September 30, 2019 – Real Estate Market Numbers

By Glen Bell (510) 333-4460

Here are some highlights for the 39 East Bay Cities that I track:

Affordability, increasing inventory, reduced sales, considerations of moving out of the Bay Area, possibility of recession, are all topics of interest in a market in transition. Properties are staying on the market longer, we’re seeing fewer offers than before, more price reductions and some incentives now being offered, in effect, all favoring buyers. Yet indecision has many buyers on the fence with a wait and see attitude despite having more choices. The gap between buyer and seller expectations has increased. A softening of the market has many sellers still holding out for top dollar, while buyers seeing a bit of leverage for the first time in years are now looking to possibly take advantage.

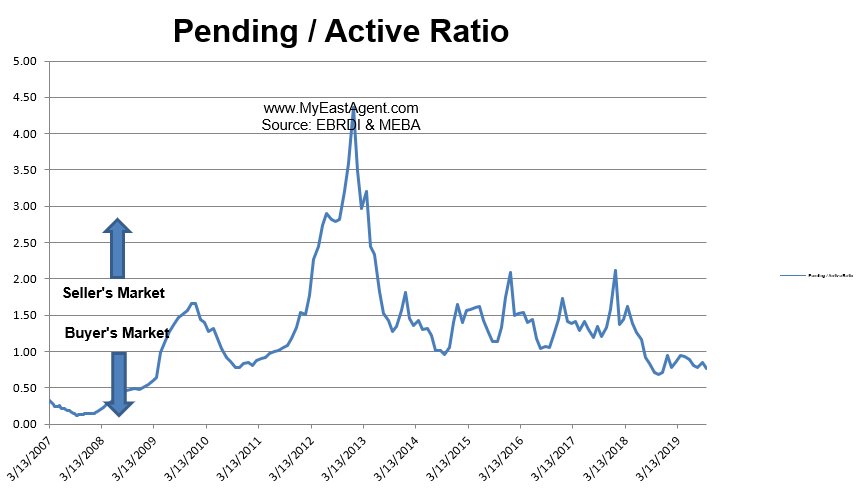

- Here’s where we stand as of the end of September. Typically, we see a dramatic drop in inventory during December followed by a modest steady increase in Spring and Summer. Inventory has increased by 83% since the beginning of the year, now sitting at a 48 day supply of homes for sale, This is where we were last year at the end of September. Pendings decreased slightly despite new inventory coming onto the market, but slightly above last year by 4%. The pending/active ratio decreased slightly to .76, still below our neutral mark. This is similar to last year at the end of September at .71. This is the 15th month in a row that the ratio has fallen below 1.00. The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (more inventory with fewer pendings) favors sellers. A number below 1 favors buyers. In short, we have moved from a strong seller’s market since the beginning of last summer towards a more normal and balanced market, and in many cases, now favoring buyers.

- The percentage of homes “sitting” has decreased slightly to 44% of the homes listed now remaining active for 30 days or longer, while 25% have stayed on the market for 60 days or longer. This is slightly higher when compared to last year’s number (with then 42% remaining active over 30 days and 20% remaining active over 60 days).

- The “distressed” market, (foreclosures and short sales) are no longer a factor representing less than .05% of the market.

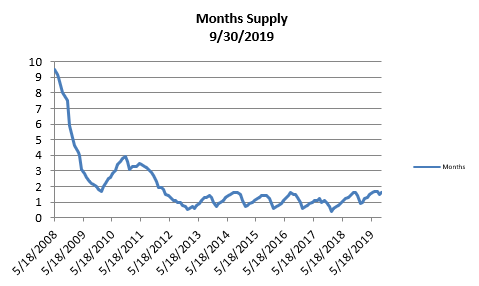

- The month’s supply for the combined 39 city area is 48 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years. We are about the same compared to last year at this time, of 48 days.

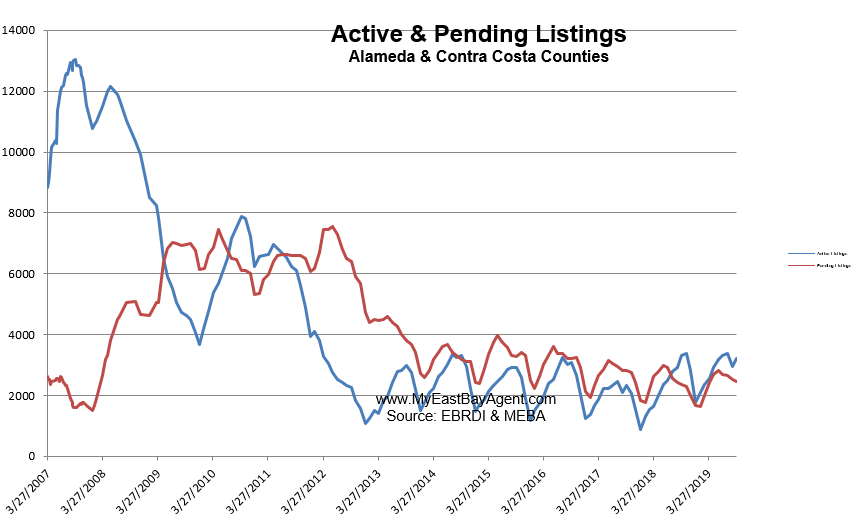

- Our inventory for the East Bay (the 39 cities tracked) is now at 3,226 homes actively for sale. This is close to what we saw last year at this time, of 3,321. We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales decreased to 2,463, slightly more than what we saw last year at this time of 2,367, or 3.9% lower.

- Our Pending/Active Ratio is .76. Last year at this time it was .71

- Sales over the last 3 months, on average, are 2.7% over the asking price for this area, lower than what we saw last year at this time, of 3.9%.

Recent News

California gets its first statewide rent control, eviction protections

By Alexei Koseff, San Francisco Chronicle, October 8, 2019

As living costs soar across California amid a severe housing crunch, millions of residents will be protected for the first time from large rent increases and losing their homes if they have been reliable tenants.

Gov. Gavin Newsom signed AB1482 on Tuesday at a West Oakland senior center, imposing the first-ever statewide cap on rent increases and requiring landlords to provide a “just cause” when evicting tenants.

Supporters estimate the law will extend protections to an additional 8 million renters in California. Cities including San Francisco and Oakland already have rent-control ordinances that cover about 2 million people.

Newsom said it is a necessary first step to address the cost of living in California, an issue driving so many others in the state, including the high rates of poverty and homelessness. But he added that there is much more work to be done.

“We need to build more damn housing,” the governor said.

California is the third state this year to adopt significant rent regulations, giving renewed national momentum to the push for rent control. Newsom predicted that more states would follow.

The new law, which was carried by Assemblyman David Chiu, D-San Francisco, will limit annual rent hikes to 5% plus the regional cost-of-living increase, or a maximum of 10% per year. Based on current inflation rates, Bay Area landlords could not raise rents by more than an estimated 7.7%.

Chiu said the cap would protect tenants from predatory rent increases while allowing landlords to make a fair rate of return.

“Just because somebody rents doesn’t make them any less worthy of having a stable home,” Chiu said.

Tenants will also receive eviction protections after living in an apartment for a year, meaning they cannot be ousted without a reason such as failing to pay rent, breaching a rental agreement, creating a nuisance or engaging in criminal activity. Advocates say this is necessary to prevent landlords from evicting longtime residents to raise the price of a unit.

If they are evicted through no fault of their own, such as when a property is taken off the market, tenants will be entitled to relocation assistance equivalent to one month’s rent.

The protections take effect in January and will expire in 2030, but can be renewed. They exclude apartment buildings built in the previous 15 years, duplexes where the owner lives in one of the units, and single-family homes except those owned by corporations.

Newsom signed six other renter protection bills Tuesday, including SB329 by state Sen. Holly Mitchell, D-Los Angeles, which prohibits landlords from rejecting prospective tenants simply because they use Section 8 housing vouchers. About 300,000 low-income Californians rely on the federal subsidies to pay their rent.

He also signed a bill to put regional tax measures on ballots in the Bay Area that would generate money for affordable housing. AB1487, carried by Chiu, would raise $1 billion to $1.5 billion annually for project subsidies, tax credits, tenant assistance and updates to city zoning plans.

California’s rent-cap law follows victories for tenant advocates in Oregon, which in February restricted annual rent increases to 7% plus inflation and required a just cause for evictions, and in New York, which strengthened its rent regulations in June and allowed communities statewide to adopt their own rent-control ordinances for the first time.

It’s a remarkable shift to the political landscape. California sharply restricted local governments’ ability to cap rents in the 1990s, and voters overwhelmingly defeated a ballot initiative in November that would have allowed cities to expand rent control, after a $74 million campaign by owners and developers of rental properties.

Amy Schur, campaign director for Alliance of Californians for Community Empowerment Action, one of the sponsors of the rent-cap bill, said legislators were finally forced to confront how severe the housing crisis has gotten. About half of renter households in California spend more than a third of their income on housing, which experts consider unaffordable.

Her group, which organizes tenants, canvassed in lawmakers’ neighborhoods and occupied the governor’s office to urge support for renter-protection measures. She said politicians were waking up to the power of 17 million California renters.

“It’s up to the people in our state to stand up to corporate interests and defend consumers,” Schur said.

Newsom, who asked the Legislature to send him a package of tenant protections during his State of the State address in February, played a crucial role in getting lawmakers to pass the final measure.

This summer, he called for a stricter rent cap than what was under consideration. That brought the state’s largest landlord group, the California Apartment Association, to the negotiating table, where Newsom helped broker a deal that cleared a path for the bill.

The association had fought the measure for months, arguing that it would discourage construction at a time when building rates have stalled at less than half of what state experts estimate is needed to meet housing demand. Ultimately, the group determined the rent cap would pass and negotiated key amendments, including one that restarts the one-year clock on eviction protections each time a new roommate moves into a unit.

The law could also serve as a political buffer for apartment owners and developers preparing to fight another rent control initiative next year sponsored by Michael Weinstein, president of the AIDS Healthcare Foundation, who funded the unsuccessful 2018 ballot measure. It would renew the debate over whether rent control is a good idea.

Kenneth Rosen, chair of the Fisher Center for Real Estate and Urban Economics at UC Berkeley’s Haas School of Business and a real estate consultant, said California was making a mistake by adopting a cap on rent increases.

Research on local rent-control ordinances has found they reduce the supply of rental housing, Rosen said, by encouraging landlords to convert apartment units to condominiums or other uses and diminishing the incentive for developers to build new housing.

The rent cap will become a floor for many landlords, he added, who will raise prices by the maximum amount allowed each year — which is far higher than annual rent increases recently.

“From a housing policy point of view, nothing could be worse,” Rosen said. “It’s going to make housing less affordable.”

Schur, the tenant organizer, said California’s rent cap is plenty high enough to allow developers and landlords a reasonable profit. Her group plans to continue its push for stricter renter protections at the state and local levels next year to address what she said is the true cause of soaring living costs: increasing corporate ownership of the housing stock.

“Instead of people who want to provide housing in our communities, we have Wall Street investors who want to extract money from housing in our communities,” Schur said. “It’s coming to a head.”

Bay Area housing, traffic have Facebook looking elsewhere for expansion

Mark Zuckerberg cites region’s infrastructure woes as a hindrance

By LEVI SUMAGAYSAY, Bay Area News Group, October 4, 2019

Facebook CEO Mark Zuckerberg said during a publicly broadcast Q&A with employees that his company is looking elsewhere for growth because of the Bay Area’s housing and traffic issues.

“The infrastructure here is really tapped,” Zuckerberg said Thursday. “Housing prices are way up. Traffic is bad.” He added that while Facebook is trying to do what it can to help with what he called the region’s policy challenges, “at this point we’re primarily growing outside of the Bay Area.”

The social networking giant has a huge footprint in the Bay Area, where it was founded. In addition to the company’s massive headquarters in Menlo Park, it also has offices in Fremont, Mountain View and San Francisco, and plans to open offices in Burlingame next year. Last month, it opened a new campus in Sunnyvale, leasing 1 million square feet that can accommodate thousands of employees.

Facebook’s largest locations outside the Bay Area are in Seattle, Austin and New York City, a spokesman said Friday. Other major cities where the company has offices include Los Angeles, Boston, Chicago, Denver and Washington, D.C.

Facebook has tried to address the Bay Area housing crunch by proposing mixed-use space in Menlo Park and subsidizing apartments for teachers, funding housing for low-income residents and more. The foundation by Zuckerberg and his wife, Priscilla Chan, earlier this year partnered with Facebook, Genentech and others to pledge $500 million to build or preserve more than 8,000 homes in the Bay Area over the next 5 to 10 years.

Zuckerberg addressed the Bay Area’s infrastructure woes as part of his answer to an employee’s question about why Facebook isn’t friendlier to remote work. The CEO said he prefers big hubs where Facebook engineering teams could be around one another, and that he doesn’t want to have a lot of small offices around the world, except for where sales teams need to be in the markets they’re serving.

Zuckerberg’s comments come as other tech companies, including Apple and Google, expand their presence in the Bay Area.

Facebook isn’t the only tech company that’s looking to grow elsewhere, though. Commercial real estate brokerage Cushman & Wakefield said this week that 58 of the 89 biggest — with headquarters of 100,000 square feet and above — tech and life science companies based in the Bay Area have leased 30.4 million square feet of office space in other U.S. cities since January 2010. Outside the Bay Area, the five markets with the most square footage leased by those types of companies are Austin, Seattle, New York, Southern California and Chicago.

Income inequality rises in California as wages fail to keep pace with housing costs

By Erica Hellerstein, CALMATTERS, October 7, 2019

California is the golden state — at least for those at the top of the income scale. For everyone else, the nickname may apply more to the sun than to money.

That’s one takeaway of an analysis of U.S.Census Bureau data by the California Budget and Policy Center (CBPC), which found a widening gap between the state’s haves and have-nots.

The CBPC analysis found major gains for California’s richest residents, modest gains for people with median incomes, and losses for the lowest income earners, when adjusted for inflation.

Median household income in California, the CBPC reported, increased by 6.4%, to $75,277 in 2018 from $70,744 in 2006, adjusting for inflation. But for the top 5% of households, income grew by 18.6% to $506,421 in 2018 from $426,851 in 2006, while households in the bottom 20% saw their average income fall by 5.3% to $15,562 in 2018 from $16,441 in 2006. The analysis was based on the census agency’s latest American Community Survey report.

An increasing gap between rich and poor is not unique to California, as recent data from the U.S. Census Bureau show. From 2017 to 2018, the data indicates, income inequality also widened in eight other states including Alabama, Nebraska, New Hampshire, Virginia and New Mexico, although in most other states it remained constant.

Income inequality is typically measured through the Gini Index, which assigns a score of 0 to indicate perfect wealth distribution within a population and a score of 1 to represent total inequality. In 2018, the overall Gini Index for the U.S. was .485, which was “significantly higher” than its 2017 estimate of .482, the Census Bureau reported.

The trends in California are especially concerning, said Sara Kimberlin, a senior policy analyst at CBPC, given the increases in the cost of living across the state. From 2006 to 2017, the organization found, inflation-adjusted median rent increased by 16% statewide, while median hourly wages for workers fell by half a percent.

“So that’s where the real challenge is that California has to face,” Kimberlin said. “We have two trends moving at the same time: Incomes remaining relatively flat for people in the middle and at the bottom of the income range, while the cost of living is going up.”

The CBPC report on the increasing income gap in the state, released Sept. 26, did not include figures for individual counties.

Alongside rising inequality, the data also showed high levels of poverty among Californians. An earlier analysis of census data from CBPC in September — based on the so-called supplemental poverty measure, which takes into account the cost of housing and other expenses — found that roughly 7.1 million people each year could not afford basic expenses between 2016 and 2018.

“We see that just one expense, one emergency of $500 or $1000, throws them over the edge,” said Joseph. “We’re talking about a huge percentage that’s living on the edge and can barely make ends meet.”

Will Mortgage Rates Stay Low Through 2019? Here’s What Experts Predict

By Aly J. Yale, Forbes, October 4, 2019

Mortgage rates logged their lowest monthly average in over three years last month, and it seems it wasn’t just a blip on the radar. According to three industry forecasts, the trend toward low mortgage rates, slowing home price growth and increased housing construction will continue well into 2020.

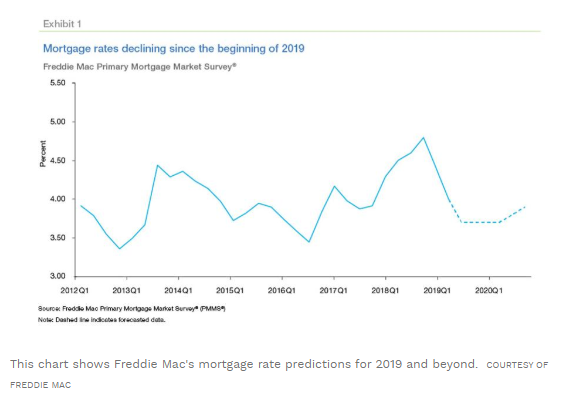

Just yesterday, Freddie Mac reported an average 3.65% rate on 30-year, fixed-rate loans—a whopping 1.06% downslide since just one year ago. Looking at forecasts from the company, as well as from economists at Fannie Mae and the Mortgage Bankers Association, it appears low mortgage rates will persist.

Economists at Freddie Mac predict the fourth quarter of 2019 will average a 3.7% interest rate on 30-year, fixed-rate loans, with 2019 claiming a 4% average overall. Fannie Mae expects the year to average out at 3.9%, while the Mortgage Bankers Association predicts 3.8%.

Looking further ahead, the three organizations expect even more favorable conditions for 2020, predicting average rates as low as 3.4% (Fannie Mae).

As Freddie Mac’s economists explain, “Concerns over the resolution of trade disputes have injected volatility into global bond markets. Investors have flocked to the safety and stability of U.S. Treasuries, pushing down interest rates. As trade talks ebb and flow, rates follow. Despite the volatility in rates, we expect long-term rates to remain flat on average . . . Low treasury yields will keep mortgage rates subdued in the coming quarters.”

The low rates have caused a surge in refinancing as of late. MBA data shows refinance activity is up 133% over last year, and even recent homebuying Millennials are getting on board. Refinances accounted for a full quarter of all Millennial loans last month, according to mortgage technology provider Ellie Mae.

Freddie Mac predicts the surge in refinancing will continue.

“Rates fell for most of this year and lower rates have translated into a stronger housing market,” its forecast states. “Both home sales and housing construction are firming. We expect a significant increase in mortgage refinance originations in the coming quarters.”

Freddie, Fannie and the MBA all predict improvements in terms of construction and home price growth. Freddie Mac expects housing starts to average 1.25 million for 2019, then jump to 1.28 million by next year.

The latest Census Bureau data backs this up, showing single-family housing starts up 12.3% for the month and 6.6% over the year. Overall completions were also up.

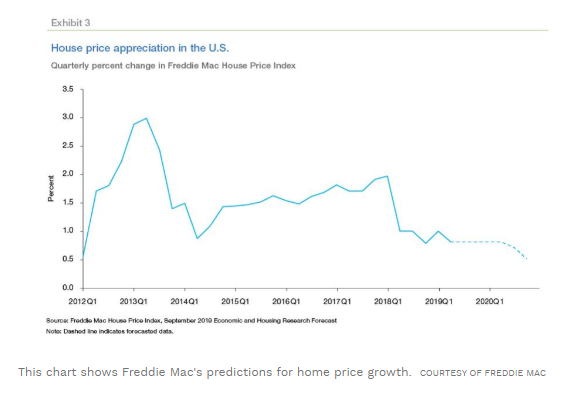

All three organizations expect home price growth to slow, reaching just a 2.2% appreciation rate by 2021, according to MBA. Last month’s House Price Index from the Federal Housing Finance Agency shows home prices were up 5% in July—down from the 6.7% uptick since just one year ago.

The 10 trends that will shape real estate in 2020

The Urban Land Institute’s annual look at the year ahead finds some direction within a fog of uncertainty

By Patrick Sisson, Curbed, Sep 19, 2019

A market as large and dynamic as United States real estate rarely moves quickly. But the most striking narrative running throughout the annual Emerging Trends report from the Urban Land Institute is the sense of static and stasis.

Economic and political uncertainty have made things feel unmoored, but the overall insight conveyed by the authors—Urban Land Institute and PricewaterhouseCoopers researchers personally interviewed 750 industry members, and surveyed 1,450 more to create this report—is that we’re in for a soft landing, not a sudden crash. There may be less sudden moves, but that doesn’t mean some of the trends emerging this year won’t become breakout investments in the near future.

Who’s afraid of a recession?

While recession fears have certainly spooked those expecting the current record-setting economic cycle to eventually correct itself, industry sources consulted for the report believe the housing sector is still in great shape. Confidence is “palpable,” due in large part to the fundamentals. Analysts don’t see the same oversupply or over-leverage issues that caused a panic and set off the Great Recession.

The market has flashed warning signs—the last year has witnessed a decline in residential permits, a softening of housing starts, and languid car sales—but instead of a precipitous drop, the real estate world may enter a sustained slow down. With unemployment already relatively low and growth expected to just inch up over the next few years—just under 2 percent annually, according to the Congressional Budget Office—we may see homeownership levels plateau. The new normal, in other words, might be a slightly small, less active version of what we see today.

Capital with no place to go

Underscoring the broad feelings of uncertainty—and in some cases, surprise that the economy is still performing well—there’s a worldwide search for safe investments that in many cases is coming up short. One investor told Emerging Trends researchers that there’s “a continued shortage of deals with desirable yields; there are more investors chasing deals than there are good deals available.”

There’s a paradox of plenty taking place in the capital market, with too much money looking for a place to invest, yet most institutional investors have taken a conservative approach. The abundance of capital is a blessing and a curse; there’s liquidity on the market, but there’s also a temptation to yield to the pressure and “invest anywhere, somewhere,” which could lead to bad bets and more uncertainty.

Top ten markets present little surprise

Emerging Trends didn’t redraw the map with its predictions for the top 10 markets for 2020, favoring large and mid-sized metros in the “smile states” (west and east coast, plus the Sun Belt). By and large, the cities on the list have benefitted from a combination of tech-driven growth and booming populations: Austin, Raleigh/Durham, Nashville, Charlotte, Boston, Dallas/Fort Worth, Orlando, Atlanta, Los Angeles, and Seattle round out the top 10. The next 10 on the list include a few smaller metros, such as Charleston, South Carolina; Portland, Oregon; and Indianapolis, as well as suburban areas such as Orange County in California and Northern Virginia, which expects to see a big bump from Amazon’s new headquarters.

The great housing unraveling

Inequality has become a feature, not a bug, of our current housing market. The report found that “price recovery has so far outstripped household incomes that affordability has reached the breaking point even in markets that previously boasted of the low cost of housing.” Rents and home prices have skyrocketed, becoming untenable in markets nationwide; there’s no county in the country where a worker clocking in 40 hours at minimum wage can afford a two-bedroom apartment, per the National Low-Income Housing Coalition.

And conditions appear to be getting worse, as the type of regulatory action and investments needed to overcome a severe shortage of affordable and workforce house aren’t materializing. “We are building 90 percent of our housing for 10 percent of our households” said one interviewee. The affordability issue has so warped local economies that even big tech giants, such as Google and Microsoft, have pledged millions of dollars to help fund affordable options. Candidates on the campaign trail have taken note, making housing a bigger issue than it’s been in decades.

The trend toward community-oriented development is here to stay

WeWork IPO aside, the future of coworking, of shared commercial space, is bright. Coliving, led by companies like Common, is poised for a huge increase in capacity across the country. And the number of urban green markets, which grew from roughly 2,000 to 8,700 in the last 25 years, shows the continuing appeal of foodie-centric public spaces, as well as food halls. This year’s Emerging Trends found that collaborative consumption—integrated platforms of products, services, and experiences—is increasingly popular with younger generations favoring sustainability and social interaction. As traditional retail continues to struggle, this type of business, or placemaking effort, can be a big draw for a larger project.

Hipsturbia

As more millennials become parents of school-age kids, and urban areas continue what seems like an inexorable rise in real estate prices, there’s a slow but steady push toward the suburbs. But, in what the report dubs “the rise of Hipsturbia,” the hot locations outside of big cities are evolving: In addition to being more diverse, they’re also becoming more walkable, with developments that favor density, retail, recreation, and transit access. Examples of this phenomenon include Hoboken, Maplewood, and Summit in New Jersey, Yonkers and New Rochelle in New York, Evanston in Illinois, and Santa Clara in California. Many, especially on the East Coast, are linked by old commuter rail stops, and have seen a renaissance with new apartments, eateries, and office space. But all of them have developers taking the live/work/play formula that revived downtowns to the ’burbs, with much success.

The “silver tsunami” of senior housing

A number of demographic trends are cresting at the same time, namely life expectancy has risen overall as the baby boomer generation begins to enter prime retirement years. The number of Americans over 80 will double, from 6 million to 12 million, in the next two decades, according to statistics from Harvard’s Joint Center for Housing Studies, and by 2035, one out of three U.S. households will be headed by someone over 65. The last boomers won’t turn 80 until 2044. This will mean a huge flood of seniors looking for a variety of housing options, including active lifestyle living and even upscale urban apartments (especially as many boomers downsize). There are huge implications for housing, both in terms of renovations for those who want to age in place, and new options for seniors looking for a new post-retirement lifestyle.

The potential, and pull, of principled investment

Millennials, and younger generations, are increasingly factoring social good into their investment decisions, which the report labels ESG (environmental, social, and governance). What does this mean for real estate? Well, projects that can lay claim to being more community-oriented, or have a bottom line beyond just profit, have the potential to become more popular investment vehicles over time, and attract more of this community-focused capital.

This includes more sustainable multifamily construction or instruments such as green bonds, which are intended to encourage sustainability, especially projects aimed at energy efficiency, clean transportation, sustainable water management, and the cultivation of environmentally friendly technologies. One Wall Street firm surveyed even says this type of investment has a performance premium of 10 to 40 percent. Doing good can do well for a developer’s bottom line.

The slow and steady march of technology

Technology in the real estate sector—both smart home devices for residential settings and proptech, which are startups bringing new ideas to the larger real estate business—have been on the verge of a breakout for years. And while the relatively slow adoption of tech in real estate continues, it is starting to make a real impact. In addition to the proliferation of iBuyers and new means to analyze and act on property data, and new tools to digitize the homeselling process, one of the biggest areas of renewed attention is the multifamily sector, where companies are developing new products to simplify management and operations, as well as new amenity-laden services for residents, such as package delivery and digital concierges. But smart home adoption, especially digital assistants and security cams, are increasingly common, and will be even more so with the rise of 5G.

Infrastructure: As Washington fumbles, states and cities pick up the ball

As the recurring jokes about “infrastructure week” suggest, the current administration’s early plans to focus on rebuilding the country’s roads, bridges, trains, and ports have not come to pass. This lack of action on the federal level to improve our degrading infrastructure has led to cities and states picking up the baton: Places like Denver and Seattle have levied taxes to help build and expand their transit systems. Considering the potential of transit-oriented development, these kind of local investments can help create important real estate development opportunities. Without sustained federal investment in this arena, there will be a tale of two cities dynamic at play; areas that invest in their own infrastructure will send a signal that they’re a good place to invest.

Recession fear spooking apartment buyers

by Sabina Mollot, Real Estate Weekly, September 18, 2019

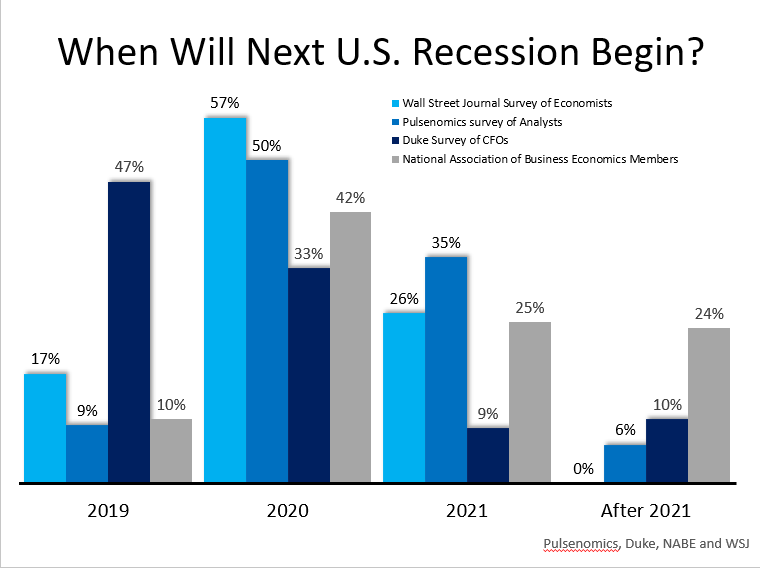

Fears of a recession, which analysts have been predicting is on the horizon, are causing some otherwise interested home buyers to put their plans on hold.

Most house hunters believe a recession will hit this year, or within the next few years, Realtor.com found in a recent survey.

And 56 percent of survey respondents said if a recession did it, they’d halt their home search until the economy improved.

That said, the upcoming recession isn’t expected to be as devastating as the Great Recession seen a decade ago.

“Economic activity is cyclical, so yes, undoubtedly we will face another recession at some point in the future, but we do not expect it to be anything like 2008,” said George Ratiu, senior economist at Realtor.com. “The next recession will likely be driven by factors outside of housing, such as a prolonged trade war, cutbacks in corporate spending or contagion from a European recession. Unlike 2008, mortgage underwriting has been more disciplined and regulated, which should provide a more secure foundation for housing during the economic ups and downs.”

More than 36 percent of the 755 active buyers surveyed by Toluna Research expect the next recession to begin sometime in 2020 (up six percent from March).

Meanwhile, according to the Realtor.com survey, 32 percent of active buyers indicated they are a lot more optimistic toward homeownership following 2008, whereas only 7 percent of non-buyers felt this way.

Additionally, 17 percent of current shoppers expect a recession to hit sometime in 2019, 14 percent expect sometime in 2021, and 7 percent expect sometime in 2022. Eight percent expect sometime in 2024 or later and 17 percent reported they didn’t know.

In response to the survey, residential brokers had mixed views on how recession fears could impact the market.

Gary Malin, president of Citi Habitats, said ultimately it depends on buyers’ individual situations.

“Not all recessions are created equal,” he said. “In the event a recession occurs, obviously it means the economy is on shaky ground. When it happens, people start looking at their personal circumstances. They look at their stocks, they look at their jobs, they look at their wages and make decisions based on those factors.

“Some people will take a conservative approach. They wait to see how their jobs react, how the market reacts. Other people might be sitting on the sidelines and believe there’s an opportunity in the marketplace. Not every sector gets hurt by a recession. You’ve got to understand what someone’s job is. People who purchased during the last downturn have done very well with their investment.”

Malin added that even without a recession, the market has already been dealing with its own downturn.

“It’s not like people are going to wake up all of a sudden,” he said. “The sales market has felt a lot of this pain to begin with. Great homes still sell. Generic properties are having difficulty and the high-end places are seeing price reductions.

“I can tell you what I hear from the marketplace; it has been having its struggles. The stock market has been going up at a rapid pace. There’s bound to be a correction.”

Other brokers said recession worries will ultimately work in the favor of those who refuse to get spooked by all the doomsday reports.

“The New York market started softening in 2016 so we are three years into the real estate market correction,” said Michael J. Franco of Compass.

“Historically in New York prices don’t drop drastically so I believe it is a good time to buy especially if more wait by the sidelines because of recession jitters. Historically recessions don’t last forever so if you can afford your monthly payment after buying you should fare well post-recession.”

Franco said he expects a recession will happen in 2020.

“Fifty percent of economists think we are due for a recession next year. Therefore, I think it is a safe bet to assume it could happen or the year after. Seems to me the more everyone reads and hears about it the more likely it is to happen. Self-fulfilling prophecy!”

Agent Steven A. Gottlieb of Warburg Realty said a recession could very well happen if the trade war with countries like China continues and those other countries hit back with tariffs and other costs that leave Americans feeling drained and willing to spend less.

“As the 2020 elections approach, the current administration will do what it can to stave off recession, as that will prove a real hurdle for reelection,” Gottlieb said.

The agent added he believes those interested in buying would be wise to do so before the election, if their intention is to keep the property long-term.

“Now is a great time to buy if the buyer will own the property for a while. Prices (at least in our local market) have been softening for years, but I think that buyers have settled into the political and economic uncertainty that we’ve been experiencing lately, and thus are coming out of the woodwork.

“I don’t think it’s a good time to ‘flip’ since we are not in a surging market, like in 2013 and 2014, but it’s a good time to get in. Sellers are becoming more realistic and there are deals to be had.”

Meanwhile, at least one broker, Gill Chowdhury of Warburg, doesn’t believe there’s a recession ahead any time soon.

“Although the media has been reporting on an upcoming recession, that is simply not the reality,” he said. “The current trade war with China has caused some turbulence in the stock market. What’s important to note is that anyone using the total number of points to describe how the market is doing is simply not sophisticated and/or is fear-mongering. In addition to this we see American wage growth going strong with inflation slowing down.

“Unemployment remains at historic lows. Personally, I don’t expect us to see a recession until well after 2020 which is exactly what I tell buyers who bring it up.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link