last year at the end of January. Pendings remained flat, probably due more to the lack of inventory and similar to what we saw last year.

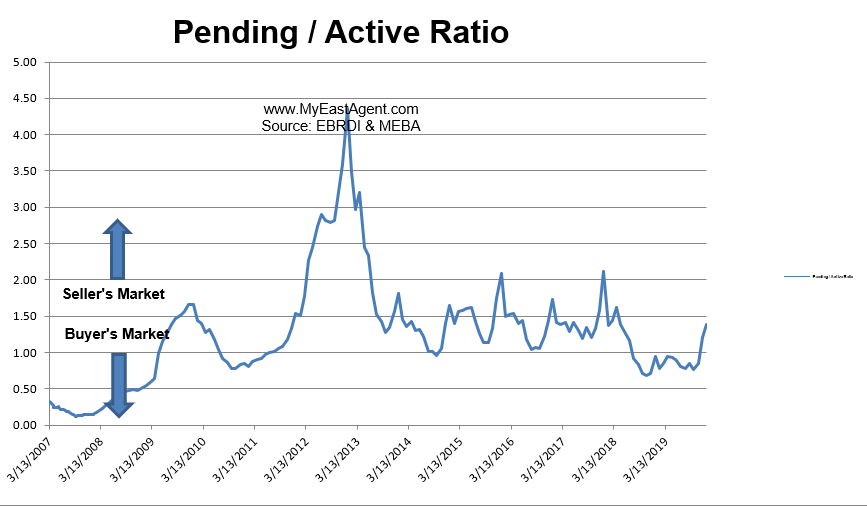

The pending/active ratio decreased slightly to 1.2. This is still much higher when compared to last years’ number of .78. The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (less inventory with more pendings) favors sellers. A number below 1 favors buyers. The last three months have been into positive territory with a ratio of over 1 for the first time since June 2018. It signals that we may be setting up for a stronger seller’s market in the spring.

61% of the homes listed are now “sitting” for 30 days or longer, while 40% have stayed on the market for 60 days or longer. This is slightly higher than what we saw last year (with then 41% remaining active over 30 days and 29% remaining active over 60 days). However, these percentages can be somewhat misleading. It really indicates that we are simply not seeing the number of new home listings come onto the market like we did last year, even without the rain.

The “distressed” market, (foreclosures and short sales) are no longer a factor representing less than .05% of the market.

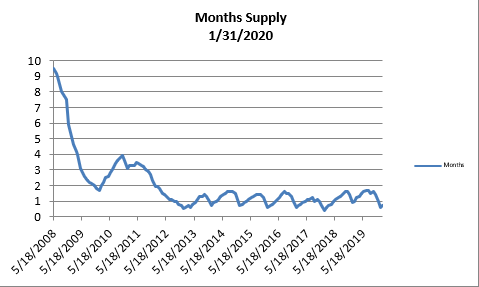

- The month’s supply for the combined 39 city area is 21 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years. Supply is less when compared to last year at this time, of 30 days.

- Our inventory for the East Bay (the 39 cities tracked) is now at 1,348 homes actively for sale. This is fewer than what we saw last year at this time, of 2,098. We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales remained relatively flat at 1,613, about what we saw last year at this time of 1,629.

Our Pending/Active Ratio is 120. Last year at this time it was .78

Sales over the last 3 months, on average, are 1.6% over the asking price for this area, slightly higher than what we saw last year at this time, of 1.2%.

Recent News

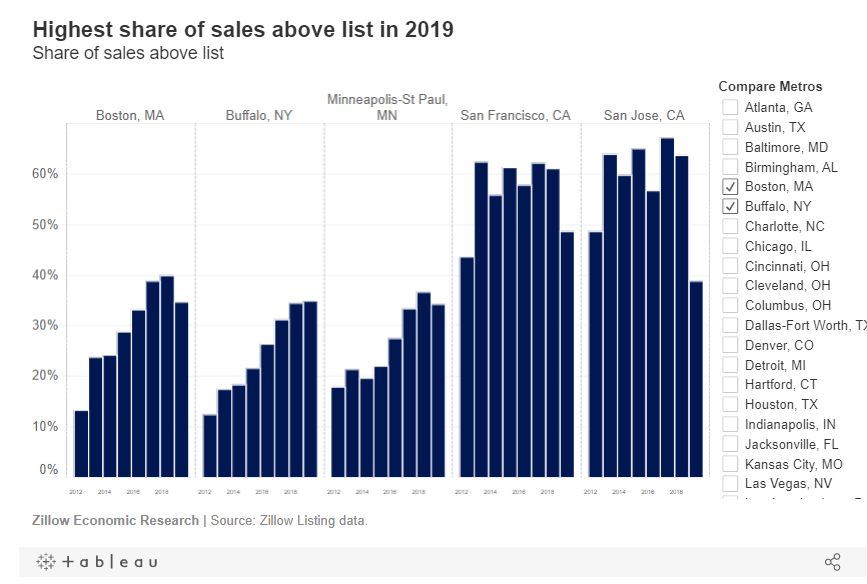

Homes Sold Above List Price Fell to Three-Year Low in 2019

By Treh Manhertz, Zillow, Feb. 5, 2020

- The share of U.S. homes that sold for more than their list price in 2019 fell to 19.9%, the lowest annually since 2016.

- Even with a significant cooldown from previous years, the California Bay Area remains the most competitive housing market in the country.

- Homes that sold above list last year typically brought in $5,100 more than the asking price, down from $5,500 the year before.

Roughly one-in-five (19.9%) U.S. homes sold for more than their list price in 2019, the lowest share in years — a reflection of cooling market dynamics and subsequent shifts in pricing and offer strategies in response. But as those market dynamics begin changing direction again, so too will the balance of power in the ongoing price/offer game between buyers and sellers.

The share of homes sold for more than their list price last year was the lowest since 2016, and down from 21.5% in 2018, according to an analysis of transactions in which we could match a listing’s initial list price with its final sale price. The year-over-year decline breaks a streak of four consecutive years in which a greater share of homes sold above list than the year before. The dip coincides with a year in which annual home value growth fell steadily from recent highs recorded in 2017 and 2018, to levels more consistent with both annual wage growth and historic annual norms.

Despite recent year-over-year drops in home value, San Francisco (48.6% of homes sold above list) and San Jose (38.8%) top the list of metros with the greatest share of homes sold above list among the top 35 — a sign of just how competitive the Bay Area remains even after cooling significantly in 2019. Boston (34.7%), Minneapolis-St. Paul (34.3%) and Seattle (31.2%) round out the top five.

The coolest top-35 markets were Miami (8.9% of homes sold above asking), Las Vegas (12.6%) and Tampa (13.3%). The share of homes sold above list in the Las Vegas area fell from 26.8% a year ago; only San Jose’s share decreased by more, from 63.6% to 38.8%.

The median amount above asking that U.S. sellers realized was $5,100, down from $5,500 in 2018 and the lowest since at least 2011. San Jose ($41,000 above asking) and San Francisco ($37,500) lead the country in this measure as well, a product of both intense competition among buyers and the high prices of real estate there making these figures relatively in line. Still, these figures are much lower than a year ago when San Jose homes typically sold for $101,000 above asking and those in San Francisco sold for $50,000 above asking.

The Games We Play

A home-buying/-selling transaction can be a difficult process, full of uncertainty — often especially on the most essential part of settling on the price. The transaction process itself in its simplest form has at least three stages, and no definite end. The seller lists at one price. The buyer offers another. The seller accepts or rejects the offer. If the seller rejects, the process often reverts back to steps one and two — or sometimes falls apart completely.

There are any number of personal financial factors at play in both the asking price and offer price, and a good deal of gamesmanship too: Do sellers start at a low price in an attempt to attract more buyers, more quickly? Or do they start at a high price point in an attempt to get the most for their property, risking a longer and potentially more expensive process? From the buyers side, do they offer below the list price in hopes of saving money but with the risk of being rejected? Or do they offer top dollar upfront, hoping for a smoother deal but risking overpayment?

As a result of these personal dynamics, the final price can end up substantially above or below the initial asking price. But lurking in the background are underlying local market dynamics, which often exert more influence over final price/offer strategies than any personal calculation. And for the first time in years, 2019 represented a notable shift from prevailing trends, with the first half of the year featuring a short-lived bump in inventory, along with a year-long slowdown in home value growth that threw some established buyer/seller dynamics out of whack.

A Down & Up Year

In 2018, almost 900,000 U.S. homes sold above list, the highest number recorded by Zillow. Throughout the 2018 spring home shopping season, more than one-in-five homes (22%) sold above list. But that share began falling as the year wore on and the calendar turned to 2019, at roughly the same time as a stock market swoon, spike in mortgage interest rates and a prolonged government shutdown combined to effectively hit pause on what had been a roaring housing market. By January 2019, the share of homes sold above list had bottomed out at 17.7%. In this environment, buyers began to claw back a little more pricing power for the first time in years.

Through the 2019 spring home shopping season, it appears many sellers were seemingly caught off guard by the changing conditions, and ended up accepting offers at or below list prices that may have been expected during the height of the market just a few months prior. Relieved of some pressure, buyers were bidding more conservatively. In April 2019, the share of homes sold above the original list price was lower than April 2018 in 37 of the largest 50 metropolitan areas.

But as 2019 played out, the cloudy outlook for sellers began to clear as the late 2018-early 2019 inventory buildups experienced in several cities were whittled back down to record lows. The stock market bounced back, mortgage interest rates fell back below 4% and the economy kept chugging along — bringing out more buyers to chase a still-limited pool of available homes. So even though there were 26,000 fewer sales in 2019 compared to 2018 in which the seller received more than they were asking, the market ended up coming a long way from its January trough.

2020 Vision

This improving outlook — at least for sellers hoping to realize larger gains — looks set to continue into the early part of 2020, if not beyond. Over the last quarter of 2019, the share of sales above list grew compared to prior months in roughly two-thirds of large markets analyzed, with more expected to follow if recent listing trends manifest in actual sales. Typically, the longer a home is on the market, the lower the likelihood of selling above the list price. But currently, homes are typically on the market 3 days fewer than last year. And at a time of the year when the market usually slows down in the face of cold weather and holiday relaxation, there were almost 20,000 more sales overall in December compared to November.

For now, it all adds up to an environment that should be somewhat more favorable for sellers next year — at least until they have to turn around and become buyers themselves, shifting their calculus yet again in housing’s ongoing game of “let’s make a deal.”

2020 Housing Market Forecast: More Buyers, Fewer Homes for Sale

By Tim Ellis, Redfin, January 29, 2020

The direction of this year’s housing market is clear ahead of the Super Bowl.

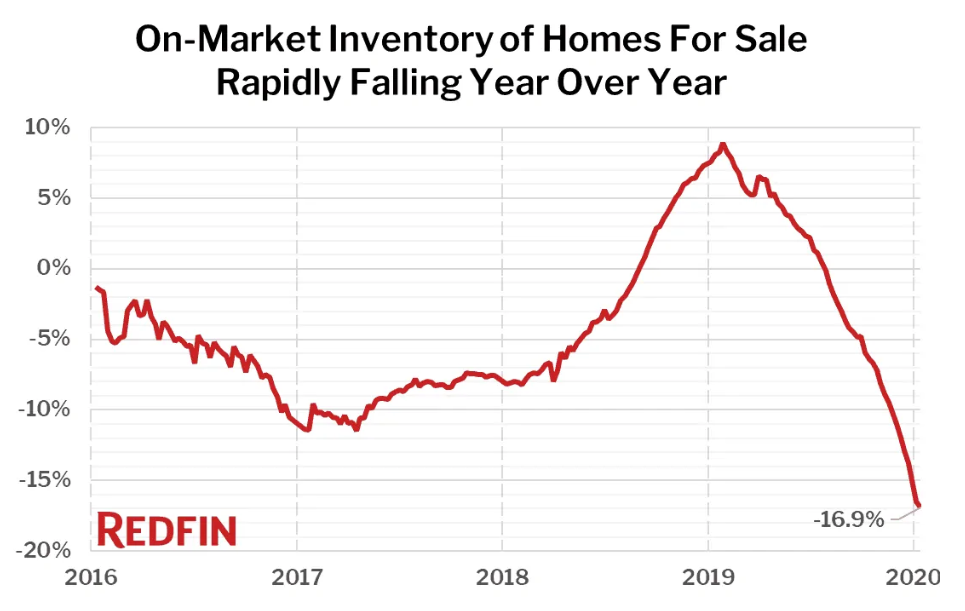

The U.S. housing market is off to a strong start in 2020 as a deepening shortage of homes for sale and surging homebuyer demand are set to push prices up at the fastest rate in years. Buyers may be coming out of winter hibernation early, but so far the sellers are few and far between, which is setting the stage for intense competition even as the year has just begun.

Redfin CEO Glenn Kelman has previously called Super Bowl weekend “the weekend where the housing market either goes crazy or it takes a nap.” This year, we may not need to wait until game time to see how the housing market is playing out. Homebuying demand is spiking in January as many potential homebuyers are turning into active homebuyers well in advance of the typical spring peak homebuying season.

Unfortunately, the supply of homes for sale has so far been unable to keep up with surging demand. Recent data from the National Association of Realtors show December housing inventory at just 1.4 million units—the lowest level in at least 20 years. Low mortgage rates could also be to blame for the shortage of homes for sale, as homeowners are content to sit on their cheap mortgages rather than list their homes, even when they choose to move up to a larger house.

“With every new release of data this year, I’m becoming more and more confident that demand will be strong in 2020—just as strong as, if not stronger than, in 2018 and 2017,” said Redfin chief economist Daryl Fairweather. “The big question for the housing market this year is supply. Will homeowners sit on the sidelines, content with their refinanced loans, or will they want to get in on the action too and move up, move down, or cash out entirely? New construction is beginning to pick up in some markets though, so even without new listings of existing homes there will be some relief for homebuyers hoping for more selection. However, due to the high cost of acquiring and developing land in expensive coastal cities, much of that new construction will be built far away from urban centers or in already affordable metros.”

Foreign buyers try to escape American real estate market

By Antonio Pacheco, Archinect News, February 7, 2020

Chinese investors sold off billions more in U.S. commercial property last year than they bought, as other foreigners start to sour on the U.S. market as well.

Foreign investors were net sellers of U.S. commercial real estate last year for the first time since 2012, posing a fresh setback for a market that is already showing signs of strain. — The Wall Street Journal

The Wall Street Journal reports that foreign investors sold $20 billion more in real estate than they bought last year as a number of international economic trends, including Brexit and an ongoing effort by the Chinese government to bring investment back home, converge to make the American real estate market less appealing to these buyers.

In total, foreign buyers sold $63 billion in property in 2019 and purchased just $48.7 billion, according to Real Capital Analytics. In part, The Wall Street Journal cites flat vacancy rates in the US apartment market and falling rents due to new construction and rent control initiatives as being partially responsible for the real estate cool off, as well, adding that “in New York City, values of rent-regulated apartment buildings have fallen by about 25% in a matter of months.”

It’s typical to see a spike in early homebuying activity, but this year the jump is unusually large. On January 15, the Mortgage Bankers Association released data showing that their Purchase Index—a measure of how many homebuyers are applying for new mortgages—hit an 11-year high. In addition to public data, like the MBA Purchase Index, internal Redfin data—including the number of Redfin users touring homes with our agents—are also showing big year-over-year gains.

Unless a lot of new housing inventory hits the market soon, the 10-year peak in homebuying demand coupled with a 20-year low in the number of homes for sale will lead the housing market straight into the mother of all inventory crunches. That could result in a sudden and rapid rise in bidding wars and spiking home prices.

“It is busier than I expected this year,” said Redfin Boston listing agent Delince Louis. “My first listing of the new year has already received four offers. Low interest rates and low inventory are fuelling activity, and we are seeing activity now that we normally wouldn’t see until March. 2019 was slow, people were worried about a recession, but this year is back to being competitive. A lot of millennials who put their searches on pause last year are coming back now, and they are coming back early because they want to beat the rush.”

Seattle Redfin agent Shoshana Godwin says 2020 already feels busier than even the craziest times in 2017. “I’m regularly seeing homes with well over a dozen offers that sell for hundreds of thousands above list price, even in the middle of our recent snowy week. In a typical year, I’d say to wait it out and expect more homes for sale in the next few months… but now I’m warning clients prices may only continue to rise and the inventory may not appear.”

If the data continues coming in as strong as it has through the first few weeks of January, 2020 may turn out to be the most robust housing market in a decade. That’s great news for those looking to sell a home, but for homebuyers it will mean increasing competition and rising prices.

Are You Waiting for House Prices to Drop During the Next Recession to Buy a Home? Why You Could Have a Very Long Wait

By Jacob Passy, Realtor.com, Feb 7, 2020

It’s unclear when the next recession will come. But a recent report argues that when it does the U.S. housing market is unlikely to adversely affected in any major way.

Researchers at First American Financial Services, a title insurance company, examined how the country’s housing market has fared historically during recessionary periods. Based on what’s happened in past recessions, the report argues that the next recession is unlikely to prompt a major downturn in housing.

“While the housing crisis is still fresh on the minds of many, and was the catalyst of the Great Recession, the U.S. housing market has weathered all other recessions since 1980,” wrote Odeta Kushi, deputy chief economist at First American and the report’s author. “In fact, the housing market may actually aid the economy in recovering from the next recession — a role it has traditionally played in previous economic recoveries.”

Using its own data along with information from Freddie Mac and the National Association of Realtors, the report maps out how the housing market has traditionally fared in economic downturns. In most other cases, home price appreciation continued at an even pace, and existing-home sales growth only edged downward slightly, Kushi wrote.

So what made the Great Recession different? The housing boom that preceded the last recession was largely driven by an explosion in both home-building activity and mortgage credit. Home buyers were able to get mortgages with no documentation of their income and no down payment, and many loans had introductory 0% interest periods that made them cheap to start but more expensive as time wore on.

These homeowners were over-leveraged. “The housing crisis in the Great Recession was fueled heavily by the fact that job loss was paired with a significant share of homeowners who didn’t have much equity in their homes,” Kushi wrote.

And because developers constructed so many homes, their home values quickly sank when the bubble burst, exacerbating the situation further.

The growth in home prices seen during the current economic expansion has not been fueled by increased access to mortgage credit. Rather, it’s a simple reflection of supply and demand: Many Americans want to become homeowners, but the supply of homes available for sale is very low, pushing prices upward.

While this has made the prospect of buying a home unaffordable for millions of Americans, it has also meant that those who are homeowners have seen their home equity grow substantially in recent years. That decreases the likelihood that they would be underwater on their loan if home prices were to dip in a recession.

“Were we to have a recession, I’d argue housing would provide a cushion because the shortage of supply at the entry-level suggests builders could actually continue to build,” Doug Duncan, Fannie Mae’s chief economist, told MarketWatch in December.

There still are red flags that homeowners should be on the lookout for when it comes to how a potential recession might affect the housing market. For starters, many Americans have taken out cash-out refinance mortgages on their homes as their home values have grown. That’s whittled away the equity these people have in their property, leaving them more vulnerable to owing more than their home was worth in the potential event the home prices drop.

Another issue: Many Americans who fell behind on loan payments and modified their mortgages in the wake of the recession to avoid foreclosure have since redefaulted. Were these people to lose their jobs in a recession, they could easily fall into foreclosure. Research has shown that foreclosures exacerbate economic downturns — and they can have a ripple effect through a local market, causing other homes to drop in value.

And at the local level, certain local housing markets could prove more resilient in the event of recession, depending on the strength of the local economy relative to what’s going on at a national level.

Top 8 housing trends that’ll dominate 2020

LifestyleHome Design, February 6, 2020

As home prices continue to increase, about 12 million Americans now spend over half of their earnings on purchasing a home. This is just one of the recent housing trends that continue to shape the real estate sector as the new decade begins.

Indeed, the latest housing trends have been a mixture of both desirable and undesirable developments. With millennials making up the largest percentage of home buyers, real estate prices have continued to skyrocket.

So what does 2020 have in store for the real estate market?

That’s what we discuss in this article. We hope that by the time you’re done reading, you’ll be able to make informed decisions on any home purchase or sale you may intend to make.

1. Investment in Real Estate Will Continue to Increase

One of the most prominent real estate trends at the moment is the increased investment in the industry, despite the economic decline of 2018. The industry continues to receive hundreds of billions of dollars in capitalization.

Domestic institutions have continued to increase their net holdings in real estate. This enhanced domestic activity is the main reason for more investment flow to the industry. Moreover, the presence of new tech in the market that helps property owners boost their management capabilities will continue to spur growth in the sector.

As numerous markets continue to experience remarkably low vacancy rates, expect investors to continue pouring money into the industry.

2. There Will Be a Slower Rise in Home Prices

The housing market saw a jump in home prices between 2017 and 2018. Real estate prices have still continued to increase but at a lower price. The percentage of home listings have also increased, albeit marginally. These developments will continue in 2020.

Why?

The first reason is the prevailing economic uncertainty in the country. Many home sellers are choosing to hold on to their property until things look rosier. The increasing mortgage rates have also made some investors shy away from the real estate market.

Interest in new homes, however, is still high. Experts anticipate a considerable increase in the construction of new homes.

3. Millennials Continue to Dominate the Home Buyers’ Market

In the past few years, millennials have dominated the residential property buyers’ market. This is one of the trends in real estate that’s set to continue for a while. There are many reasons for this.

Firstly, members of this demographic are finding more stable jobs with impressive incomes. Besides, American millennials prefer middle-class and upper-middle-class homes. In 2020, millennials are expected to account for almost half of the new home buyers and top the mortgage pack.

There are many things sellers can do to benefit from this housing trend. For instance, they can focus on leveraging the internet, given that most millennials research online before making a purchase decision. Sellers can also offer sustainable homes that have lots of usable space.

4. Buyers Need Affordable Homes

For a long time, house rents have consistently beaten house purchases by a huge margin. As residential home prices continue to increase, the demand for rental housing will increase as well.

So what does this mean for home developers? Well, there’s obviously a need to create affordable homes to attract more buyers.

5. There’s a Shift to Second-Tier Cities

With real estate prices in first-tier cities out of reach for many investors and home buyers, more people are setting up shop in more affordable second-tier cities. It’s one of the housing market trends that have contributed to a significant increase in investments in such cities.

But as more investors and buyers flood more affordable locations, the price of real estate prices in those regions continues to increase. This capital movement will result in greater value for homes in second-tier cities. Ultimately, the continued investment in real estate in these cities will equalize capitalization rates in both first-tier and second-tier markets.

6. New Technology Will Continue to Be Featured in Housing Trends

Technology has had a tremendous impact on a wide variety of industries. The real estate industry is one of them.

In 2020 and beyond, the housing market will continue to adopt new technology, including apps, smart home technologies, and online selling platforms. Expect to see an upsurge in the number of high-tech companies that service the real estate sector. Most of these tech companies will focus on simplifying transaction processes.

AI will play a significant role in the sector, especially when it comes to building design, organization, and management. Machine learning will continue to help in property design, urban planning, and other areas.

7. Higher Interest Rates on Mortgages

After several years of stagnation, mortgage interest rates have recently started to increase. This trend is expected to continue in 2020. Rising interest rates point to the continued willingness of Americans to borrow and spend.

So what should home sellers expect as interest rates continue to increase? Generally, buyers will usually give lesser offers for homes. Besides, some buyers may decide to postpone their purchases to avoid the additional burden of paying higher rates.

For those looking to buy homes in 2020, higher interest rates should not be a hindrance. Eligible owners can consider VA loans. A major VA Home Loan benefit is that it typically has a lower interest rate compared to other types of loans.

8. Increased Focus on Amenities to Attract Buyers

Residential property developers and landlords are increasingly capitalizing on amenities to entice buyers and tenants. Besides parking access and the staple gym, builders are offering other unique amenities such as movie theaters, communal gardens, and so on. There’s an influx of smart homes as well, thanks to savvy investors.

Housing Trends Will Continue to Change

While we can’t predict the future of the real estate market with absolute certainty, we do know that buyer preferences are always evolving. Housing trends will always come and go. One thing that’s for sure, however, is that the need for residential property is here to stay.

Hopefully, the trends presented here will serve as a guide as you invest in or sell a property this year.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link