February 28, 2019 – Real Estate Market Numbers

By Glen Bell (510) 333-4460

Here are some highlights for the 38 East Bay Cities that I track:

Affordability, rising interest rates, increasing inventory, reduced sales, considerations of moving out of the Bay Area, are all topics of interest in a market in transition. Properties are staying on the market longer, we’re seeing fewer offers than before, more price reductions and some incentives now being offered, in effect, all favoring buyers. Yet indecision has many buyers on the fence with a wait and see attitude despite having more choices.

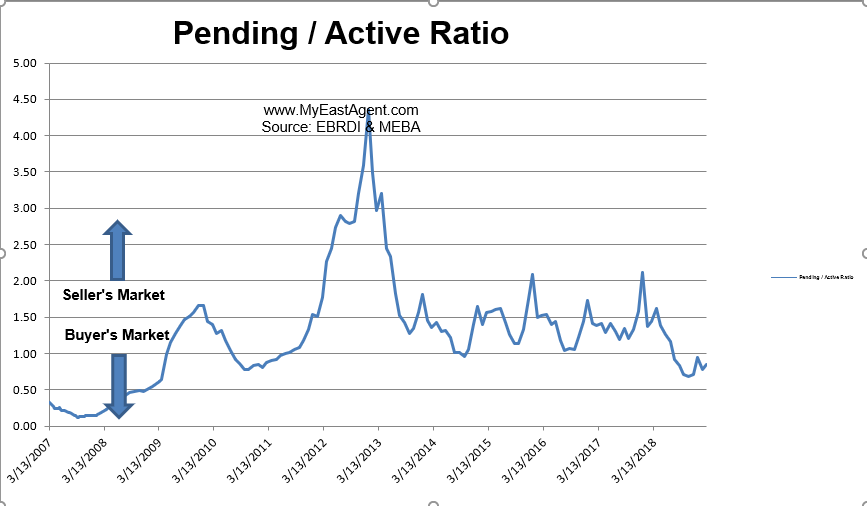

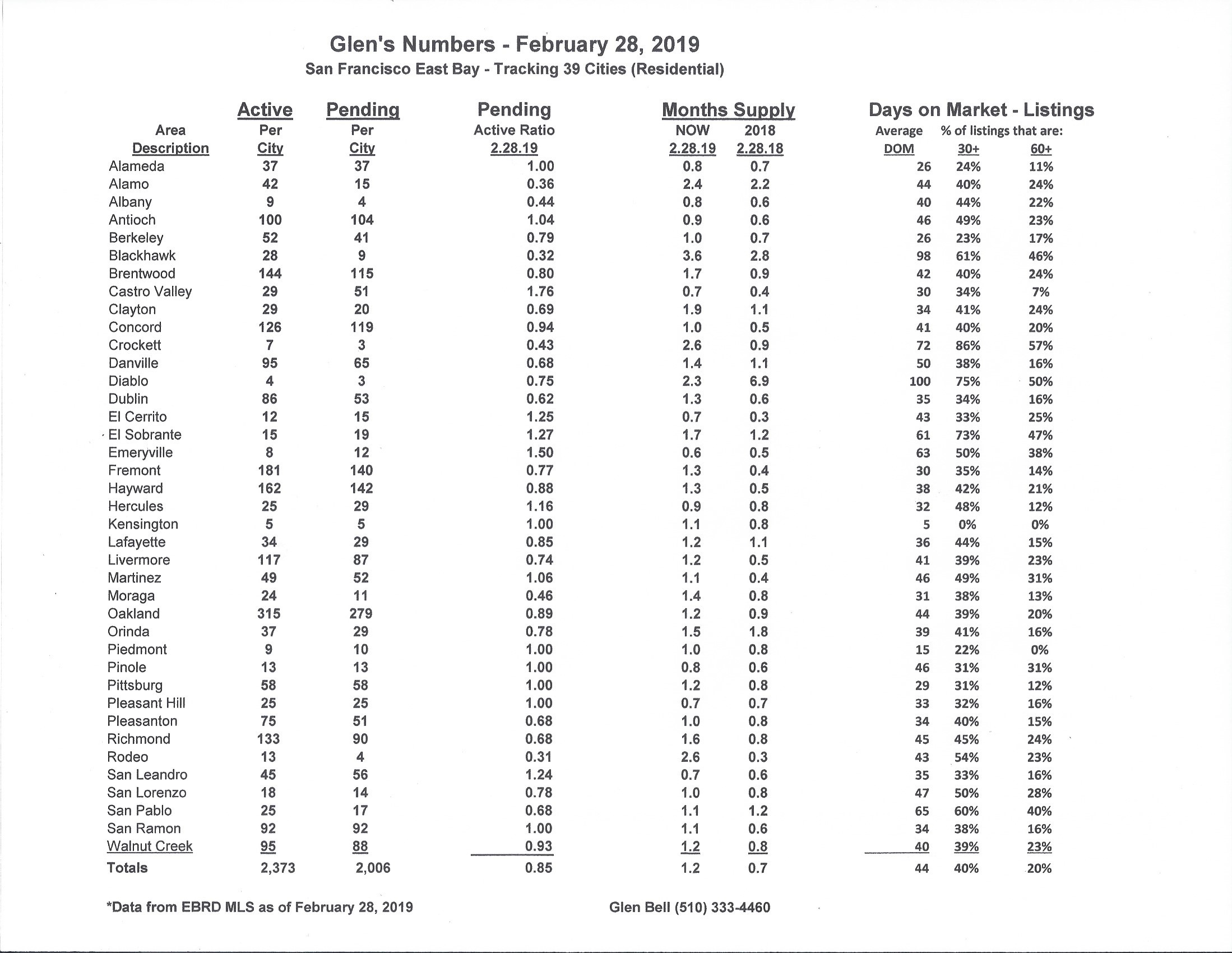

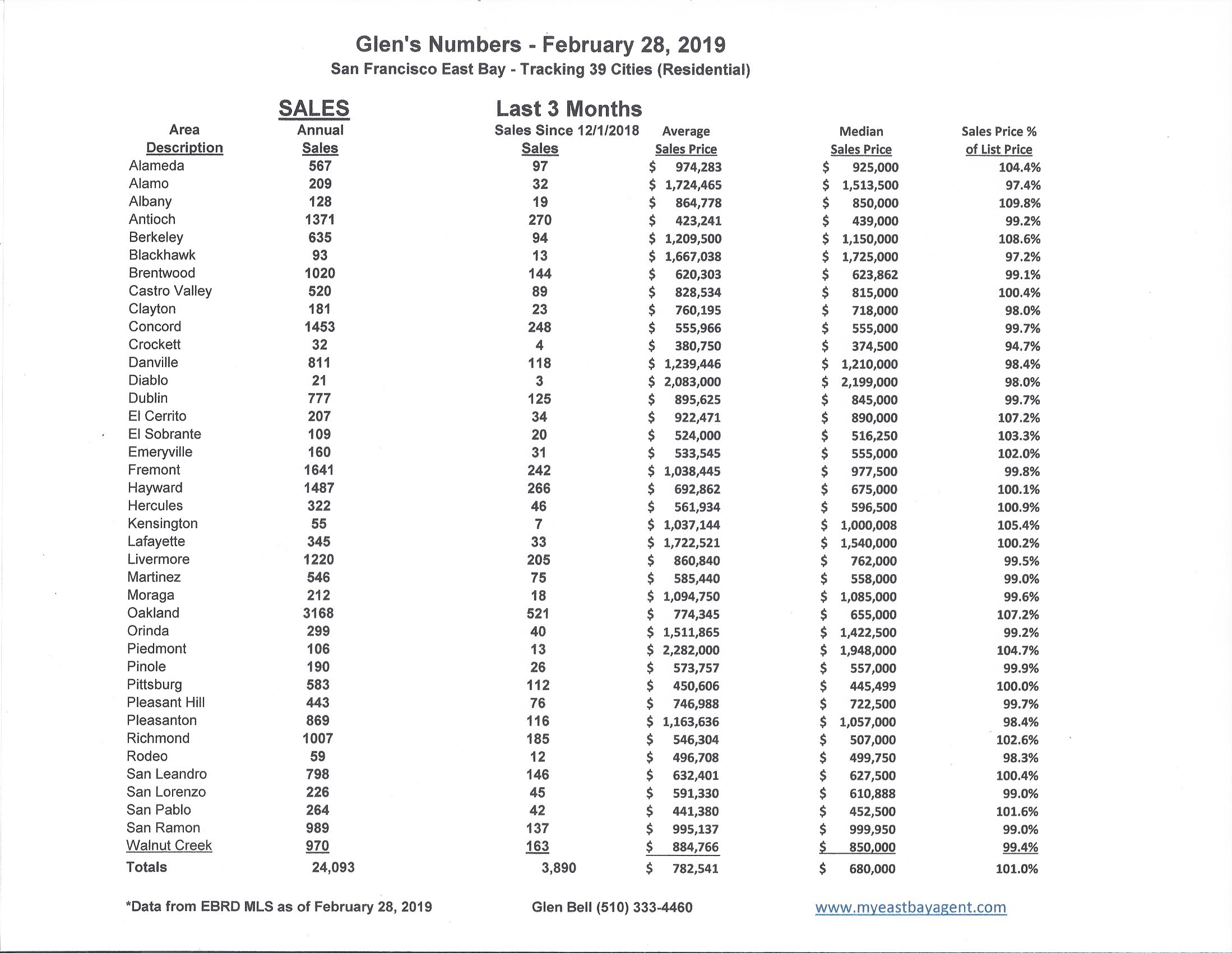

- Here’s where we stand as of the end of February. Typically, we see a dramatic drop in inventory during December followed by a modest increase in January and February. Inventory has increased by 34.4%, now sitting at a 36 day supply of homes for sale, (However, this is much higher in comparison to last year’s end of February of a 21 day supply). Pendings increased slightly, however, we are now 9.1% lower as compared to last year. The pending/active ratio increased slightly to .85, still below our neutral mark. However, our ratio last year at the end of February was 1.44. This is quite a difference. This is the eighth month in a row that the ratio falls under 1.00. The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (more inventory with fewer pendings) favors sellers as has been the case now for quite some time. A number below 1 favors buyers. In short, we have moved from a strong seller’s market since the beginning of last summer towards a more normal and balanced market, and in many cases, now favoring buyers.

- The percentage of homes “sitting” has come down to 40% of the homes listed now remaining active for 30 days or longer, while 20% have stayed on the market for 60 days or longer. This improvement is usually due to the number of New homes that were listed in January and February. Still there are more homes “sitting” this year as compared to last year, (with then 27% remaining active over 30 days and 12% remaining active over 60 days).

- It’s hard to predict how much tax reform will play into this but see the article, “Is California facing a tax exodus? Thanks to Trump’s tax law, more may start to flee.” We are seeing interest rates starting to go up. Prices have continued to rise and are only now beginning to flatten out. More and more, affordability, the high cost of living and our traffic woes are coming into play for those, especially in the “middle class,” who may now be considering leaving the Bay Area.

- The “distressed” market, (foreclosures and short sales) are no longer a factor representing less than .05% of the market.

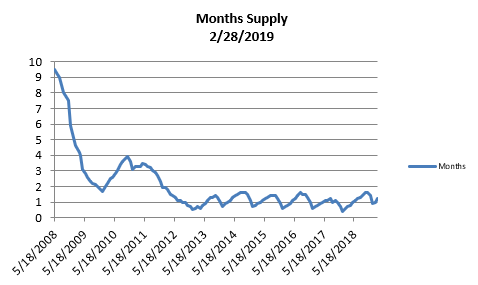

- The month’s supply for the combined 39 city area is 36 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years. We are higher when compared to last year at this time, of 21 days.

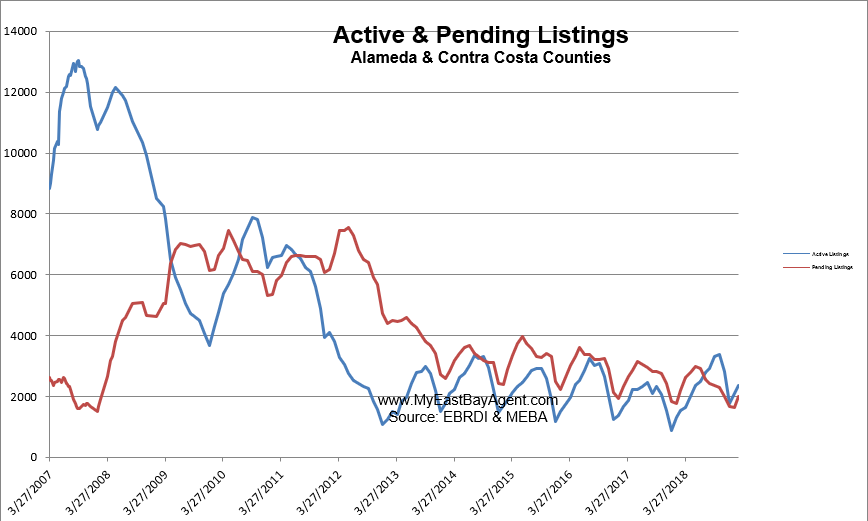

- Our inventory for the East Bay (the 39 cities tracked) is now at 2,373 homes actively for sale. This is higher than last year at this time, of 1,524 or (55.7% higher). We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales increased to 2,006, less than what we saw last year at this time of 2,201, or 9.1% lower.

- Our Pending/Active Ratio is .85. Last year at this time it was 1.44.

- Sales over the last 3 months, on average, are 1% over the asking price for this area, lower to what we saw last year at this time, 3.8%.

Recent News

Power is Shifting To Buyers in Most California Housing Markets in 2019

By Michael Gerrity, World Property Journal, March 8, 2019

High prices still make it difficult to afford a home in many US markets

Zillow is reporting this week that a limited U.S. housing inventory and rapid price appreciation have kept sellers firmly in the driver’s seat for several years as the United States recovered from the housing market collapse in 2008. Now, buyers are gaining more negotiating power as the housing market slows, especially in some of the nation’s hottest markets.

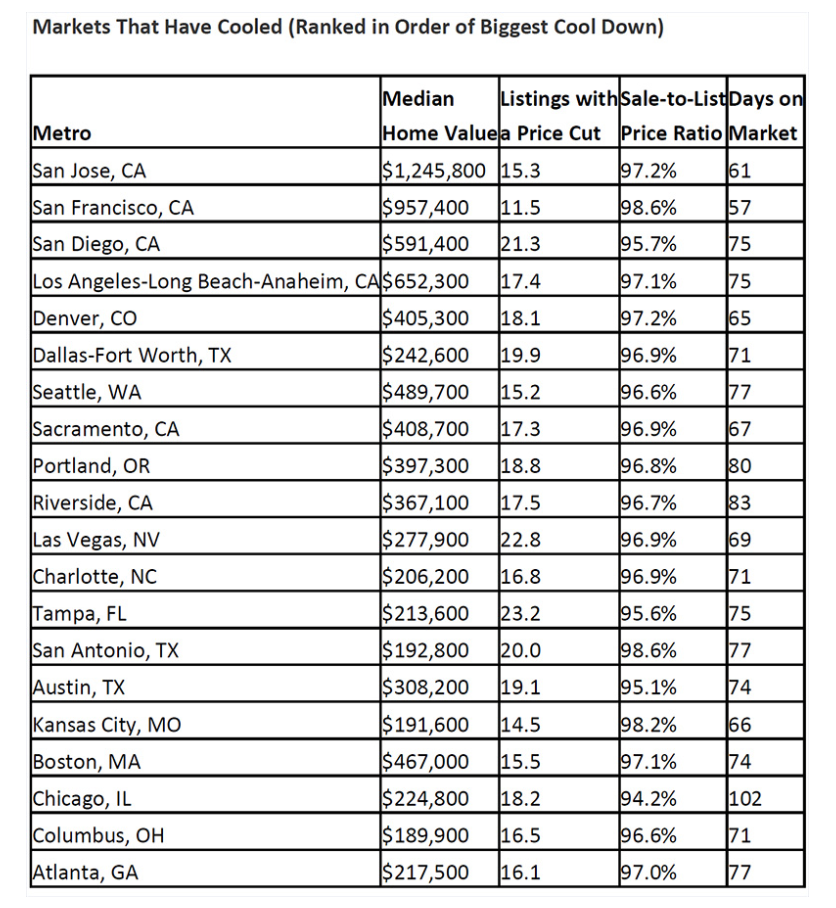

According to Zillow’s Buyer-Seller Index, in 20 of the 35 largest U.S. metros, market conditions favor buyers more than they did a year ago. The index is based on the share of listings with a price cut, how long it takes to sell a home, and the sale-to-list price ratio. By comparing each metro across time, this analysis shows whether the market is cooler (favoring buyers) or hotter (favoring sellers) than it was in the past.

California markets have seen the biggest shift toward buyers since last January, led by San Jose, which has seen the most significant swing. San Francisco, San Diego, Los Angeles and Denver round out the top five markets where buyers will have an easier time navigating the market than they would have in recent years.

Even though San Jose and San Francisco have cooled exceptionally, they are still the hottest markets compared with others around the country, markets where listings see few price cuts, homes don’t stay on the market for long, and sale-to-list price ratios are higher. In these two Bay Area markets, home prices are so prohibitive, the typical buyer must put more than a 20 percent down to keep mortgage payments at or below 30% of monthly household income.

San Jose buyers would need a 49 percent down payment, or $614,100, nearly three times as much as the national median home value. Buyers in San Francisco (43 percent), Los Angeles (43 percent) and San Diego (31 percent) would also need to put down more than 20 percent.

“It is no surprise that the markets which pushed the bounds of affordability over the housing recovery are now experiencing significant cooling,” said Skylar Olsen, Zillow Director of Economic Research. “As down payments and mortgage payments far outpaced incomes, buyer demand eventually exhausted itself. Those buyers looking in cooling markets will likely welcome the relief, although the entry price is still high. Inventory is returning and spending more time on market, meaning their decision making can be made with a cooler head.”

While some of the hottest markets slowed down over the past year, others have become more seller-friendly.

Miami – which tends to see large fluctuations – has seen the biggest overall shift toward favoring sellers over the past year, with homes selling about a week faster than they did a year ago.

Even cool, Bay Area housing market is still hot

The typical buyer in Santa Clara County needs $614,000 down to keep mortgage within budget

By LOUIS HANSEN, Bay Area News Group, March 20, 2019

he San Jose housing market has cooled more than any other in the country — and it’s still the hottest in the nation, according to a recent Zillow survey.

The bidding wars and quick cash sales have abated, and home sellers are cutting prices more often and waiting longer to close deals than a year ago. But middle-income families still struggle to afford the median priced home of $1.2 million in the San Jose metro area. A typical family needs to put about $600,000 down to fit that mortgage comfortably in their budget.

“Buyers are not being forced into crazy bidding wars to leapfrog each other into a house,” said Zillow economist Jeff Tucker. But, he added, “It has been the hottest market in the country. In a lot of ways, it still is.”

The Bay Area housing market has rocketed up and pushed out many would-be buyers. Median sale prices for existing homes have climbed, year-over-year, every month since April 2012, according to real estate data firm CoreLogic. These rising prices — the median sale price in January for the nine-county region was $750,000 — have slowed Bay Area home buying to its lowest level in a decade.

Sales slumped nearly 13 percent in January from the previous year. Agents say homes priced over $2 million are spending longer on the market, and CoreLogic data found transactions for luxury homes in San Mateo and Santa Clara counties dropped by more than 25 percent in December and January.

Real estate agent Ramesh Rao said higher-end properties in Cupertino and Saratoga are taking longer to sell. “At the moment, it is neither clearly a sellers’ market nor a buyers’ market,” Rao said in an email. “The market is moving sideways.”

Zillow measured the slowdown by charting home listings with a price cut, the length of time it takes to sell, and the sale-to-list price ratio. Last year, homes in San Jose metro took 41 days from listing to close, a remarkably quick turnaround given the typical steps a home sale requires — bank approval, inspections and insurance. It took 49 days in the San Francisco and Oakland metro area.

“That’s just lightning fast,” Tucker said. Some of the quick deals could be attributed to all-cash offers with buyers agreeing to take properties as-is, with no contingencies, he said.

San Jose homes now take about 60 days from listing to closing, while homes in the East Bay and San Francisco take 57 days to finalize a sale, according to Zillow.

About 15 percent of homes listed in the San Jose metro area took a price cut. Homes still sold for a robust 97 percent of asking price. Last year, the typical property sold for a 7 percent premium over asking price.

In the East Bay and San Francisco, 11.5 percent of sellers dropped prices and sold their homes for an average of 98.6 percent of the asking price.

But even as the market cools, median home values have surpassed $1 million in the San Jose metro area and ticked up to $957,000 in the San Francisco metro. At those prices, a family in Santa Clara County making the county’s median income of about $107,000 would need to put $614,000 down to keep mortgage payments at 30 percent of their monthly earnings.

Agents say demand remains robust, despite the few hints of a slowdown.

Agent Mark Wong of Alain Pinel said demand is strong for entry-level homes, listing for about $1 million, on the Peninsula. Wong sold two homes recently in Mountain View and San Jose for more than the asking price and with no contingencies. Both sellers accepted offers within two weeks, he said.

On a recent weekend, Wong had 50 people tour an open house during a rainstorm. “Lots of people still want to get into the market,” he said. “I don’t think it’s slowing down.”

Will Doerlich with Realty One in San Ramon said homes for sale have increased in East Bay cities, and sellers have been willing to accept more contingencies on offers.

But in San Ramon, Dublin and Pleasanton, he said, “it’s extremely busy and extremely competitive, still.”

Here’s why San Francisco housing prices could soon get even crazier

San Francisco has the highest housing prices in the nation, and it may only get worse.

By MIKEMURPHY, Market Watch, Mar 7, 2019

San Francisco is already facing a housing and affordability crisis, but it may be about to become a lot worse.

By the end of 2019, the city could have hundreds, even thousands, more millionaires — on paper at least — thanks to a slate of tech IPOs lined up. On Thursday, a report by the New York Times’ Nellie Bowles laid out what may be coming, boiled down to two words: “Housing madness.”

San Francisco-based tech unicorns planning to go public in the near future include Uber Technologies, Lyft, Slack, Postmates, Pinterest and Airbnb. While the San Francisco Bay Area has been no stranger to tech IPO riches in recent years, as Bowles pointed out, previous big tech IPOs — think Google and Facebook — have been largely based outside San Francisco and had workers spread out around the area. This new crop are based in the city itself, and many of their employees live there as well — or want to.

Real estate agents are already drooling. According to the Times, at a recent gathering, one agent said there likely won’t be any one-bedroom condos in San Francisco under $1 million within five years. And single-family homes, which already average well over $1 million, will reach an average of around $5 million, he forecast.

Millennial tech workers want the convenience of the city, another real-estate agent told the Times: “They seem to not want to own cars, and food deliveries are really easy now, and they want to be close to entertainment, so they’ll stay in the city.”

That could be bad news for non-millionaires who are trying to find an affordable apartment or — gasp! — even a house. Displacement is likely to increase as housing prices become even more out of reach for lower- and middle-class people. The median price of a one-bedroom apartment in San Francisco recently hit a new high of $3,690 a month, according to real-estate website Zumper, up 9% from the same time last year. That’s more than $800 higher than the median New York City apartment.

But while San Francisco’s inequality gap may grow, some small businesses are poised to cash in. Event planners told the Times that the upcoming IPO boom will likely surpass the ‘90s tech bubble in terms of sheer excess — which is good news for them. One told the Times that party budgets for tech companies can top $10 million, with A-list entertainment. One recent tech exec’s ‘80s-themed party featured the B-52s, Devo, The Bangles, Tears for Fears and A Flock of Seagulls, the planner said.

At least one electric bike shop is stocking up its inventory, predicting a sales boom later in the year, and a nearby ice sculptor is gearing up for a big year, likely carving everything from massive ice sculptures to ice cubes with company logos engraved in them.

The size of the coming boom is no sure thing — IPO bubbles have a nasty tendency to pop, as employees of companies such as Snap SNAP, -0.11% and Blue Apron APRN, -3.85% can attest to. Employees’ stock options will be locked up for months after the companies go public, and it’s unlikely most will entirely cash out at once. Still, there will likely be a noticeable effect.

The growing financial excess has some talking about the certain backlash.

“There’s some who’ve talked about pitchforks,” a private wealth adviser told the Times. “And I don’t think we’ll go there, but there’s a point when that makes sense.”

Bay Area home prices ‘totally random’ as sales slow

By Kathleen Pender, San Francisco Chronicle, March 1, 2019

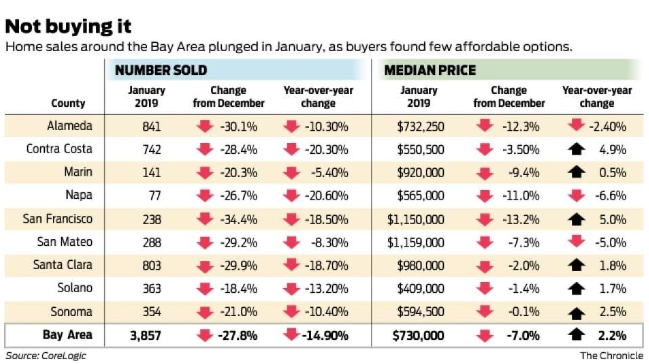

The median Bay Area home price rose at its slowest year-over-year pace in two years in January as a slowdown that hit the real estate market in September continued into the new year.

The median price paid for a new or existing home or condo in deals that closed in January in the nine counties was $730,000, down 7 percent from December and up 2.2 percent from January of last year, according to a report released Thursday by research firm CoreLogic. In January 2018, the median price rose 13.8 percent from a year earlier.

Prices rose in the double digits for 13 consecutive months until September, when the market downshifted amid a big jump in inventory. Buyers backed off during the past three months of the year amid a jump in interest rates, a sharp stock market correction and general lack of affordability.

Many sales that closed in January were struck in December.

By the end of February, the stock market had recovered most of its losses and mortgage rates were the lowest in more than a year. The average rate on a 30-year mortgage this week is 4.35 percent, down from nearly 5 percent in November and 4.43 percent a year ago, according to Freddie Mac.

The market now “is totally random,” said agent Alexander Clark of TheFrontSteps Real Estate in San Francisco.

He listed two homes on Page Street last spring “that literally flew off the shelves,” he said. He listed another on Page Street just after Labor Day that didn’t sell until January, after he had taken it off the market. The buyer had seen it in September. Another house he sold on Page Street that closed in late January took just as long.

Bay Area home sales slow but prices shift back into high gear

Sales drop nearly 20 percent in Santa Clara, Contra Costa counties

By LOUIS HANSEN, Bay Area News Group, March 1, 2019

For a few months, it seemed as if the speeding Bay Area housing market was ready to slow down.

Agents reported sluggish sales and buyers having a few more options.

But any buyer relief was short-lived — median sale prices for existing Bay Area homes surged 4.9 percent year over year in January, according to a report released Thursday from real estate data firm CoreLogic. The region’s highest-in-the-nation home prices sent many shoppers to the sidelines, and overall sales dropped 12.8 percent, hitting lows not seen in more than a decade.

CoreLogic analyst Andrew LePage said buyers delayed purchases due to stock market volatility and uncertainty caused by the government shutdown. The Bay Area had its lowest number of January home sales in 11 years, according to CoreLogic.

“Sales started to sputter late last year,” LePage said. “There’s plenty of people just priced out.”

Future changes in the market, he added, will hinge on mortgage rates, housing inventory and the strength of the economy.

In December, median sale prices inched up just 1.3 percent, hinting at a possible end to a record-breaking streak of higher prices that started in April 2012. Four counties actually saw price drops.

But families and individuals buying homes in January found the simmering market still bubbling throughout the nine-county area, with median prices for existing homes rising to $750,000 in January, a gain of $35,000 from the same time last year.

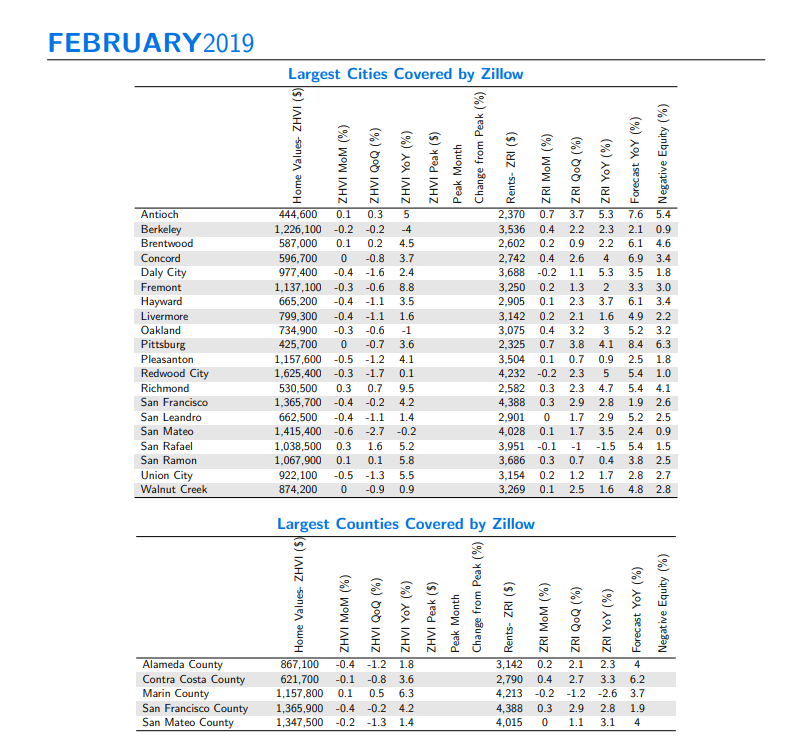

Median sale prices rose 1.9 percent to $1.07 million in Santa Clara, 5.6 percent to $565,000 in Contra Costa, 1 percent to $767,750 in Alameda, and 3.9 percent to $1.3 million in San Francisco. Prices dropped slightly in San Mateo County, where the typical home sold for $1.33 million.

The median sale price for existing homes peaked in May at $935,000.

But the high prices in Santa Clara County — home to tech giants and a booming economy — contributed to home sales falling 18 percent from the previous year. Bargain hunters even stayed away from more affordable Contra Costa County, where transactions dropped 17 percent.

Agents say the market for starter homes — in the Bay Area, around $1 million — remains hot. Buyers are more discerning for properties selling around $2 million.

The sales slowdown was more pronounced for high-end homes on the Peninsula, according to CoreLogic. The number of homes that sold for more than $2 million dropped, year-over-year, in December and January by 36 percent in San Mateo County and 26 percent in Santa Clara County.

But overall, agents report strong demand and short housing supply as the local economy surges.

“Is now a good time?” said Alameda agent Sophia Niu. “In the Bay Area, now is always a good time.”

The market looked to be slowing down in the last quarter of 2018, Niu said. But the first two months of 2019 have been busy for Niu and other East Bay agents, she said.

Nui placed a four bedroom, 1,800-square-foot single family home in Alameda on the market in January. Her clients expected a softer market than the year before. But after two open houses, the owners received multiple offers substantially above the $828,000 asking price, Niu said.

“All indications are that this year is going to be really strong,” she said.

Nancie Allen, president of Bay East Association of Realtors, said the pace of sales has slowed. “Buyers are feeling much more patient,” she said. If a home looks like a good deal, she added, “I’m still seeing multiple offers and offers way above asking.”

Real estate agent Ramesh Rao, of Cupertino, said high-end sales have been slower, and customers have been more savvy about checking prices.

Michael Tkachuk, 42, moved from Luxembourg in September with his wife and 11-year-old son. He braced for high prices in the Bay Area but was willing to make the move for an enticing tech job and good schools.

“We knew that it was expensive,” said Tkachuk, an executive at a cybersecurity firm in Santa Clara. But by the end of July, he added, “the market kind of cooled down.”

They spotted an ideal house with five bedrooms and a big backyard on a quiet street in Los Gatos and bought below the $2.8 million asking price. The school is great and the neighborhood is filled with redwoods.

Rao, Tkachuk’s agent, said his tech industry clients come into the market with more data and sophistication.

New agency would raise public dollars to build thousands of housing units in the Bay Area

By Rachel Swan, San Francisco Chronicle, March 7, 2019

A new Bay Area agency would raise public funds to build thousands of homes a year, provide emergency rental assistance for tenants and help cities acquire land parcels for affordable housing, under a bill that state Assemblyman David Chiu will introduce Thursday.

The regional agency would be a housing version of the Metropolitan Transportation Commission, which oversees roads and transit in the nine-county Bay Area, and it would be empowered to place funding measures on the ballot. But already, the blueprint for Chiu’s bill has drawn opposition in suburbs that have long fought off affordable housing and fear they could lose local control.

Chiu is resolute. “I deeply respect the process and importance of localities being able to shape their communities,” he said. “But this cannot mean doing nothing … when so many residents are considering leaving our region because of housing costs, when workers are driving two or three hours a day to get to their jobs, when eviction rates are what they are.”

His legislation calls for the creation of the Housing Alliance for the Bay Area, spawned from a controversial 10-point document that Bay Area leaders approved in January. Dubbed CASA, the compact brought together developers, tech executives, politicians and tenant advocates who agreed to a set of principles: produce 35,000 homes a year throughout the nine-county region, protect longtime residents in neighborhoods that are rapidly gentrifying and tackle a housing shortage that has gnawed at the Bay Area for years.

The bill would use those guidelines as inspiration for a binding law and would generate $1.5 billion a year to get it started.

“This is the most intense challenge our region faces,” said Chiu, D-San Francisco. He added that the nine counties are “deeply interconnected” — failure to add development in Berkeley, Brisbane and Cupertino puts more pressure on Oakland and San Francisco.

CASA — a catchier nickname for Committee to House the Bay Area — had its genesis two years ago, when the Metropolitan Transportation Commission and the Association of Bay Area Governments convened a panel of mayors, developers and tech companies to address the problem together, drafting policies that would shield residents from displacement while putting more homes near transit lines and job centers. These ideas are catching on throughout the state: Gov. Gavin Newsom elevated housing to the top of his policy agenda, and lawmakers have introduced more than 200 bills this session to tackle the issue.

Yet the push to accelerate production has also hit resistance, particularly from smaller cities that call the CASA 10-point compact a cynical attempt to undermine their authority to make decisions. On Wednesday, just hours before Chiu planned to roll out AB1487, the city councils of Lafayette, Moraga and Orinda held a joint meeting at the Lafayette Library to air their concerns. Council members of the three cities were unaware of Chiu’s bill when they scheduled the meeting.

“They’ve totally usurped the public process here, and as a result they’ve influenced legislation,” said Lafayette Mayor Cameron Burks, referring to what he and others view as an underhanded attempt by the CASA panel to create a script for legislators. He noted that many of the 200 state bills have “CASA elements”: Some would override local zoning ordinances and limits cities’ ability to obstruct new development.

Chiu stressed that the Housing Alliance wouldn’t strip land-use authority from cities or counties, and it wouldn’t have the power of eminent domain to seize private property. Yet he’s still bracing for conflict. Critics of CASA reject the notion of a regional housing strategy, calling it “cookie-cutter” and “one-size-fits-all.” Proponents say the Bay Area has to unify if its leaders want to solve the complex housing crisis, which has pushed people into wildfire zones and forced them to endure long commutes.

The same debate flared up last year when Chiu successfully pressed legislation that enabled BART, the region’s rail system, to zone its parking lots for housing. That bill, AB2923, was supposed to sail through with little opposition. Instead, it drew support in the housing-hungry urban core but angered mayors and city council members in the suburbs who didn’t want to cede land-use decisions to a transit agency.

Even within the Metropolitan Transportation Commission, officials have mixed feelings about the CASA housing plan.

“There are things I love about it, but some of the dollar amounts are ambitious,” said Commissioner David Rabbitt, who is also a Sonoma County supervisor. He represents an area where officials are spending their political capital on sales tax measures to raise money for disaster relief. Housing is a huge need, he said, but there’s no money for it.

Commissioner Gina Papan, a city councilwoman in Millbrae, has also panned CASA for trying to “cookie-cut” a diverse Bay Area.

“Seventy percent of Bay Area residents live outside the big three cities that seem to be pushing this,” she said, referring San Francisco, Oakland and San Jose. Papan was appointed to the commission this year to represent San Mateo County, replacing Redwood City Councilwoman Alicia Aguirre, who lost her seat after voting for CASA.

Quest to leave Bay Area’s high prices and traffic grows

Bay Area most popular place to leave, Redfin study says

By LOUIS HANSEN, Bay Area News Group, February 15, 2019

High home prices, expanding rush hours and maybe the futile search for a cheap cup of coffee and affordable avocado toast adds up to one thing — the Bay Area is getting more popular to leave.

A new study by Redfin shows about 24 percent of online searchers in the Bay Area are looking elsewhere for a home — up from 19 percent last year.

“We’ve seen a lot of people leaving San Francisco and that trend has only increased,” said Daryl Fairweather, chief economist at Redfin. She added that data from searches on the company’s website has been able to predict migration trends that later appear in census data.

The study looks at home searches done on Redfin in the last three months of 2018. Bay Area residents were the top searchers for homes in Sacramento, Portland, Seattle, and Austin, Texas. The region outstripped New York, Los Angeles and Washington, D.C. for highest concentration of Redfin users actively looking to leave their city.

The strong Seattle economy, relatively lower housing prices, and the ease of transferring to other tech companies make that city a favorite choice, Fairweather said. “It’s really about jobs,” she said. “If you’re already in the industry, it’s a really easy transition.”

The study highlights a trend of outward migration from the Bay Area, although until recently newcomers outnumbered those leaving. The nine county region’s tops-in-the-nation home prices — the median sale price for an existing home in December was $775,000 — have sent discouraged residents young and old to out-of-state Realtors and moving companies.

An annual study released Wednesday by Joint Venture Silicon Valley confirms the steady migration away from the region. Silicon Valley gained roughly 20,500 foreign immigrants last year, while 22,300 residents moved to other regions and states.

Between July 2015 and July 2018, about 64,300 Silicon Valley residents left the region, replaced by 62,000 immigrants from other countries, according to the Joint Venture index.

Relocation has become a growing part of many local real estate agent’s portfolios.

Sacramento agent Devone Tarabetz has collected clients from San Jose, San Francisco, Oakland, Milpitas and Petaluma in the last year. “Affordability is usually the number one thing,” said Tarabetz, a San Jose native who has lived in Sacramento for two decades.

The mix of Bay Area clients going north include young families moving from San Francisco for a bigger home in a safer neighborhood to investors looking for deals on duplexes and small apartment buildings, she said. In the last year, she said, “I’ve seen a huge jump.”

She cautions newcomers about the weather (it’s hotter) and the schools (spotty) but encourages them to trade high rents and small apartments for single family homes in growing and safe communities. When they see their first homes, she said, “it’s a shock.”

Los Gatos agent Brian Schwatka has seen his business grow by focusing on older residents looking to leave Silicon Valley. The Sacramento region has been a favorite destination for several of his clients, he said, as well as Santa Rosa.

“People are looking for some sort of equivalent to the Bay Area,” he said. “It’s a mass exodus.”

Older Bay Area movers are generally looking for a less expensive area with the nice weather they’re used to — ruling out desert climates like Las Vegas and Phoenix, but opening up cooler spots like Portland and even Boise, Idaho, Schwatka said.

Idaho’s largest city has a population of 225,000, averages 30 inches of snow annually, and has summer temperatures that peak at 90 degrees. It’s a two-hour flight to the Bay Area, Schwatka said, making it an easy trip back to friends and family.

House hunters can find deals where the median home value is $287,000, according to Zillow. Prices have climbed 17 percent in the past year.

Many of his clients, he said, share a common refrain: “It just doesn’t feel like the old Silicon Valley anymore.”

Recession Watch: Will Another Downturn Rock the Housing Market?

By Clare Trapasso, Realtor.com, Feb 21, 2019

The Great Recession has receded in the rearview mirror, and pretty much every American would like to keep it that way, thank you very much. But we’re still all too aware that the whole financial disaster was precipitated by a deluge of bad mortgages. Sure, we’ve had nearly a decade of booming home sales and prices. But now that they’re slowing their roll, the whispers are starting to mount: Is another recession around the corner?

About 39% of Americans think the economy is slowing down, while 17% think we’re already in a recession or depression, according to a recent Gallup poll.

Yes, we might see a recession soon, economists say—but there’s no need to panic. That’s because the financial factors that helped cause last decade’s crash don’t exist this time around.

“We’re just scared because of what happened last time. And that’s not what’s going to happen [again],” says Lisa Sturtevant, a housing consultant and chief economist at Virginia Realtors, the state’s real estate association.

If there is another recession, she says, “most people are not going to lose their house. Most people are not going to lose their jobs.”

That’s a relief to hear—but then again, few experts predicted the lasthousing bust.

If a downturn does hit, probably toward the end of this year or the beginning of next year, most economists believe it will be brief and not nearly as painful as the last one. They anticipate that unemployment, currently at an extremely low 4%, will tick up slightly and there will be fewer new jobs created. But they don’t envision widespread layoffs resulting in scores of foreclosures and plunging home prices, as we saw in 2008–09.

“We’re at a record-low level of unemployment. The economy can’t stay here,” says Chief Economist Danielle Hale of realtor.com®. She forecasts a recession beginning within the next two years. “This one will be mild.”

Why it looks like we’re due for a recession

Although a recession can be precipitated by a housing bust, trade war, or global event, this time the U.S. economy may simply become a victim of its own success.

With national unemployment so low, employers have to compete hard for talent by offering higher wages. Those increased costs are often passed onto consumers. This in turn causes inflation as goods and services become more expensive. If inflation rises much higher than wages, then the country has a problem.

Enter the U.S. Federal Reserve. It battles inflation by notching up interest rates. The downside is that makes it more expensive for businesses to borrow money to expand or bring on more workers. And that can effectively slow down the economy.

It’s like someone blowing too much air into a balloon—eventually a little needs to be let out or it’ll pop. Similarly, the Fed needs to siphon off a little of the economy’s helium. It hiked rates four times last year, when the economy was hurtling along, but this year it may do it only once, if at all.

Actually, economic cycles in which the economy is growing and more jobs are being created historically don’t last more than a few years. The longest stretched from 1991 to 2001. This summer will mark the longest economic expansion in U.S. history from the trough of the crisis in June 2009.

So the good times eventually must come to an end.

This slowdown, coming on the heels of a wild run-up in home prices, may feel like déjà vu. But the main culprit behind the previous housing market bust was the torrent of subprime mortgages doled out to underqualified and often uninformed buyers. When those owners defaulted, it created a domino effect, ultimately affecting all corners of the nation’s economy.

After that, lending laws were considerably tightened across the board. Borrowers today must be in much better financial shape in order to snag a mortgage.

“Underwriting is a lot tighter, and the [loans] are a lot less risky,” says Joel Kan, who oversees economic and industry forecasting at the Mortgage Bankers Association. “Households are in a better position to absorb the shock than they were back then.”

Will a recession lower home prices?

Buyers on a budget shouldn’t pin their hopes on a recession to create a vast clearance sale of deeply discounted properties. Prices aren’t expected to plummet, although they may dip in more expensive markets. Overall, price appreciation will likely just continue to slow.

But if the Fed lowers interest rates again to counteract a poor economy, mortgage rates will likely go down, too. That will also make it cheaper to buy a house.

“If there is a recession, the people with stable jobs will see it [as] a second-chance opportunity to buy a home,” says Lawrence Yun, chief economist of the National Association of Realtors®. Yun doesn’t anticipate a recession this year, or next. “Prices may [or may not] come down. But certainly buyers will be in a better negotiating position.”

And even in a shakier economy, overall demand for housing, which keeps prices up, isn’t going to evaporate. The huge millennial population is getting older, settling down, and having children—and searching for homes of their own. Those life factors are not likely to change, and they create a massive demand for housing. A decade ago, it was mostly Gen Xers at that stage, a smaller generation with less impact.

The places that are most likely to see prices sink are more expensive markets that have experienced years of steep price hikes. For example, Silicon Valley’s San Jose, CA, could see corrections, says Hale.

Markets with more housing than buyers, such as Miami, where new developments have been going up at a breakneck pace, may also soften, says Norm Miller, a real estate finance professor at University of San Diego.

The luxury market, which is the priciest 5% of homes in any area, will also probably be affected.

“There are just more expensive homes [than affordable ones] for sale, and so the luxury market is likely to be more vulnerable to price corrections in the event of a recession,” says Hale.

A recession could worsen the housing shortage

One of the signatures of the past recession was the overabundance of newly built homes. When the economy collapsed and the buyers disappeared, builders across the nation were forced out of business basically overnight. Abandoned construction sites were littered across the country. The industry still hasn’t caught up with the renewed demand, and another recession could worsen the situation.

Only about 875,00 single-family homes were built last year, according to the National Association of Home Builders. But the nation needed about 1.1 million to ameliorate the shortage. If another downturn hits, builders will likely construct even fewer homes, says Rob Dietz, chief economist of the NAHB.

That means when the country recovers, we could experience even greater housing shortages than we’ve seen over the past few years.

The pace of single-family home construction growth is already slowing down, from 9% in 2017 to about 3% in 2018. Dietz predicts it will be less than 2% in 2019.

Building is expected to remain strong in places with strong population growth, such as the Southeast, Texas, and the mountain states of Montana, Idaho, Colorado, and Utah. Folks need places to live, after all.

But the current higher mortgage rates make it harder for folks to buy homes. Meanwhile, inflation results in higher land, materials, and construction labor costs. That typically translates into fewer new homes going up.

“For builders, it means that demands will fall back in some markets and they will pull back,” says Dietz.

Renters won’t be spared by a recession

Cash-strapped tenants hoping for a rent break likely won’t get lucky even if the economy does start to slump. Rent price growth is likely to slow or even stall as fewer folks are going to be dropping big bucks on housing, says Greg Willett, chief economist at RealPage, a property management technology and analytics company focused primarily on rentals. But it’s not likely to fall.

The exception is the luxury market, where landlords will have the most trouble finding tenants.

“Luxury will feel the pain first,” says Willett.

There could be some longer-term consequences as well as fewer rental developments are typically built when the economy sputters, so when things are a bit rosier, there may be fewer units available to fill demand.

Depending on how long the recession lasts, some condo buildings that can’t find buyers may eventually go rental. That’s most likely in places with an oversupply of housing, such as Miami, Miller says.

“[The last] financial crisis was unique with an unprecedented number of foreclosures, home price declines, and a stunning drop in homebuilding,” says Dietz. “The question is whether we’re going to experience a soft landing, a bumpy landing, or a crash landing.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link