October 31, 2019 – Real Estate Market Numbers

By Glen Bell (510) 333-4460

Here are some highlights for the 39 East Bay Cities that I track:

Affordability, increasing inventory, reduced sales, considerations of moving out of the Bay Area, possibility of recession, are all topics of interest in a market in transition. Properties are staying on the market longer, we’re seeing fewer offers than before, more price reductions and some incentives now being offered, in effect, all favoring buyers. Yet indecision has many buyers on the fence with a wait and see attitude despite having more choices. The gap between buyer and seller expectations has increased. A softening of the market has many sellers still holding out for top dollar, while buyers seeing a bit of leverage for the first time in years are now looking to possibly take advantage.

This is the time of year when things begin to slow down. Buyers are hesitant on doing much when we start to reach the holiday season and they tend to shelve their search until the beginning of the new year. Sellers are aware that with less activity comes fewer buyers. If they haven’t already listed their property by now, considerations on delaying until the spring comes into play. We see fewer listings come onto the market now, and inventory begins to come down. It’s also a time for possible bargains. However, there’s less to look at. Many sellers who “have to” sell will stay the course and soften their expectations.

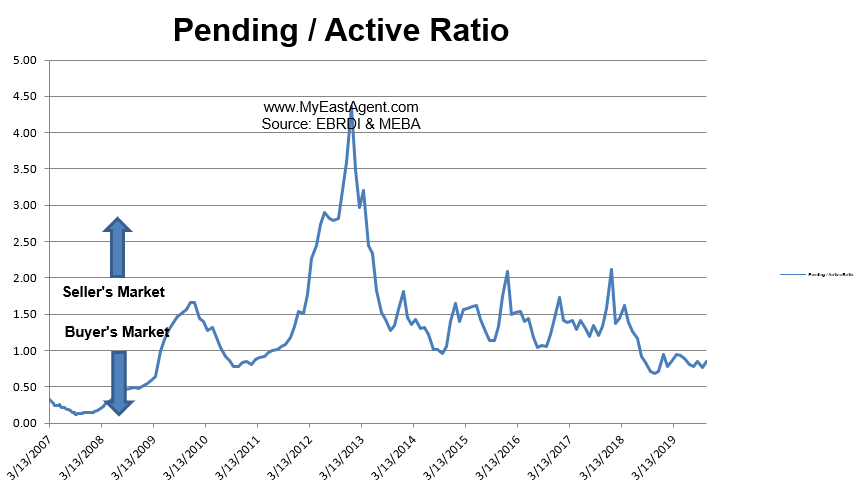

- Here’s where we stand as of the end of October. Inventory has decreased since last month by 8.8%, now sitting at a 42 day supply of homes for sale. This is slightly less than what we saw last year at this time of 48 days. Pendings decreased slightly, but is slightly more than last year by 4%. The pending/active ratio increased slightly to .84, still below our neutral mark. This is slightly more than last year at the end October at .68. This is the 16th month in a row that the ratio has fallen below 1.00. The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (more inventory with fewer pendings) favors sellers. A number below 1 favors buyers. In short, we have moved from a strong seller’s market since the beginning of last summer towards a more normal and balanced market, and in many cases, now favoring buyers.

- 51% of the homes listed are now “sitting” for 30 days or longer, while 28% have stayed on the market for 60 days or longer. This is slightly lower when compared to last year’s number (with then 48% remaining active over 30 days and 22% remaining active over 60 days). However, this is fairly normal for this time of year and these percentages can be somewhat misleading. Many of the homes that have not been selling remain on the market while fewer newer homes are coming onto market because of Holiday concerns.

- The “distressed” market, (foreclosures and short sales) are no longer a factor representing less than .05% of the market.

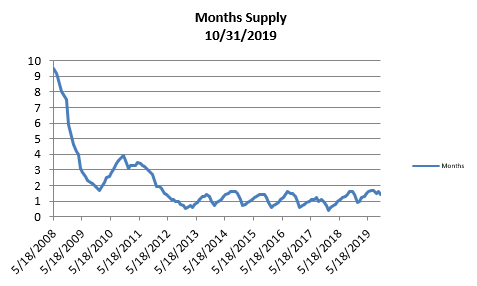

- The month’s supply for the combined 39 city area is 42 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years. Supply is less when compared to last year at this time, of 48 days.

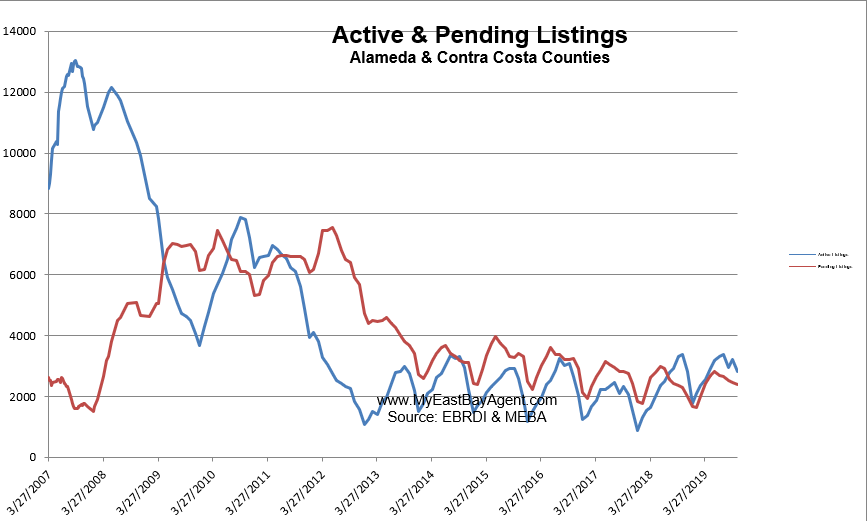

- Our inventory for the East Bay (the 39 cities tracked) is now at 2,825 homes actively for sale. This is fewer than what we saw last year at this time, of 3,369. We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales decreased to 2,385, slightly more than what we saw last year at this time of 2,289, or about 4% higher.

- Our Pending/Active Ratio is .84. Last year at this time it was .68

- Sales over the last 3 months, on average, are 2.7% over the asking price for this area, lower than what we saw last year at this time, of 3.3%.

Recent News

Bay Area homes are getting more affordable, closing gap with rest of state

Kathleen Pender, San Francisco Chronicle, Nov. 8, 2019

This may sound hard to believe if you’re house hunting, but Bay Area homes got significantly more affordable in the third quarter, thanks to a big drop in mortgage rates, rising incomes and lower home prices, according to a report issued Thursday by the California Association of Realtors.

The region is still the least affordable in California, but it’s closing the gap with the rest of the state.

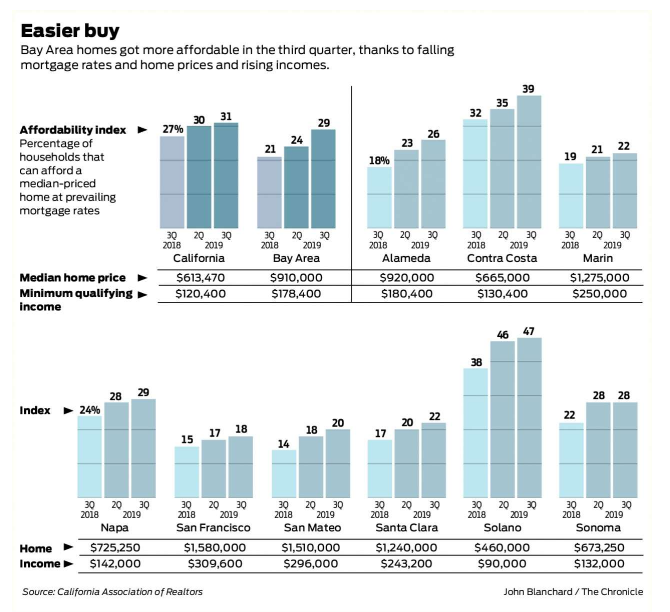

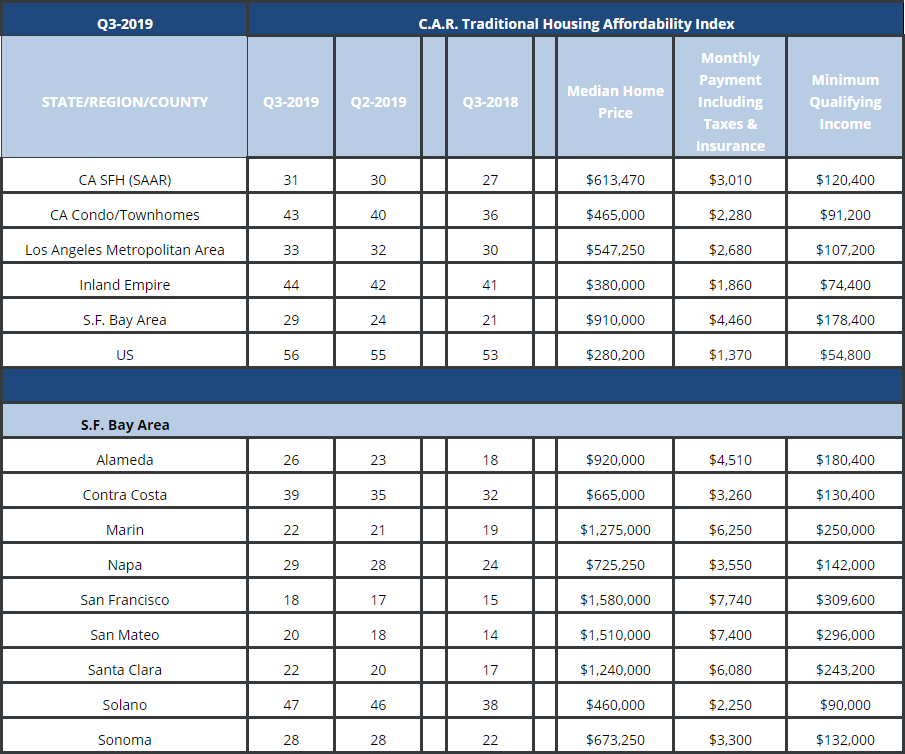

In the Bay Area, 29% of households theoretically could buy a median-priced, single-family home in the third quarter, up from 24% in the second quarter and 21% in the third quarter of last year, according to the association’s “affordability index.”

Statewide, 31% of households could afford a median-price home, up from 30% in the previous quarter and 27% a year ago.

The report calculates the annual household income needed to make the monthly payment (including mortgage, taxes and insurance) on a median-priced, single-family home with a 20% down payment and a 30-year fixed-rate mortgage at prevailing rates. It then estimates what percent of households in a county, region or state earn that much. The result is the affordability index.

By this measure, every Bay Area county got more affordable in the third quarter, but the improvement was generally greatest in the less expensive counties. In Solano, the index rose from 38% to 47% year over year. In Alameda, it went from 18% to 26%, and in Contra Costa it rose from 32% to 39%.

In San Francisco, the most expensive county, the affordability index rose from 15% to 18% year over year. In the city, you’d need to earn $309,600 a year to buy a median-priced home, but that’s down from a peak of $344,440 in the second quarter of last year.

Although 18% affordability still sounds low, it’s been worse in San Francisco. For most of 2005, during the previous housing boom, it was 9%. The highest it got during the housing bust was 29% in the first quarter of 2012.

The association’s index probably understates affordability, especially in San Francisco, because it excludes condominiums, which are generally cheaper than single-family homes. Oscar Wei, the association’s senior economist, said it excludes condos because statewide they only account for about 15% of sales, but in San Francisco they are about half.

The biggest contributor to rising affordability was a big drop in mortgage rates, Wei said. Mortgage rates have dropped nearly a percentage point, to 3.85% in the third quarter from 4.77% a year ago.

The other big drivers were rising incomes and falling home prices. The median Bay Area income for the year as a whole rose to $105,803 in 2019, up 8% from a year ago.

The median Bay Area single-family home price was $910,000 in the most recent quarter, down 7.1% from the previous quarter and down 4.2% from a year ago.

All of these things came together to help first-time buyer Carlos Villarreal buy a single-family home in Oakland.

“I’ve been looking since May,” he said. “All through the summer, the homes I liked were not affordable, they were outside of my price range. In the fall, prices did come down a tiny bit in the neighborhood I was looking at.”

He also got a raise at his job consulting with local governments three months ago, which helped, as did a drop in interest rates. When he started looking in May, “I was quoted 4.25%. A couple weeks ago I locked in 3.5%.” Villarreal also got help with the down payment from his parents. “Without that, I wouldn’t have been able to get it,” he said.

Elisabeth Watson, an agent with Abio in the East Bay, said, “There’s absolutely no question, it’s getting better for first-time buyers” as prices take a breather. “We are seeing buyers getting properties closer to asking price.”

Although median home prices have been mostly on the upswing statewide, in the Bay Area the median price on a year-over-year basis has fallen for eight consecutive months and nine of the past 10, the association reported in its monthly report for September.

The median price for a Bay Area single-family home that closed in September was $930,000, down 2.2% from August and 5.4% lower than September 2018. Bay Area homes are taking longer to sell; in September the median number of days on market was 23, up from 21 days in August and 19 a year ago.

“In 2017 and 2018, we saw some pretty solid increases in home prices. In 2019, the fact that it dropped, I’m not completely surprised, it’s just little bit of a giveback,” Wei said.

Prices “are taking a timeout,” said Elliot Eisenberg, an economist who does consulting for MLS Listings, the multiple listing service for several counties, including San Mateo and Santa Clara. “There isn’t that much money around anymore.” Chinese buyers have retreated from the market since the government made it much harder to get money out of the country.

The big jump in prices that many thought would follow this year’s flood of initial public offerings hasn’t materialized, although they may have prevented prices from falling further, especially in San Francisco, where most of the newly public companies are headquartered. In San Francisco, the median home price was up 2.2% in September year over year. Employees and early investors in Uber, which raised $8.1 billion in its May 9 IPO, were only allowed to sell their shares after a six-month lockup period ended Wednesday.

“In the East Bay, we are starting to see things sitting on the market longer, but we are not seeing a big drop in prices,” said Compass agent Jessica Nance. “Buyers can breathe and determine their next steps. The market has slowed down but properties that are priced well and show well are seeing multiple offers.” She added that “lower rates are driving more buyers into the market than I saw six months ago.”

Bay Area home prices continue to slip

Sales flat in Alameda, Contra Costa, Santa Clara and San Mateo counties

By Louis Hansen, Bay Area News Group, November 8, 2019

Bay Area home prices continued to decline in September as the regional market slows from the rapid pace set over the past seven years.

The median sales price in September for an existing home in the Bay Area dropped 4.7 percent, to $810,000, despite low interest rates, a strong stock market and booming regional economy, according to real estate data firms CoreLogic and DQNews.

Bay Area home prices still are among the highest in the nation.

“It’s still a good, strong seller’s market,” said Jeff LaMont, a Coldwell Banker agent in San Mateo. “It’s still a challenge for buyers.”

The Bay Area residential market has seen year-over-year sale prices drop in several months this year. That follows a record run of rising home prices that began in April 2012 and ended in March.

Adding to the housing pressure is the region’s robust economy, which added 5,100 more jobs in August, according to the state’s Employment Development Department.

Existing home sales increased 3.5 percent, led by busy markets in outlying counties: Sonoma (up 29 percent), Napa (up 14 percent), and Solano (up 18 percent). Sales remained relatively flat in Alameda, Contra Costa, Santa Clara and San Mateo counties.

Year-over-year median prices grew 3.9 percent to $632,500 in Contra Costa County, increased 4.2 percent in San Francisco to $1.48 million, and inched up less than one percent to $869,500 in Alameda County. Prices dropped 3.7 percent to $1.16 million in Santa Clara County and fell 2.7 percent to $1.45 million in San Mateo County, according to DQNews.

Agents say buyers are willing to wait for the right deal, avoiding bidding wars and hesitating to push far past their budgets. Homes in move-in condition, near transit or with a short commute still top the list of desirable features.

Matt Rubenstein, a Compass agent in Walnut Creek, said starter homes between $700,000 and $900,000 have been attractive, especially if they’re in good shape and within a strong school district. “If they show really well, there’s always going to be interest,” he said.

Rubenstein has noticed some nervousness among buyers — the market has stayed strong for nearly eight years, and some are concerned about an inevitable drop. He said he tells buyers to plan on staying in the house for at least seven years and trust the strong, regional economy.

Ramesh Rao, a Coldwell Banker agent in Cupertino, said pricing at or below comparable homes in a neighborhood is key to attracting buyers. The market isn’t as hot as it was last year, he said, but plenty of younger tech professionals still want to buy.

Larger trends in the housing market don’t apply to Silicon Valley. “Listen to what’s happening locally,” Rao said, “not nationally.”

As bidding wars have largely receded, house hunters can afford to shop around a bit longer.

Bay Area natives Tiphanie and Paul Cimoli have bought and sold houses for 30 years. The couple lives in a single family home in South San Jose and wanted to buy an investment property to rent out to their oldest son and a roommate.

The Cimolis blitzed the market, touring 75 homes in three months. They bought a San Jose townhome for about $780,000 after it had been marked down twice and the seller was motivated to get rid of the unit. Still, the couple found the diligent search a bit more demanding than other, earlier purchases.

“We actually thought that there were a lot of choices out there,” Tiphanie said. “We found that the really good ones went fast.”

Big Changes at NAR—Are Pocket Listings Dead?

Welcome to RealClues – The Weekly Newsletter for Real Estate Professionals

Bernice L. Ross, Real Estate Coach, 11/18/2019

Last Monday NAR passed a new rule that pretty much puts an end to pocket listings and severely limits “Coming Soon” marketing as well. The new rule goes into effect on January 1, 2020, and Multiple Listing Services must complete the transition to the new policy no later than May 1, 2020.

Listing agents will now be required to have their listings posted on the MLS within 24 hours of the time you start publicly marketing the property. This means putting it online, putting a sign on the property, sending out postcards, door knocking, etc.

While you may not like the policy the truth of the matter is maximum exposure results in maximum price, so this is probably in the seller’s best interest.

Your sellers still have the option of “discreetly marketing” their listings which means they do not appear on the MLS, there is no sign, or other public marketing. Celebrities like Bill Gates and other sellers who fear kidnapping, theft, or merely want to maintain their privacy will not be impacted by this rule, provided again, there is no public marketing.

What’s unclear is whether you can use “Coming Soon” in a slightly different way. For example, could you list a house today, submit to the MLS, but not make it available for showings until the sellers finish preparing the house for sale over the next two weeks? This might create a whole new category of “drive-by-only” listings.

Before you decide to get creative with any type of work around, please verify with your Board of Realtors/MLS what is and is not permitted. Like any major change, this will be a mess and will ultimately get worked out.

National Bidding War Rate Hit a 10-Year Low in October

By Tim Ellis, Redfin, November 13, 2019

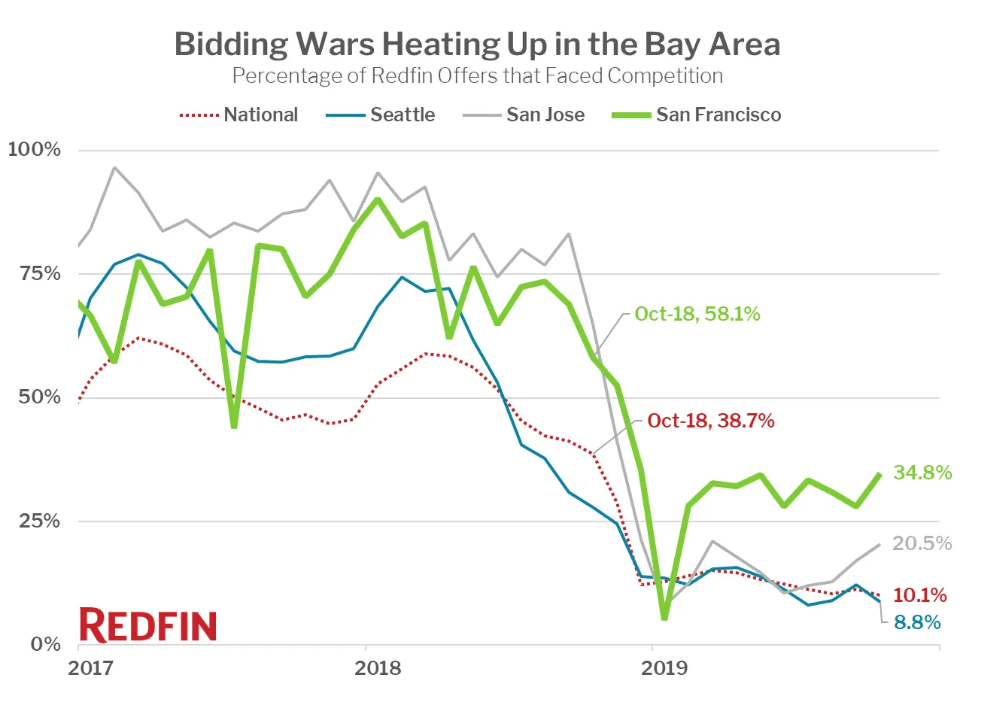

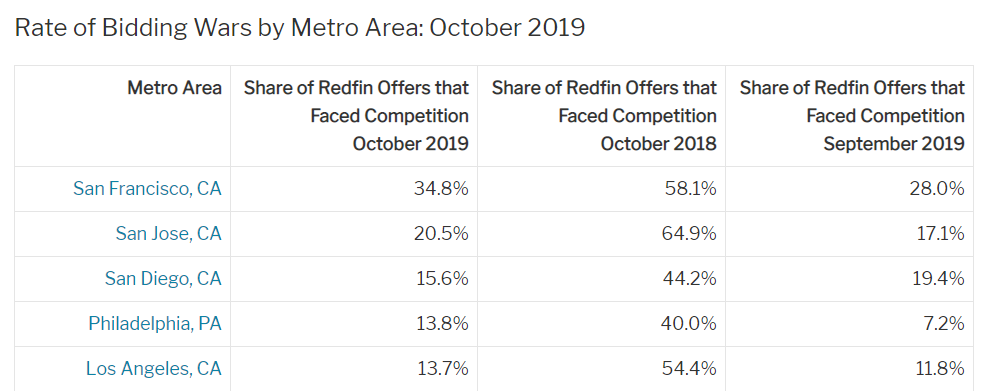

Nationally, just 10 percent of offers written by Redfin agents on behalf of their homebuying customers faced a bidding war in October, down from 39 percent a year earlier and now at a 10-year low. However, low mortgage rates and a lack of homes for sale point to a likely return of bidding wars next year.

Of the top five markets where bidding wars were most common in October, four were in California—San Francisco (34.8%), San Jose (20.5%), San Diego (15.6%) and Los Angeles (13.7%). On the East Coast, in Philadelphia, 13.8 percent of offers faced bidding wars.

The rate of bidding wars in San Francisco and San Jose hit new highs for the year in October, a month when competition typically cools. That said, both markets’ bidding war rates were still well below last year’s levels of 58.1 percent and 64.9 percent, respectively.

If 2019’s big tech stock IPOs like Uber, Lyft, and Slack had been as hot as many expected earlier in the year, it’s likely the market in the Bay Area would be a lot more competitive right now.

“There was a lot of hype earlier this year in the Bay Area around some big IPOs,” said Palo Alto Redfin agent Kalena Mashing. “But we haven’t seen that hype translate into a hot market, regardless of how well the IPOs did. Really, it’s not the IPO money making the market hot, it’s the perception that the IPO money COULD make the market hot that has really driven the local housing market this year.”

This unseasonal uptick in competition in the Bay Area may be a sign of things to come elsewhere, according to Redfin chief economist Daryl Fairweather. “Right now, there are fewer homes for sale than we usually see this time of year, and sales are picking up thanks in part to low mortgage interest rates. All of the pieces are in place for bidding wars to become more common and for the housing market to shift back toward the seller’s favor next year,” said Fairweather. “Now may be the last chance in the foreseeable future for buyers to win a home without facing a bidding war.”

Are the wealthy fleeing California taxes?

BY DAN WALTERS Cal Matters, OCTOBER 27, 2019

Here is an indisputable fact about California taxation: More than two-thirds of state general fund revenues come from personal income taxes and about half of those taxes are paid by the 1% of taxpayers atop the income scale.

In other words, K-12 schools, state colleges and universities, health and welfare support for the poor, prisons and many other services for 40 million Californians are utterly dependent on the ability and willingness of a few thousand very high-income residents to cough up tens of billions of tax dollars each year.

There’s a perpetual political debate about that dependency. If nothing else, it creates what is called “volatility” — the tendency of state revenues to soar during periods of economic prosperity but plummet during downturns.

There is, however, another aspect of being so dependent on wealthy taxpayers. As their tax bites increase, some react by voting with their feet and moving from high-tax California to a state with low or no income taxes, such as neighboring Nevada.

There have been anecdotal accounts suggesting such flight.

The state waged a nearly three-decade-long battle to collect taxes from high-tech inventor Gilbert Hyatt after he decamped from Southern California to Las Vegas.

Two years ago, the Wall Street Journal published an article about the $31.1 million sale of a Lake Tahoe estate once owned by casino tycoon Steve Wynn to Michael and Nora Lacey, a very wealthy couple who lived in a 30,000-square-foot Tudor mansion in Los Altos Hills.

They changed their official residencies to their new estate on the Nevada side of Lake Tahoe. “The Wynn estate is our permanent home and our main home and the Morgan estate is a beautiful place when we want to get away,” Mrs. Lacey told the Journal.

By joining other wealthy residents of Incline Village, the Laceys would be able to shield at least some income from California taxes.

The Oakland Raiders football team will soon become the Las Vegas Raiders and when the team’s quarterback, Derek Carr, who grew up in Fresno, negotiated a new contract a couple of years back, it was “back-loaded,” meaning most of the money will be paid after the team relocates. The Tax Foundation calculated that Carr would save $3.2 million a year in state taxes by plying his trade in Nevada.

A highly detailed study by two Stanford University economists, Joshua Rauh and Ryan Shyu, provides new fuel for debate over California’s dependency on the rich. They conclude that the out-migration and “behavioral responses” of high-income taxpayers increased markedly after voters approved Proposition 30, a 2012 measure that sharply increased their income taxes, and the effect was a reduction in net revenues to the state.

The 2012 increase, sponsored by former Gov. Jerry Brown, was to last only a few years, but a 2016 ballot measure, Proposition 55, extended it to 2030, thus increasing the incentive to move out or otherwise limit tax exposures. Moreover, a federal tax overhaul signed by President Donald Trump tightly limits the deductibility of state and local taxes, still another incentive.

In fact, as he introduced his last budget in 2019, Brown worried aloud about a potential flight of wealthy Californians. “People with higher incomes pay a lot more money, and some of them may be tempted to leave,” Brown said.

The study by Rauh and Shyu implies that some have already succumbed to temptation. And with public education advocates proposing still another income tax hike on the wealthy for the 2020 ballot, they could have still another incentive to depart.

Glen Bell – (510) 333-4460 jazzlines@sbcglobal.net

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link