Glen’s SF East Bay Real Estate Market Update December 31, 2021

December 31, 2021 – Real Estate Market Numbers

By Glen Bell (510) 333-4460

This is always the time of year where we reflect on where we’ve been and where we’re headed.

“The housing market has been breaking new records across multiple fronts throughout 2021, leaving home shoppers wondering if they should buy now or wait in the hope that more homes become available, and at more affordable prices in 2022.”

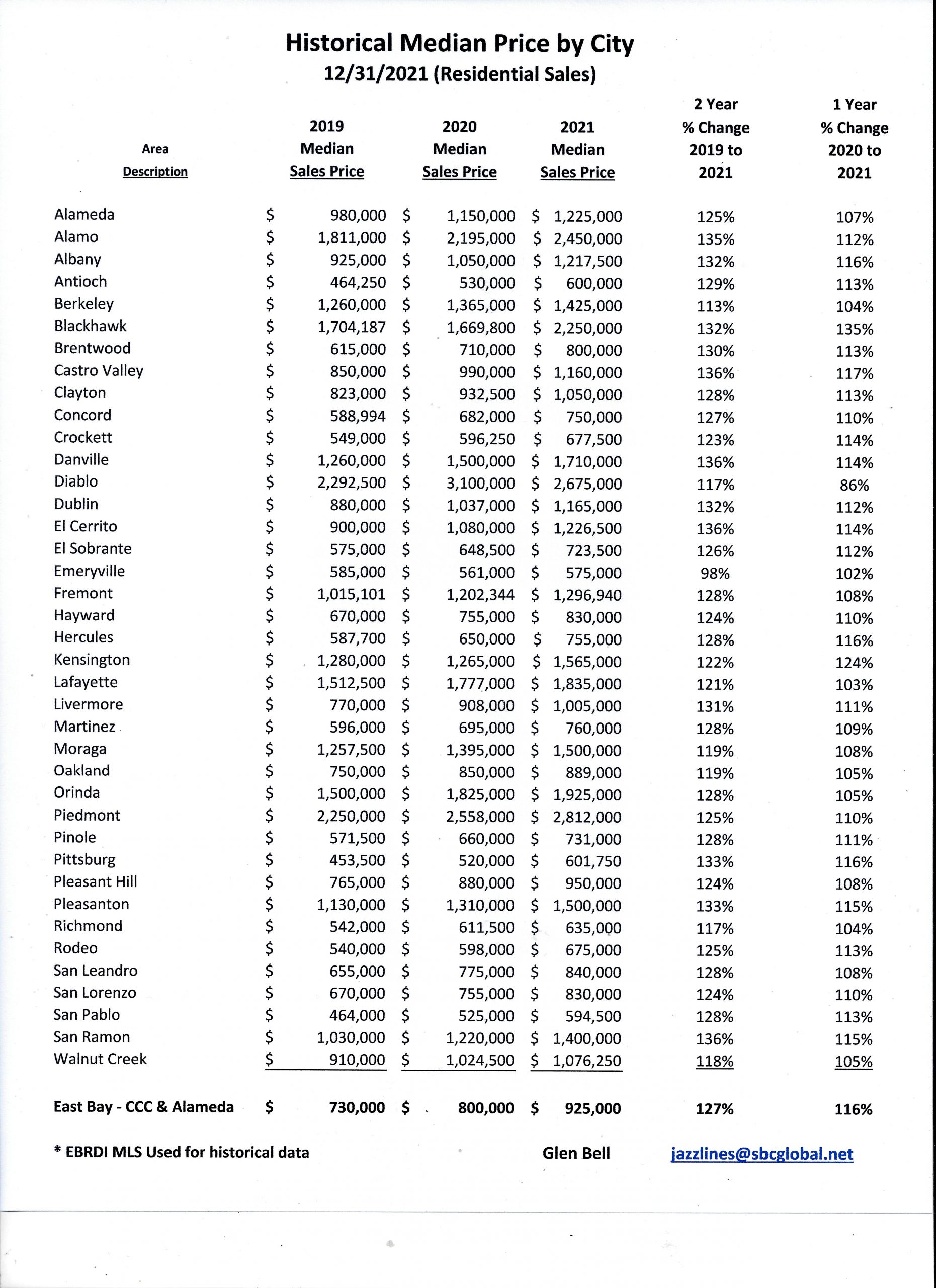

The Historical Median Price graph below, demonstrates just how much homes have appreciated over our last two years; For the East Bay, (Alameda and Contra Costa Counties), we’ve seen an average increase of 27%.

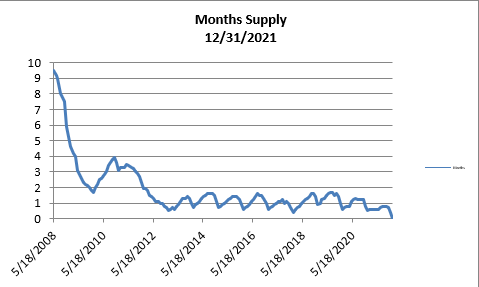

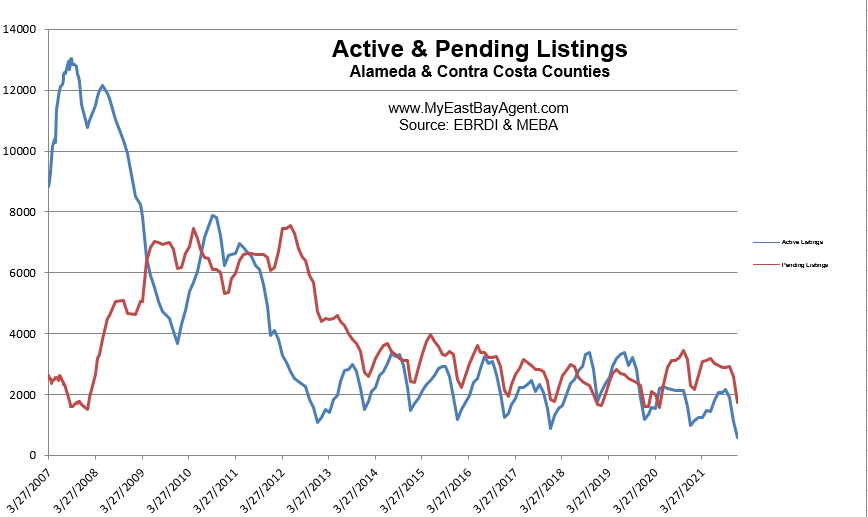

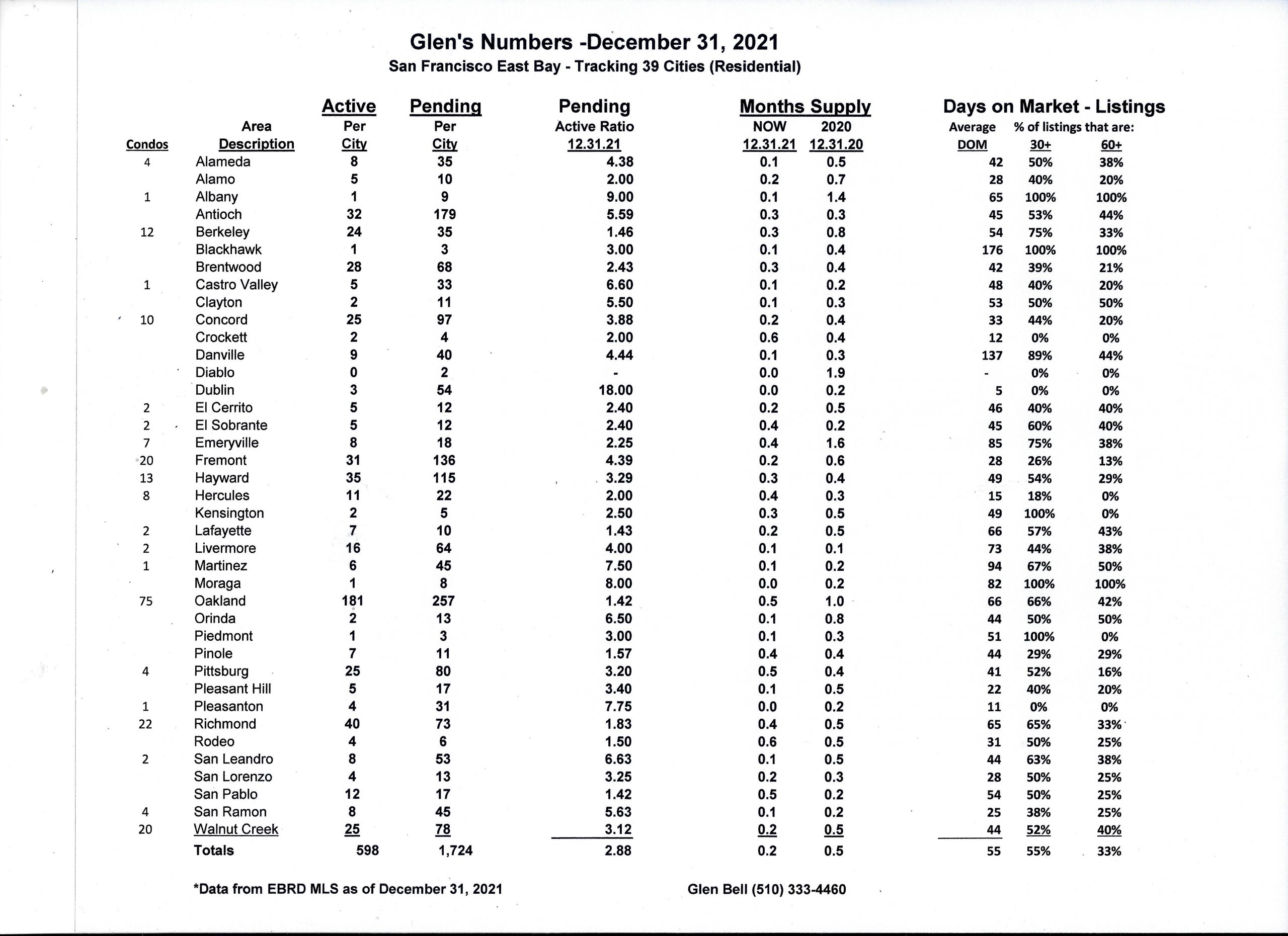

At the same time, the number of houses for sale has dropped, creating even greater pressure on home prices. Last year at this time we experienced a 55% drop in November and December of 2020. Seasonality has always been a huge factor, but this was more than normal. This year we saw an even greater reduction, a 70% reduction of inventory for November and December of 2021. As of December 31, 2021, there were only 598 homes listed for sale in the 39 cities that I track. Approximately 55% of those listings are homes that have been sitting for 30 days or longer. I’ve been tracking statistics since 2007, and this is the lowest number of homes for sale that I’ve ever seen. This leaves us with only a 6 day supply of homes, compared to a 15 day supply last year.

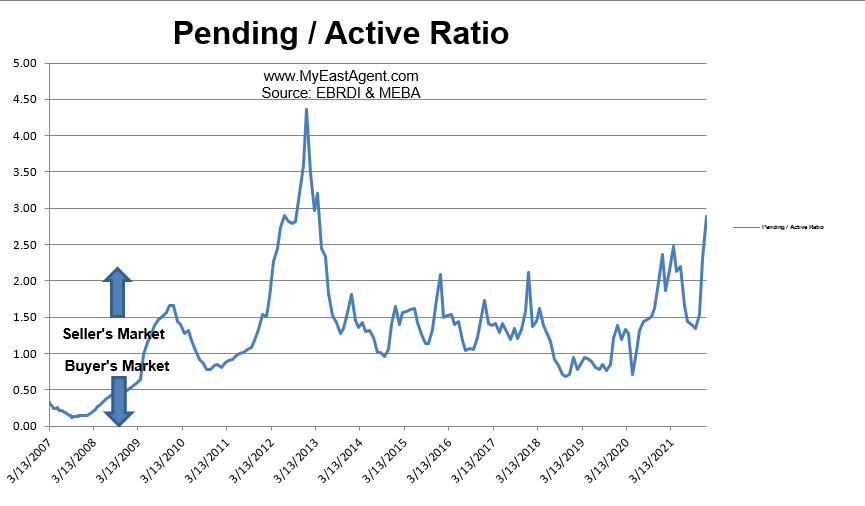

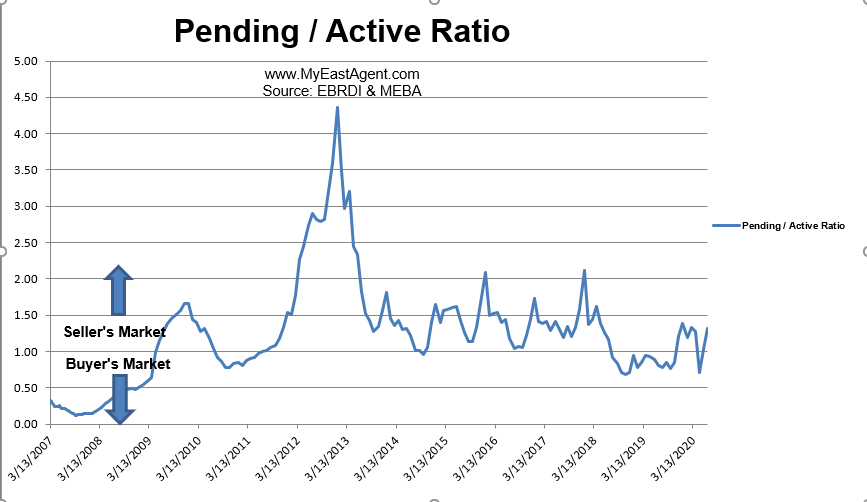

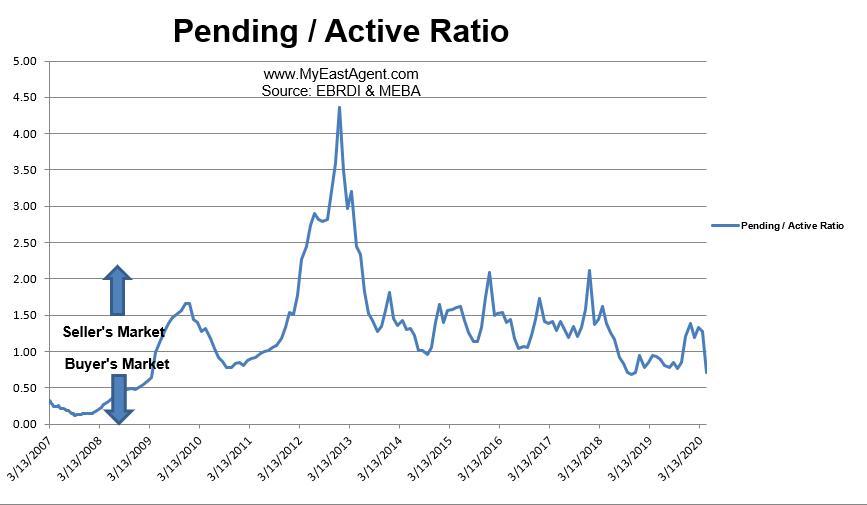

Our supply and demand ratio, (or pending over actives) has jumped up to 2.88, it’s highest level since March of 2013. I rarely see this ratio go over 2, indicating a “strong Sellers” market.

The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (more inventory, or supply, with fewer pending sales, or demand) favors sellers.

Asked “Will home prices fall?

“The question on the minds of sellers, buyers, homeowners, and just about everyone else is whether prices might actually fall. Sorry, buyers, that likely won’t happen anytime soon.”

“You’ve still got a lot of young people who have still not bought a home but who would like to,” says Realtor.com Chief Economist Danielle Hale. “Anytime the market starts to cool, you’ve got people on the sidelines waiting for their chance to get in. That keeps both home sales and home prices from declining too much.”

I expect more homes to hit the market this spring, but doubt it will be enough to resolve the problem of demand.

You can read what some of the experts are predicting for 2022 in the articles shared below.

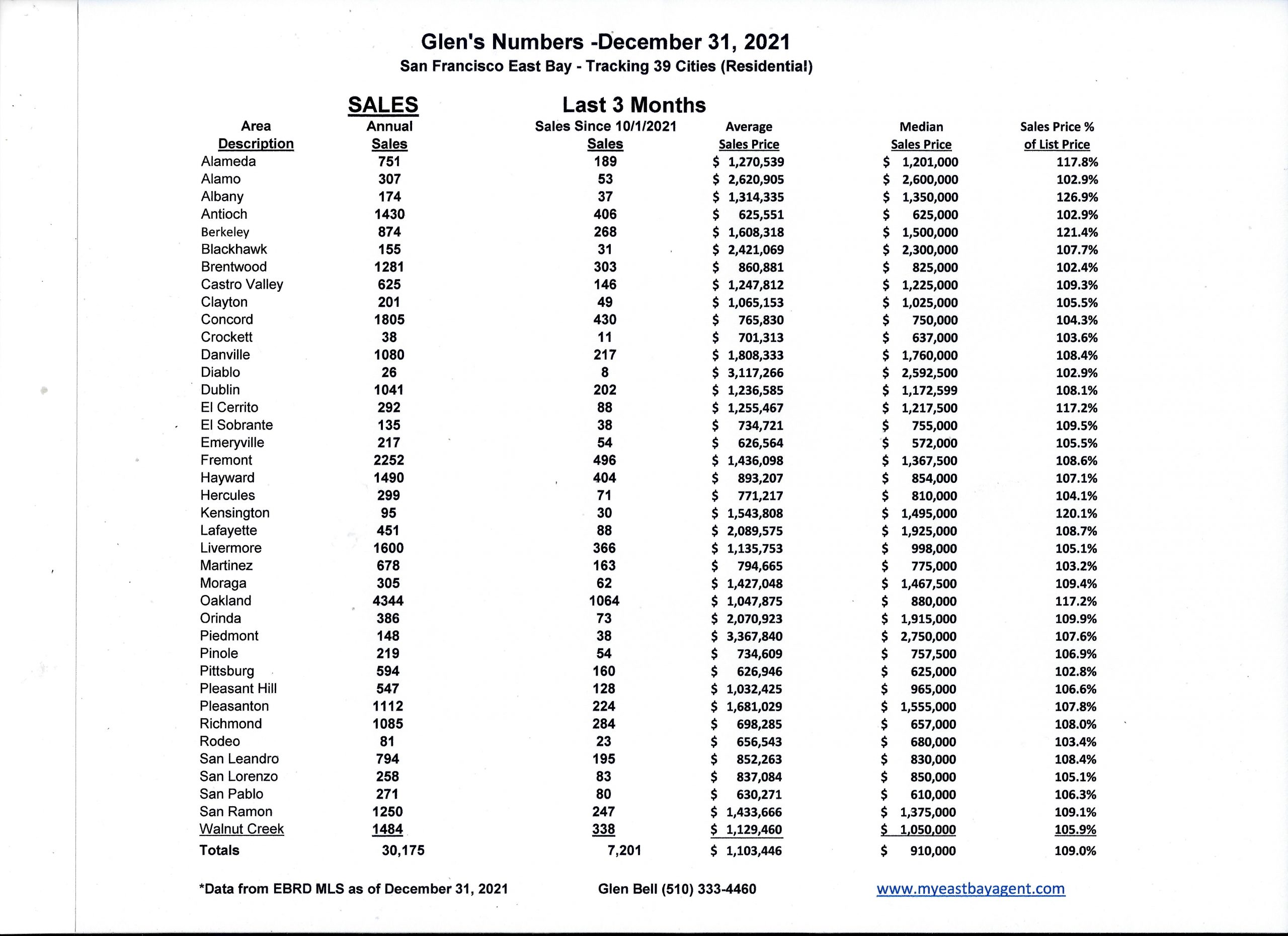

Here are some highlights for the 39 East Bay Cities that I track:

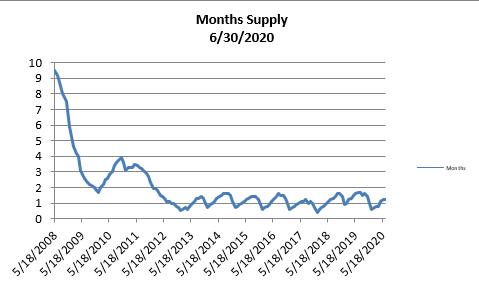

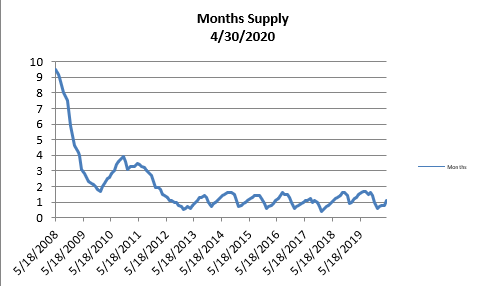

- The month’s supply for the combined 39 city area is only 6 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years. Last year we saw a 15 day supply at this time.

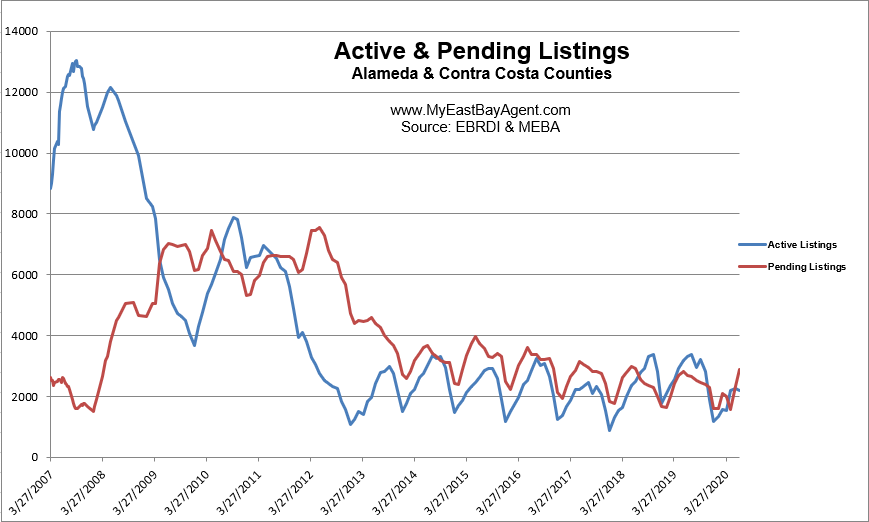

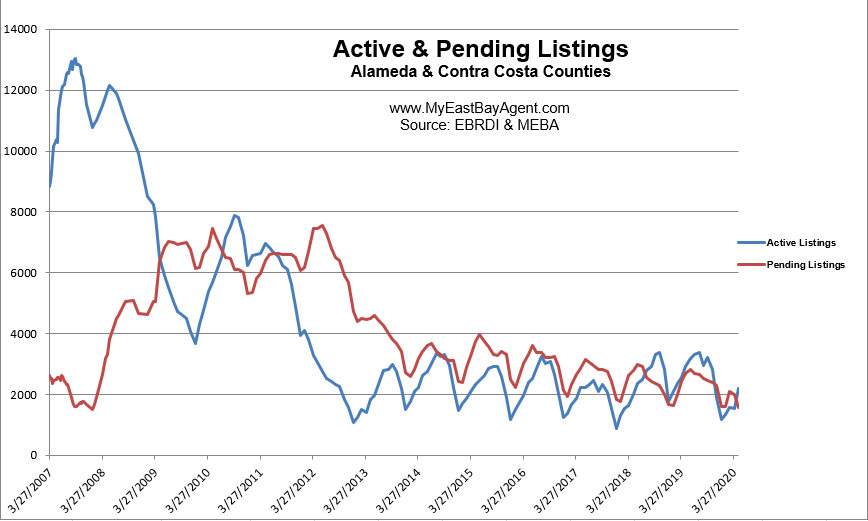

- Our inventory for the East Bay (the 39 cities tracked) is now at 598 homes actively for sale. This is lower than what we saw last year at this time, of 971. We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales decreased to 1,724, also lower than what we saw last year at this time of 2,293.

- Our Pending/Active Ratio is 2.88. Last year at this time it was 2.36

- Sales over the last 3 months, on average, are 9.0% over the asking price for this area, much higher than what we saw last year at this time, of 4.9%.

Recent News

Experts predict what’s next for the Bay Area real estate market in 2022

By Tessa McLean, SFGATE, December 29, 2021

When the COVID-19 pandemic hit the Bay Area, many expected the real estate market to tank. While it certainly slowed for a bit as open houses were prohibited and residents stayed in their homes, it quickly picked back up, fueling a competitive market with low inventory and a strong set of buyers rethinking their living spaces. That continued into 2021 as the suburbs stayed king, demand outstripped supply, and, at least in the Bay Area, many residents have yet to return to an office. Now, with a still very uncertain future ahead of us, what’s next for the Bay Area housing market? We talked with local experts in the home buying and rental market to get their opinions on what’s to come.

It’s still going to be a seller’s market

Every real estate agent we spoke with agreed that 2022 is still likely to be a seller’s market in the Bay Area. Even as interest rates are projected to go up, the demand for homes will still be greater than the inventory, especially for single family homes, in the region. “In the history of United States real estate, being a seller in San Francisco right now is the single best opportunity you’re ever going to have in your lifetime,” said San Francisco real estate agent Aaron Bellings of Compass. “… I think San Francisco is going to have a banner year. If I was thinking about selling in the next 6 to 12 months I wouldn’t hesitate to put my house on the market.”

He said much of that demand is from buyers that were starting to look in 2021 and still haven’t found a place. “I see the spring being absolutely crazy again. I have buyers right now that are chomping at the bit to get in there and there’s nothing out there for them,” Bellings said. “It’s going to be a strong market.”

Nina Hatvany, a real estate agent in San Francisco for over 30 years, said the amount of quality, single family homes on the market is usually low in the city, but those houses are now in particularly short supply. Plus, between the continuing pandemic and the inevitable hike in interest rates, now is the time to put a home on the market. “It’s definitely a good time to sell,” Hatvany said. “… I would definitely take advantage since we don’t know what the future will bring.”

Khrista Jarvis, an East Bay Compass real estate agent, said the robust seller’s market translates into a tough buyer’s market — especially in the East Bay. “It’s frustrating to be a buyer in this market. There are multiple offers, bidding wars, paying $200,000 over asking is just the norm,” she said. “You have to be super competitive and sometimes make offers several times before you get a house.”

Jarvis said the region continues to be particularly hot for buyers from San Francisco as many are still looking for more space than they can get in the city.

Seasonality has disappeared

The old adage says that if you’re going to put your home on the market, you better wait until after the Super Bowl. And you definitely can’t sell a home during the winter. Today, none of that holds true. “We’re going to go into a very strong season right away,” Jarvis said. “Usually the market waits until spring, but this year it’s going to start really early. Seasonality is out the window. I think it’s just busy all year round now. Even December. I thought I’d get a break for the holidays and that’s just not the case.”

Bellings said there is still some seasonality, just not in the way it exists in other major markets. “We really don’t have an off-season. It really just comes down to whether people are in town to actually look at and bid on the homes put on the market,” he said. “Usually we start to see pick up post-President’s Day, but I wouldn’t be surprised if things start to pick up mid- to late January this year.”

Everyone is watching interest rates

Interest rates are going up, it’s just a matter of when. If the Fed sticks to their plans, prospective buyers and sellers are going to have to keep that in mind in 2022. “It is going to create a sense of urgency,” Bellings said. “I’ve already had buyers reach out to me and say we need to make this happen before the Fed starts hiking rates. People are already starting to feel the pressure even though we don’t know when this is going to happen and how high the rates will go.”

For sellers, that means the time is now. “It would be wise to move quickly if you want to be in the driver’s seat when it comes to selling your home,” said Daryl Fairweather, Redfin’s chief economist. “For the second half of 2022, if mortgage rates increase, that could definitely put the brakes on demand and make it harder to sell a home.”

Even if rates creep up to 4%, that’s still historically low, especially for an area with as much wealth as the Bay Area has. “In other places I would expect the housing market to slow down significantly, but San Francisco is on a different trajectory,” Fairweather said. “There will be more demand for homes than there was this year. … What I think is the Bay Area will look more like the rest of the country in terms of how quickly prices grow, how many homes sell over list price.”

Rent will probably go up

As the home buying market reached new heights over the past year and a half, the rental market in San Francisco, Oakland and San Jose did the opposite. These Bay Area cities are some of the only places in the country where rent has yet to creep back up to pre-pandemic levels, even allowing San Francisco to lose its throne as the most expensive rental market in the country to New York, according to Zumper. Experts have speculated that’s due to the Bay Area’s embracing of remote work amid the pandemic, though many offices won’t stay closed forever.

“General inflation will probably push rent up eventually, but if offices keep getting pushed back that will still keep them down relatively,” Zumper data journalist Jeff Andrews said. “The fundamentals are all pointing to rent going up again.”

He also expects some of the seasonality of the rental market to return this year, after being more volatile since early 2020.

While Zumper found that New York City surpassed SF as the most expensive rental market in 2021, “San Francisco still stands out as the most expensive market on our platform,” said Rob Warnock, research associate at Apartment List. “But, the Bay Area is the last remaining place where there is a discount,” he said. “… That said, I think prices are going to go up again in the early parts of [2022].”

Warnock said since the Bay Area has been one of the places most amenable to remote and flexible work, it also could affect trends across SF neighborhoods. Prices in areas downtown, like SoMa, may still remain at a deep discount while more western neighborhoods like the Sunset may keep their slightly inflated rates.

Space is still a must

“Zoom rooms” and Peloton bikes became must-haves as the pandemic wore on, and none of the agents we spoke with saw that going away anytime soon. “I’m not seeing the desire for home offices or gyms go away at all,” Hatvany said. “It’s become a very locked-in thing. It’s a complete essential in ways that it never was.”

Hatvany has even seen some new “amenities” emerge — like being located near a Slow Street. She said just as parks are great nearby amenities for a home buyer, slow streets now hold the same desirability.

Outdoor space is still crucial for most clients, said Josh Dickinson, the founder of real estate agency Zip Code East Bay, and he’s even seeing more sellers get creative to upgrade that outdoor space. There’s even been a rise in ADU-like spaces, like upgrading a shed in the backyard that can be used as a multipurpose space.

Even with their confident predictions, there wasn’t one person that didn’t mention the feeling of uncertainty that still lies ahead as we continue into the next phase of the pandemic. “I think we’re all just anxious to see what is it all going to look like when we get back to the point where people are going back to the office and all the COVID numbers are declining,” Dickinson said. “It in some ways seems like we’re still a long way from there.”

Housing Market Predictions 2022: Will Prices Drop?

By Natalie Campisi, Forbes Advisor, December 28, 2021

The housing market has been breaking new records across multiple fronts throughout 2021, leaving home shoppers wondering if they should buy now or wait in the hope that more homes become available, and at more affordable prices in 2022.

So far, home price appreciation is up year-over-year (YOY) by 18.5% in the third quarter, the highest level in the Federal Housing Finance Agency (FHFA) House Price Index history. Inflation has shot up at the fastest pace since 1982. At the same time, the number of houses for sale has dropped, creating greater pressure on home prices.

Housing supply plunged to its lowest level in history, with just 1.38 million homes on the market in June, down 23% annually. Buyers scooped up homes faster than ever before, shrinking the number of days homes spent on the market to a record-low of just 15 days.

And mortgage rates are holding steady around the 3.1% mark for a 30-year, fixed-rate mortgage–although it’s not the lowest on books, it’s mighty close.

Here’s what this means for 2022, according to housing experts.

Will Home Prices Rise In 2022?

Depending on whether you’re the buyer or seller, you might be very happy or very disappointed to learn that home prices are poised to rise in 2022, most experts say. While headwinds like rising mortgage rates and a significant uptick in Covid-19 cases may impede price growth, they won’t stop home price appreciation from climbing.

“Much of what drove high price growth this year will follow us into next year,” says Nicole Bachaud, an economist at Zillow. “We will expect to see prices rising at extremely high levels for the first few months of 2022 before beginning to taper off towards more normal levels.”

Most experts say housing demand will stay strong in 2022 unless inflation continues to outrun wages at the current feverish pace, which could stall buyer appetite. Rising inflation is also putting renters in a pinch who can no longer afford to save as much for a down payment when rental rates are skyrocketing.

The national average rental price for a one-bedroom jumped 21.3% and more than 16.7% for a two-bedroom in October on a YOY basis, according to the latest Apartment Guide and Rent.com report.

“What can affect demand is the affordability challenge,” says Danielle Hale, chief economist at Realtor.com. “One thing that can offset that is a more competitive labor market.”

A recent survey by the Conference Board suggests a 3.9% in wage costs for companies in 2022, which would be the highest jump in salaries since 2008. But even this bump wouldn’t make it easier for most entry-level buyers to access homeownership.

The wild card that could cool home prices is getting Covid under control enough that it would convince people to move back to big cities, says Todd Teta, chief product and technology officer at Attom, a property data firm. He also says that the reverse could happen—a spike in Covid cases, for example—stoking more interest in suburban real estate.

“If the pandemic fades, interest in rental housing in congested urban areas could rekindle, especially if employers start demanding that more workers return to their offices. That could significantly reduce buyer demand and ease the pressure on prices,” Teta says. But “all of this will depend on how many more people with the means to buy are worried about where they live now and how the pandemic proceeds.”

It’s important to note that while these are national trends, real estate is local. So while places like Boise, Idaho had a 37.3% price jump YOY, Philadelphia saw more modest price growth of 9.9% during the same period.

Home Inventory Predictions for 2022

A major determinant of home price trends is how much supply is available relative to demand. One way to gauge this is to look at the months’ supply of homes for sale, which estimates how long the existing inventory for sale would last based on the current sales rate if no more new houses were built.

The lowest months’ supply for 2021 was in January, with just 3.6 months’ supply and the highest was in August with 6.6 months, a considerable jump, according to the Federal Reserve Bank of St. Louis. Although supply gradually picked up in spring through late 2021, some forecasters expect supply to slacken.

For one, new home construction is getting hampered by the rising cost of building materials and a severe shortage of labor. All building materials, from copper to steel, have jumped in cost but lumber prices, in particular, have hit astronomical price increases. The futures price of lumber jumped to an all-time high of $1,670 per thousand board feet in May. It began to cool in the summer, dropping to $454 per thousand board feet in August. However, it shot back up to more than $1,044 as of December 20.

Amid the affordability crisis in housing, the Biden administration is moving to make the costs of lumber even more expensive. The Commerce Department said November 24 that it will nearly double tariffs on softwood lumber imported from Canada from an average of 8.99% to 17.99% on their imports.

Several lawmakers and major trade groups like the National Association of Homebuilders are calling for a reduction in Canadian tariffs as mounting lumber costs can topple the gains new home construction made in the past six months.

“With Biden doubling tariffs on Canadian lumber, it will add a lot of pressure on home costs and how long it takes to build a home,” says Robert Dietz, chief economist and senior vice president for economics and housing policy for the National Association of Home Builders. “That’s why you see the median price of a new home above $400,000.”

The median price of a new house was $407,700 in October, up 17.5% from a year ago, according to the Federal Reserve Bank of St. Louis. New home prices have been climbing at an accelerated rate since the Covid-19 pandemic began. In April 2020, the median new home price was $310,100, the lowest point before jumping nearly $100,000 more during a span of 18 months.

As for existing homes entering the market, much of that will depend on the pandemic, says Selma Hepp, deputy chief economist at CoreLogic, a real estate data analytics company.

“While Baby Boomers preferred to downsize prior to the pandemic, it appears that they are staying put for now,” Hepp says. “Up to now, there has not been a notable increase in for-sale inventory as Baby Boomers stayed put, and potentially hosted their children and family.”

Should You Buy a Home Now Or Wait?

Buyers with the means to buy a home now may be looking at pricing factors like interest rates when deciding whether to leap. However, first-time buyers face much steeper challenges, like rising down payment requirements.

As home prices escalate, so does the down payment and monthly mortgage costs. This means that some buyers might have to save up more money or look for less expensive housing. As more companies have allowed their employees to work remotely, some buyers have moved to more affordable areas, but that’s not the case for everyone.

James McGrath, a licensed real estate broker in New York and co-founder of Yoreevo, a residential brokerage, says demand will begin to cool in 2022, so there might be more availability for those who wait.

“It’s very hard for the amount of sales to remain at record levels when there isn’t much to sell,” McGrath says. “It seems all but certain that the number of transactions will decline. With this, buyers can be more patient. There should be less competition from buyers and more houses to choose from as we normalize on both.”

There are unforeseen variables that can alter the course of real estate at any time, so the best strategy is to make sure you can afford the house you buy and still have room to save up for rainy days. For example, if you’re buying with a partner or co-signer and they lose their job, make sure you can pay the mortgage with just one income.

You should also plan on living in it for at least five years or enough time to cover your closing costs, so you don’t end up losing money when you sell. A mortgage affordability calculator is a great tool for figuring out your budget.

Will the housing market continue its hot streak in 2022?

By Mike Simonsen, HousingWire, December 10, 2021

As we approach the end of another hot year for the market, homebuyers and sellers are eagerly looking ahead to the 2022 housing market. Will the market continue its streak of strong growth, or are we finally about to see a slow down?

Here’s a high-level forecast for what to expect next year, based on the supply and demand signals we can already see in today’s data. I’ll also highlight which variables we should be watching for unexpected market shifts.

1. Demand will continue to be strong into 2022.

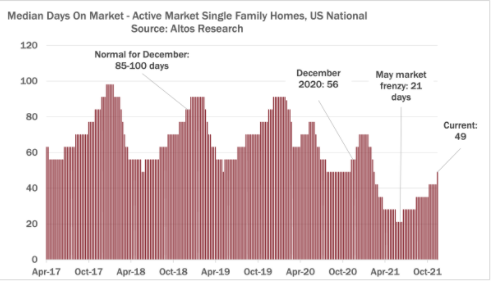

The first signal we look at to forecast the strength of the housing market is days on market – how fast are homes moving? Right now, we’re seeing a median of 49 days on market and climbing, as it normally does this time of year. A typical December would see market time at 85-100 days, so you can see from the chart that demand is staying elevated later in the year, which is a bullish sign for next year.

Due to the strong seasonal patterns, I predict days on market will hit a low of 21 days in April, tying the record-fast market times from earlier this year.

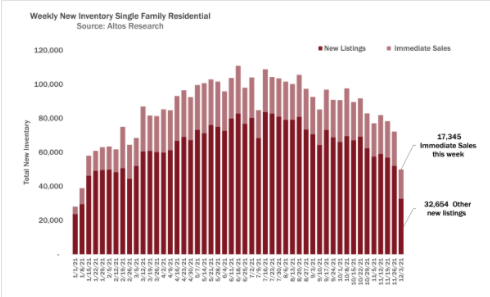

With homebuyer demand off the charts earlier this year, Altos Research began tracking the phenomenon we call “immediate sales.” You’ve probably seen this in your local market, where offers happen more or less immediately after the home gets listed for sale. At this moment, about 25% of properties are going into contract essentially immediately every week (around 20,000 of them within hours or days of listing) — even as supply and transaction volume declines through the end of the year.

I actually expected immediate sales to be dropping at this point, but it isn’t. Even over the Thanksgiving holiday, total volumes were down, but immediate sales as an indicator of demand were still dominant. The fact that this trend is continuing unabated into the winter indicates continued strong demand into next year.

That being said, if the housing market turns, immediate sales will be one of the first places we’ll be able to see it. For example, if buyers are cooled by higher interest rates, the first thing that’s going to happen is they’re not going to make those immediate offers.

Since it will take several months for rates to rise high enough to discourage buyers, we can expect immediate sales and all the related buyer competition characteristics (multiple offers, over-bidding) to remain common well into at least the second quarter of 2022.

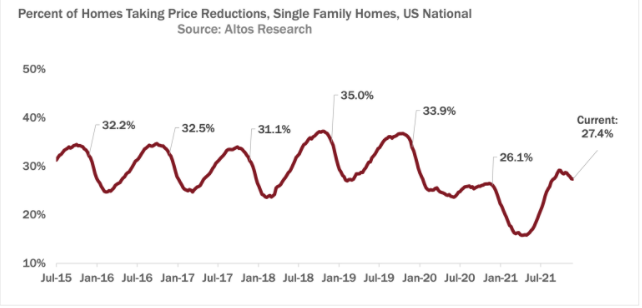

Another signal pointing to continued elevated demand is the percent of homes on the market taking price reductions. In a normal market, we tend to see about 30% to 35% of sellers initially over-price their homes and eventually reduce the price to attract buyers.

Right now price reductions are at 27%, and starting to tick down again after the fall peak in September. You can see that it’s higher than last year, but still lower than normal. Home sellers with properties on the market now know that the demand is there, and they don’t have to cut their prices. This tells us that the transactions for these homes that happen in the first quarter will still be priced very strongly.

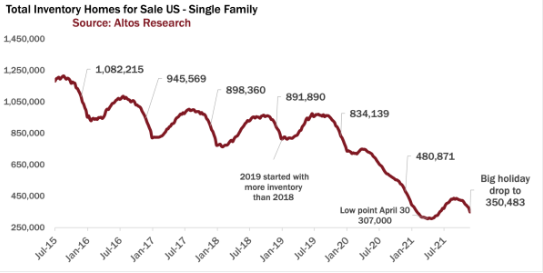

2. Low inventory will continue to be a major issue.

Unfortunately for all these eager homebuyers, inventory continues to be at record low levels. We are currently at just over 350,000 single-family homes on the market. You can see from this chart that inventory has been on a downward trajectory for years, and recent strong demand has only accelerated this trend. You can also see that it’s normal for inventory to drop at this time of year, but it’s actually declining faster than I expected even a few weeks ago, which indicates that we’ll start 2022 with record- low levels of available inventory, even less than in 2021.

At this point, it looks like we’re going to end the year at just under 300,000 single-family homes for sale. If we’re lucky, we’ll start getting greater inventory in the housing market in February, then it’ll start climbing and be at a more normal curve next year, but we’re still miles away from a normal level, with no indication that we’ll return to our usual million homes anytime soon.

That being said, keep an eye on rising interest rates. If you look at the 2018 line in the inventory chart, you’ll see that inventory hadn’t yet declined by this time of year in 2018. Why? Because interest rates rose from around 3.9% to 4.9% between April and December, and that cooled the market enough that a little bit of inventory built up during 2018. You can see that 2019 was the only recent year that started with more inventory than the year before.

3. Home prices will remain high into 2022.

With demand showing no signs of cooling and record-low inventory, I expect home prices to remain high into next year. The median home price for single family homes this week is $375,000, which is about 10% higher than last year and where we are likely to end the year.

As we look towards 2022, all the leading indicators show tight inventory and strong demand keeping prices high — a strong seller’s market. If interest rates start rising, and we’re seeing inflation or other economic challenges, this could have a cooling effect on the market. These variables aren’t in the data yet, but they’re looming. We’ll want to keep watching the data closely to spot any major shifts.

Zillow’s Hot Housing Takes for 2022

By Zillow Research on Dec. 8, 2021

The housing market may not reach the incredible heights of 2021, but we expect it will be anything but slow next year. Expect the strong sellers market to persist, the Sun Belt to maintain its top spot as the most in-demand region, and flexible work options to continue to shape housing decisions in new ways in 2022.

The following are Zillow’s bold housing predictions for 2022. Whatever happens, the Zillow Economic Research team wishes you and yours a safe, healthy, prosperous and enjoyable year!

2022 will fall just short of record-breaking

2021 marked the hottest housing market in U.S. history by some measures, including Zillow’s Home Value Index. While we may not see those records broken in 2022, Zillow economists expect incredibly strong price growth and sales volume to continue.

Zillow’s forecast calls for 11% home value growth in 2022. That’s down from a projected 19.5% in 2021, a record year-end pace of home value appreciation, but would rank among the strongest years Zillow has tracked. Existing home sales are predicted to total 6.35 million, compared to an estimated 6.12 million this year. That would be the highest number of home sales in any year since 2006.

Sellers keep the upper hand

The usual seasonal cooldown in the housing market is reappearing this fall after a hiatus in 2020. Fewer homes are selling above list price, homes are staying on the market a few days longer than they did during the summer, and more sellers are cutting their price.

Zillow economists expect these metrics to trend slightly cooler in 2022, but don’t mistake that for a buyers market. The market forces that have given sellers the upper hand over the past two years or so — tight supply after years of underbuilding, and elevated demand due to remote work, U.S. demographics and low mortgage rates — will persist next year as well. Expect to see bidding wars on many homes, especially as the market heats up during the spring and summer shopping season.

Large rentals will be in high demand

Rising home values will impact the rental market as well. After a slowdown in the early months of the pandemic, rent prices came roaring back, especially in what were previously some of the most affordable markets. As rising costs make it harder to save for a down payment, expect demand for larger rentals to increase, including for single-family homes, as families stay in the rental market longer.

The ‘Sun Belt surge’ will extend to secondary markets

2021 was in many ways the year of the Sun Belt. Zillow predicted Austin would be the hottest market of 2021 as part of a “Sun Belt surge,” which proved to be the case — no metro has seen home values grow more than Austin so far this year, and all of the top destinations for long-distance movers were in the Sun Belt.

Zillow predicts this surge will extend to smaller Sun Belt cities in 2022 as price hikes in this year’s star markets make more-affordable nearby markets more attractive. From April to August, Austin held the top spot in quarter-over-quarter home value growth, which is a good indicator of current housing demand. As of October, the smaller Florida metros of Fort Myers and Sarasota held the top spots, and 24 of the top 25 markets were in sunny states – a sign of things to come in 2022.

More Gen Zers and millennials will buy a ‘second home’ before a primary residence

Americans are taking advantage of remote work flexibility to move to larger homes in more-affordable markets, but many will not want to commit to a new location full-time. This is often true for younger people who are attracted to the amenities of living in a city, where expensive housing is more likely to put homeownership out of reach.

With these factors in play, there may be more people buying what’s traditionally a second home — either a part-time vacation home or an investment property — before they buy a home as a primary residence.

Young people today are savvy watchers of the housing market, in part because of time spent Zillow surfing. Purchasing a “second” home in a market more affordable than the one they live in is a way to break into the market and start building equity while mortgage rates are low, possibly teaming up with friends or family to lessen the financial burden. Virtual home shopping tools available today, such as Zillow 3D Home tours, make buying a home in a far-flung location easier.

No end in sight for the renovation boom

In the race to buy a home in the ultracompetitive pandemic housing market, many buyers have had to make one or more compromises (81%). As prices and mortgage rates rise, expect many homeowners to upgrade their existing home rather than try to wade back into the market to trade up.

A Zillow survey of homeowners found nearly three-quarters would consider at least one home improvement project in the next year. The top projects on their to-do list are renovating a bathroom (52%) or kitchen (46%), adding or improving a home office space (31%), finishing a basement or attic (23%), adding a room (23%) or adding a separate dwelling unit (21%).

Work will play a key role in moving decisions

The rise of flexible work options has changed how heavily a short commute factors into where Americans live. Home buyers used to pay handsomely to live near downtown and reap the benefits of a quick trip to and from the workplace each day, but that dynamic flipped in much of the country last year as buyers prioritized affordability and extra space. In 2022, hybrid and fully remote work will continue to reshape which areas are most in demand as the pandemic winds down and more workers receive permanent guidance on their flexible work options.

Zillow economists expect fully remote workers to continue to seek affordable markets, like those in the Sun Belt and other nontraditional housing hot spots where they can afford to buy their first home or trade up for a bigger one. And amid the “Great Resignation” and a generally aging population, traditional retirement markets are likely to see elevated demand.

New construction gains will only be a drop in the bucket, despite best efforts of builders

The reason home prices are rising so quickly is economics 101: high demand and low supply. Zillow research shows that in the 35 largest housing markets alone, there has been a shortfall of 1.35 million new homes since 2008 because of a construction slowdown following the housing crash. Home builder confidence is sky-high, and builders are doing all they can to get houses up, but supply chain snags and labor shortages are limiting progress. The gap shrunk in 2021 and will likely shrink again in 2022, but the housing shortage will be a defining feature of the market once again next year.

Glen Bell – (510) 333-4460 jazzlines@sbcglobal.net

Glen’s SF East Bay Real Estate Market Update June 30, 2020

SF East Bay Real Estate Market Update

June 30, 2020

By Glen Bell (510) 333-4460

No doubt that the COVID-19 has had its effects on our local real estate market. We haven’t seen dramatic changes just yet. What we have seen is a “mixed” bag. Low inventory levels and low interest rates continue to be the story of this market.

What we’ve seen since COVID-19 began, is that many sellers decided to delay or postpone coming onto the market until some of the uncertainty subsides. Many buyers have jumped back on the fence and are holding off. The uncertainty of their job being in jeopardy, a loss in income, health fears, or seeing a “big hit” in their stock portfolio has taken its toll. Although there may be fewer buyers out there, there are still even fewer homes for sale. Many are getting gobbled up now.

The C0vid-19 market is such a “mixed” bag right now that it’s difficult to wrap your hands around it or even try to predict what’s coming down the pike. As I’ve said before; this is unchartered territory. Affordable homes in the right location that are in somewhat move-in condition seem to be getting the most attention. Many buyers are reluctant to make big commitments on cash reserves for the “high end” market or big time fixers. That market seems to be a little “soft” in many areas right now. Buyers may also be shying away from the “close quarters” of the more expensive condos. However, the “right” house, in the “right” location will still experience a competitive market with multiple offers.

Income properties are more sensitive to risk aversion. Eviction moratoriums, rent reductions, local pre-tenant ordinances being passed, COVID-19 related payment deferrals, have all taken their toll and made these properties less attractive to buyers.

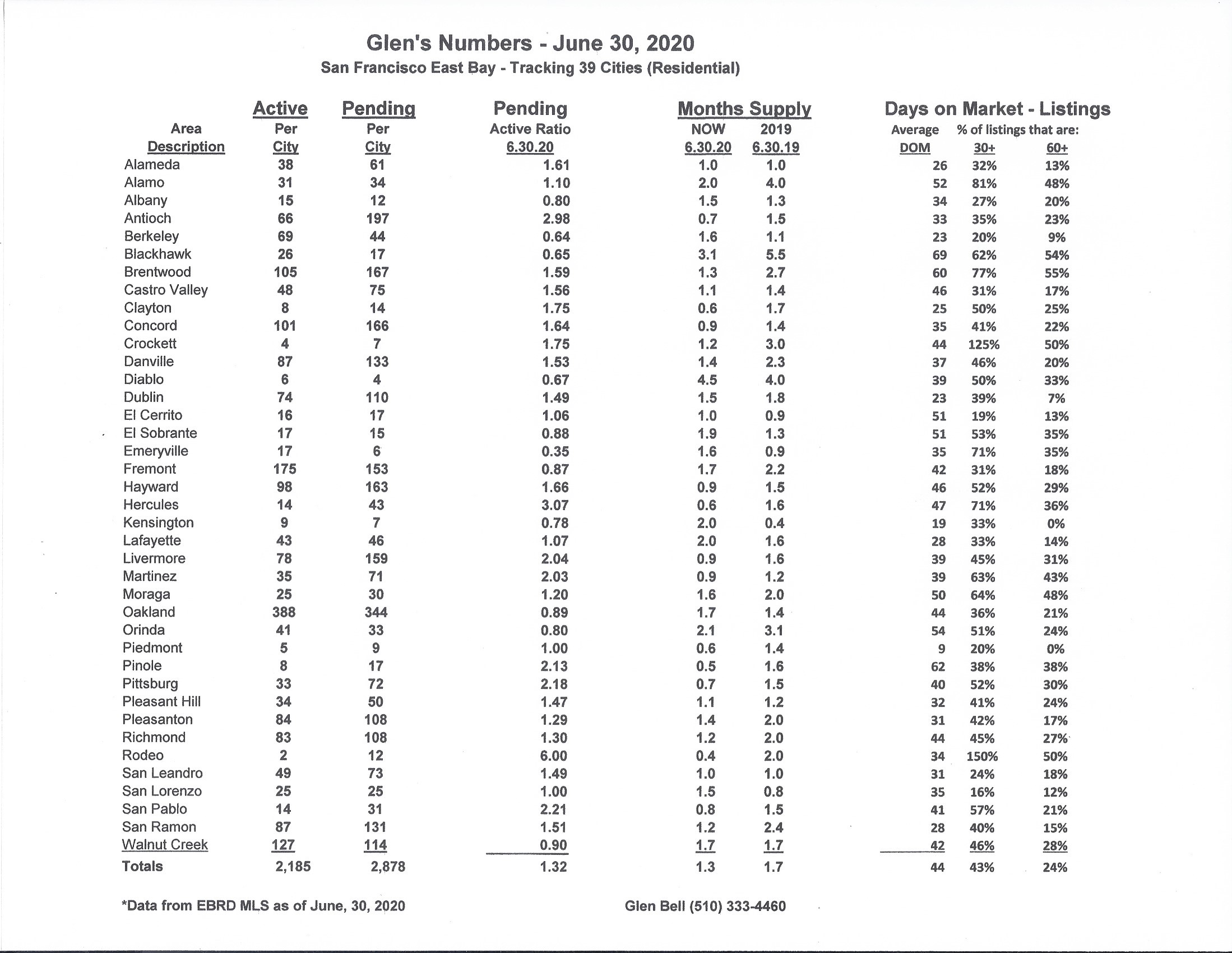

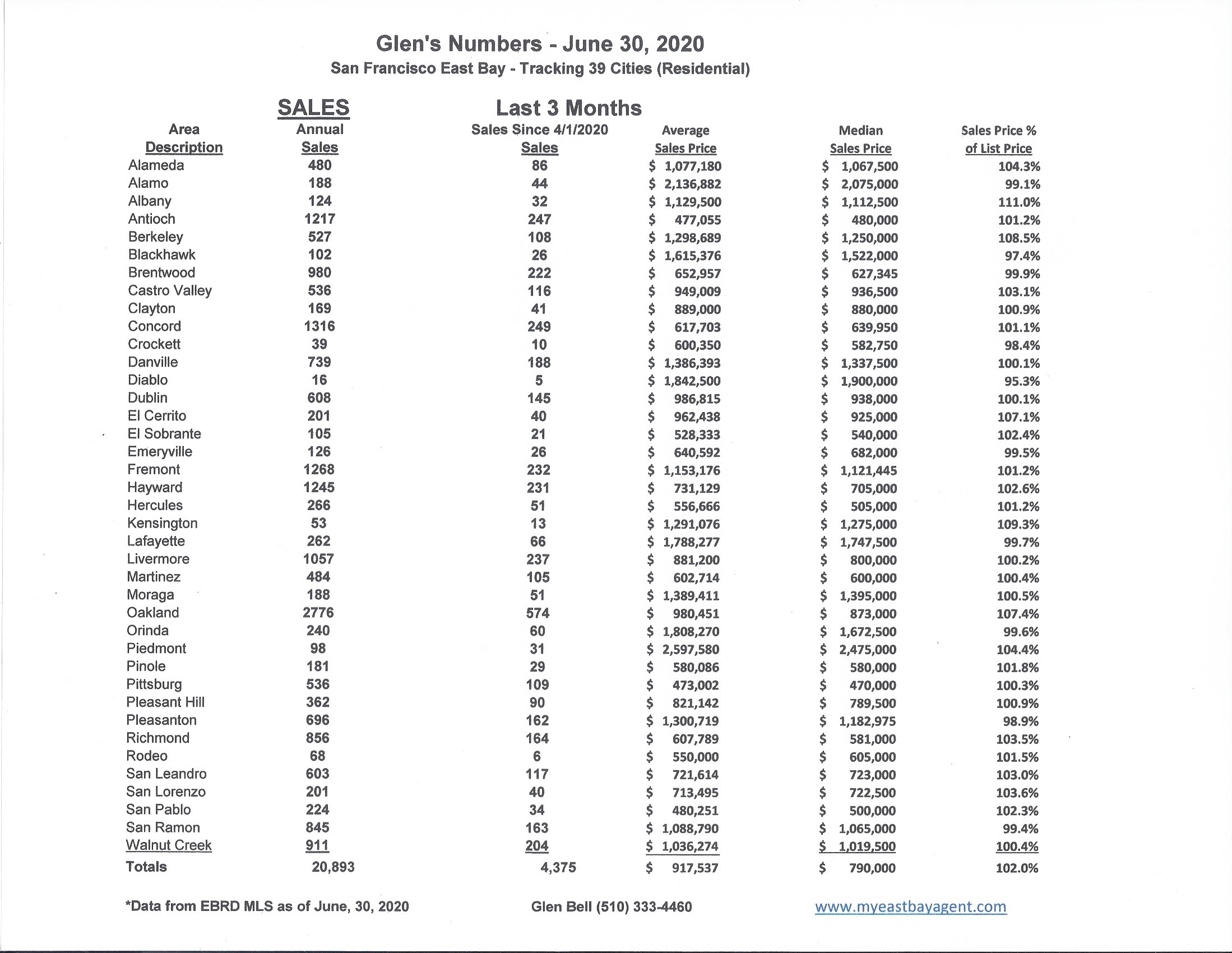

Here are some highlights for the 39 East Bay Cities that I track:

Sales are up slightly from last month, but 38% lower than last year’s numbers. Prices have been up slightly through spring but are now beginning to flatten out during the summer months. More homes seem to be “sitting,” and taking longer to sell. We’re seeing more price reductions with more transactions falling out.

The seasonal drop in inventory followed our normal pattern during the holidays. We watched the number of homes decrease by nearly 60% over November and December. Last year was somewhat unusual because we saw a late season start and early season end. Inventory at the end of December was at its’ 2nd lowest level since I began tracking these 39 cities in 2006, with only 1163 homes for sale at the end of December. Our expectations normally are that new home listings begin to appear on the market as early as mid-January with a steady increase of inventory every month through to September, traditionally our high point.

Inventory decreased slightly in June by 4%. This was unexpected. We normally expect to see more than that in June, typically one of our strongest selling m0nths of the year. That’s 34.2% lower than what we saw last year at this time. This represents a 39 day supply of homes, compared to a 51 day supply last year at the end of June. This is the lowest I’ve seen for a June since I started tracking numbers in 2008. The number of pendings improved by a 23.7% compared to May, a good sign that we still have buyers. We’re also 7.4% higher when compared to last year at this time.

The pending/active ratio continued to move upwards, crossing more into a sellers market similar to what we saw at the beginning of the year. This is much higher when compared to last years’ number of .81. We were at 1.02 last month. The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (less inventory with more pendings) favors sellers. A number below 1 favors buyers..

- The month’s supply for the combined 39 city area is 39 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years. Supply is less when compared to last year at this time, of 51 days.

- Our inventory for the East Bay (the 39 cities tracked) is now at 2,185 homes actively for sale. This is fewer than what we saw last year at this time, of3,317. We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales increased to 2,878, higher than what we saw last year at this time of 2,679.

- Our Pending/Active Ratio is 1.32. Last year at this time it was .81.

- Sales over the last 3 months, on average, are 2% over the asking price for this area, lower than what we saw last year at this time, of 3.4%.

Recent News

Stunning rebound: Bay Area home sales surged nearly 70% from May to June; prices rose 3.6%

By Katheen Pender, SF Chronicle, June 16, 2020

The Bay Area home market saw an enormous resurgence in sales and a modest increase in prices from May to June, as pent-up demand and record-low interest rates collided with sparse inventory, according to a California Association of Realtors report issued Thursday.

Sales of existing, single-family homes rebounded 69.2%, the largest month-to-month sales jump since the association started keeping records for the Bay Area in 1990. Compared to June of last year, sales were down 7.8%. The median price rose to an even $1 million, up 3.6% from May and 4.2% higher year over year.

Because deals typically take around a month to close, June sales and prices largely reflect deals that started in May, as shelter-in-place orders eased and the economic outlook became “less-opaque,” said Jordan Levine, the association’s deputy chief economist. “I think the last couple weeks we have seen uncertainty increase,” he added.

On Monday, Gov. Gavin Newsom took steps to close down parts of the state’s economy that had reopened. On Thursday, the government reported that 287,732 Californians filed unemployment claims last week, up 8.7% from the week before and the highest since early May.

June’s sales surge represents a sharp turnaround from the May, April and March, when Bay Area home sales fell 51%, 37% and 12%, respectively, on a year-over-year basis as shelter-in-place orders and widespread economic uncertainty kept buyers and sellers on the sidelines.

“Pending sales hit bottom in late April,” Levine said. By late April and throughout May, demand was coming back as “the economy opened up slightly.” Also by May, people who were tired of living — and working — in cramped quarters were looking to expand.

What they found on the market was — not much. In June, there were just 5,304 active listings in the Bay Area, down 31% from 7,655 in June of last year. The only Bay Area county with an increase in active listings was San Francisco.

Falling mortgage rates also helped with affordability. On Thursday, the average rate on a 30-year fixed-rate mortgage fell to 2.98%, the first time it had ever dipped below 3% in the nearly 50 years since Freddie Mac has been tracking the rate on government-backed mortgages.

The association’s report does not include sales of condominiums, newly built homes and ones not advertised on a Multiple Listing Service.

The market for condos was generally weaker than for single-family homes last month. The median condo price fell to $701,000, down 0.6% from May and down 6.5% year over year. Condo sales were up 82% from May but down 22% from last June. The association reports condo numbers separately from its main report.

Jing Fang, a broker associate with the Compass real estate firm who works mostly with condo buyers in San Francisco, said he is seeing “a lot of momentum and activity. Buyers think there is a little bit of an adjustment in the market, and interest rates are below 3% now.” For one-bedroom units, “I’m not seeing much of a price reduction.” Two-bedroom units selling for close to $2 million “are a little soft.” She added that “sellers are pretty motivated. Otherwise they wouldn’t put their home on the market right now.”

Jessica Tsai and Marvin Lam are purchasing a one-bedroom unit with patio and den in a new condominium building that’s nearing completion on Third Street, in San Francisco’s up-and-coming Dogpatch. The couple put a deposit down in November because “we are engaged and wanted to spend a little bit more time in the city. We weren’t ready for the burbs yet,” Lam said.

They like Dogpatch for its proximity to the waterfront and new Warriors arena. Lam was planning to open a new business in the neighborhood. After the coronavirus hit, they monitored condo prices south of Market Street and found “more volatility” than before. “Some close above asking, some under, some still on the market longer,” Lam said.

“A lot of price reductions were in other areas. The new buildings in Dogpatch seem to have retained their value,” Tsai said. They’re going ahead with the purchase because “we still really like the property.”

Statewide, single-family home sales rose 42.4% between May and June and the median price rose 6.5% to $626,170, a record high. “A change in the mix of sales was one primary factor that pushed the median price higher in June, as sales of higher-priced properties bounced back stronger than lower-priced homes,” the association reported.

That was true in the Bay Area as well. In April, lower-priced homes were selling faster than higher-priced ones.

In June, “high-price home market segments around the Bay Area were extremely strong,” Patrick Carlisle, chief market analyst for Compass said in a report last week. “In San Francisco, houses selling for $2.5 million and above constituted 30% of all house sales, well above the 2-year monthly average of 18%.”

San Francisco overall, which has had some of the strictest shelter-in-place rules, has been the “weakest performing market as measured by supply and demand indicators (but not median price change) in the Bay Area in the last 4 months. However, it too has seen a very strong rebound from the huge declines immediately following (shelter-in-place) rules being implemented in mid-March,” Carlisle wrote.

He added that the San Francisco rental market “has been hammered by declining rent rates and increasing vacancy rates as newly unemployed residents leave the most expensive apartments in the country. Unemployment typically hits the rental market much harder than the for-sale market.”

If unemployment continues to rise, the “ripple effect” will be felt throughout the housing market, Levine said.

Bay Area home sales plummet during coronavirus, but prices rise

Home prices up in 5 of 7 counties

By Louis Hansen, Bay Area News Group, July 11, 2020

Bay Area home sales plummeted in May, falling by more than one-third in most counties and by nearly half in San Francisco as COVID-19 fears chilled buyers and sellers.

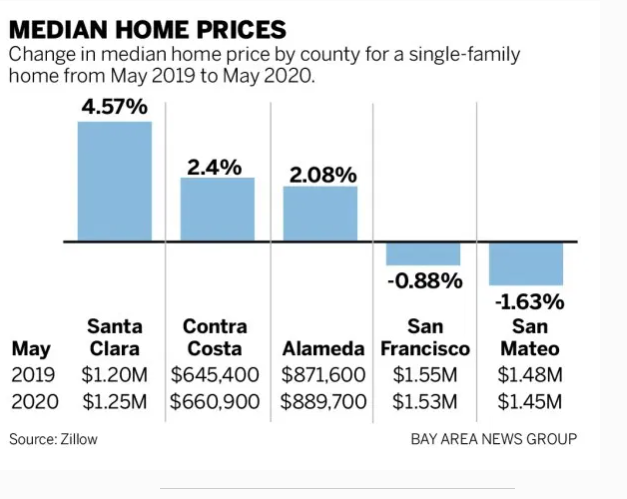

But the slowdown in transactions did little to slow prices — median sale prices rose noticeably in Santa Clara, Alameda and Contra Costa counties, according to Zillow data. The median home sale price for seven counties came in at $866,900.

Bay Area demand for scarce homes remained strong despite the shutdowns and constraints caused by the pandemic. “These numbers are pretty impressive. Pretty striking,” said Zillow economist Jeff Tucker.

The smaller pool of Bay Area house hunters shrugged off historic job losses, an ever-lengthening health crisis and economic uncertainty to snap up the few homes for sale at rates not seen since the peak of the market in 2017. Even limited in-person home tours and less personal meetings with brokers did not discourage these buyers.

The lure of record-low interest rates — hovering around 3.1 percent — has also encouraged many to start shopping.

Median prices for single family homes rose, year-over-year, in five of seven counties in May, according to Zillow. The median price for a home in Santa Clara County rose 4.6 percent to $1.25 million, grew 2.4 percent to $660,900 in Contra Costa County, increased 2.1 percent to $889,700 in Alameda County, jumped 5.9 percent to $462,100 in Solano County, and climbed 2.9 percent to $646,300 in Sonoma County.

Prices fell in the region’s two most expensive spots, but provided no bargains. The median sale price in San Francisco fell about one percent to $1.53 million and dropped 1.6 percent to $1.45 million in San Mateo County, according to Zillow.

Data for Marin and Napa counties was not available.

The market for condominiums in core Bay Area counties continued to crumble, with price drops nearing 15 percent in Santa Clara County, and smaller declines in San Francisco, San Mateo, Alameda and Contra Costa counties.

Tucker said the appeal of single-family homes — with yards and private space — has grown during the pandemic. Many condo units now have limited access to common areas, community gyms and outdoor spaces, and tighter living conditions could be a turn-off for some buyers.

Agents say buyers remaining in the market are serious and prepared to move. Some are reporting bidding wars for Silicon Valley properties, with low inventory fueling the market. And despite the growing reliance on remote work, few have noticed a run for distant suburbs with lower prices and bigger spaces.

Core Silicon Valley communities, including Palo Alto, Mountain View, Cupertino, Sunnyvale and Saratoga, have seen growing interest and sales over listing prices.

Compass agent Mark Wong of Saratoga said business remained brisk with motivated buyers. During the pandemic, he’s seen several clients looking to move from San Francisco high rises to single-family homes in the South Bay.

The tech economy has also remained solid, he added. “People are still buying and selling every single day,” Wong said. “They seem to be bullet-proof on their income.”

Buyers are shopping online and making quick decisions, he said, with offers being accepted as quickly as a day after a property has been listed. “Buyers just can’t wait,” he said.

Agent Tina Hand, president of the Bay East Association of Realtors, said demand remains strong along the I-880 corridor. Low mortgage rates have boosted buying power. “It’s free money,” she said.

Realtors have adapted to new rules, staggering home showings in one-hour intervals because open houses have been banned. The inventory of homes for sale in the East Bay has fallen, like the greater Bay Area.

The pandemic has changed some buyers’ habits. “People are now seriously looking at traditional single-family homes,” she said. “They’re looking for yards again.”

Home Sales Exceed Pre-Pandemic Levels for the First Time as Mortgage Rates Hit Another Record Low

By Sheharyar Bokhari, Redfin, July 15, 2020

Key takeaways for the week ending July 5

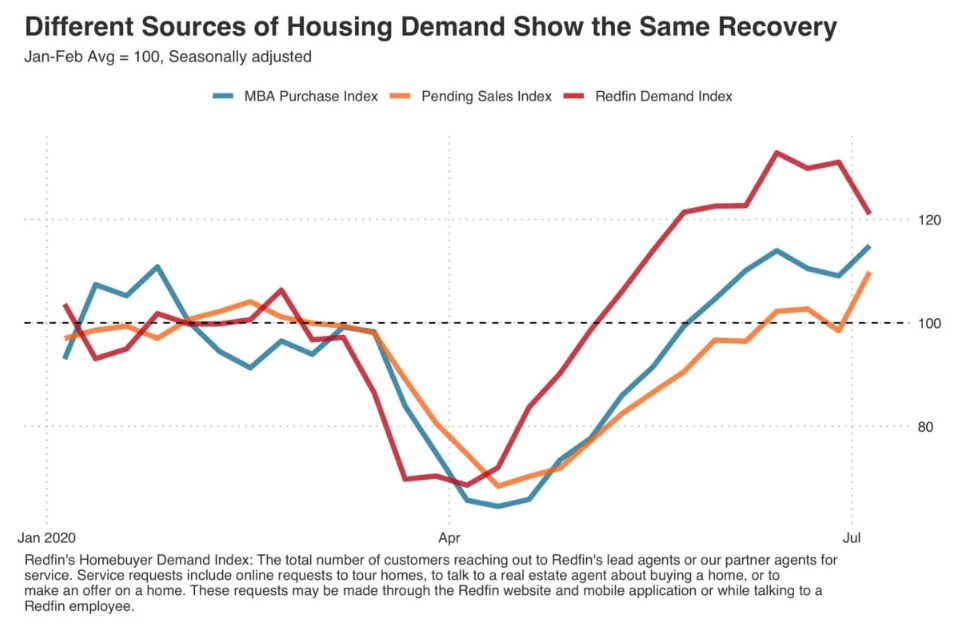

- Home sales were up 2% from pre-pandemic levels and are likely to continue rising; pending sales were up 10% during the same period.

- Weekly average mortgage rates fell to a new low of 3.03%, fueling homebuyer demand.

- New listings recovered to pre-pandemic levels for the third straight week, but can’t keep pace with buyer demand; the number of homes for sale was down 29% from last year.

- Nearly half of homes that sold during the week spent two weeks or less on the market, making the market feel “chaotic” for buyers.

- Low rates and low inventory pushed home sale prices up 7% from a year earlier.

With mortgage rates at a record low, pending sales and homebuyer demand remain above pre-pandemic levels

The housing market continued its recovery in the week ending July 5 despite the rise in COVID-19 cases. For the first time, home sales exceeded pre-pandemic levels from January and February, up 2% on a seasonally adjusted basis. Demand is being propelled primarily by record low mortgage rates; the average 30-year fixed rate was down to 3.03% for the week ending July 9.

“The industry is responding to an avalanche of applications for refinances and purchases.” said Rob Foos, a mortgage advisor with Redfin Mortgage in Boston. “A combination of rock-bottom rates plus pent-up purchase demand has resulted in the highest levels of purchase applications in about a decade.”

Several leading indicators suggest that home sales will continue to increase in the coming weeks; pending sales grew 10% from pre-pandemic levels on a seasonally adjusted basis and the Redfin home-buying demand index has hovered around 20% above the pre-pandemic levels for seven straight weeks. Mortgage purchase applications were also about 15% above pre-pandemic levels.

Potential sellers worry about finding their next home

New listings were at their pre-pandemic levels for three straight weeks, up 1% on average on a seasonally adjusted basis. But there aren’t enough new listings to satisfy the strong homebuying demand. As a result, the total number of homes for sale was down 29% from a year ago. Redfin agents report that sellers are now rarely citing coronavirus concerns as a reason not to list, but more often cite the lack of homes for sale itself as the thing that’s holding them back.

“Some of my clients are considering selling, but it’s a matter of finding a home they can buy,” said Redfin agent Thomas Wiederstein in Phoenix. “Even if they do find a home that checks all the boxes, many move-up buyers can’t buy a new home before they sell their current one. With bidding wars so common, it’s very hard to get an offer accepted that’s contingent on the sale of the buyer’s current home.”

Lack of homes for sale fuels competition

Buyers face competition more often than not, as more than half of Redfin offers faced a bidding war in June for the second month in a row, and homes are going off-market quickly. The share of listings that went off market within two weeks stood at 45% this week, up from 35% a year ago. Shoshana Godwin, a Redfin agent in Seattle, is seeing a return to bidding wars and buyers waiving contingencies to make their offers more attractive.

“We’re back to buyers waiving their rights to cancel the contract if something pops up during the inspection or they can’t get their loan approved. Buyers used to try to inspect the home before writing an offer, but now sellers are providing an inspection report upfront. That brings in even more bidders because they don’t need to spend $500 on an inspection just to make an offer,” Godwin said.

Redfin San Francisco agent Chad Eng describes a housing market that feels “chaotic” in the absence of pre-pandemic norms.

“Due to COVID-19, agents are scheduling back-to-back 15-minute in-person home tours instead of holding traditional open houses. If you miss your appointment, you’re out of luck. Sellers often set a deadline for buyers to submit offers so they can review all of their options at once, but now that there’s so much uncertainty, sellers who receive one strong offer are less willing to wait around to see what else trickles in. I’ve seen multiple sellers accept an offer before the deadline, meaning buyers who wait miss out on their shot at buying the home.”

With competition comes rising home prices. The average sale price for the week ending July 5 was $310,000, up 7% from a year ago. The big question is how high prices will go? Asking prices for newly listed homes continue to accelerate as well, rising 16% over the same week last year to $324,900.

What’s ahead?

Right now the market shows no signs of slowing down, but it will face a new test at the end of July. Thanks to the CARES Act, roughly 30 million Americans are receiving an extra $600 in weekly unemployment benefits. That extra benefit is set to expire July 31, unless lawmakers pass an extension or new legislation to supplement income for folks who are out of work.

The expiration of these enhanced unemployment benefits could adversely affect personal spending, a crucial component of the economy that makes up 68% of GDP. A pullback in consumer spending could hit industries outside of travel, service and hospitality which so far haven’t been as impacted during the pandemic. That’s notable because so far, highly-paid employees have been largely insulated from the recession and the high unemployment rate in service jobs has had a limited impact on housing demand. If job losses creep into new industries, all bets are off.

Why California’s housing market isn’t tanking

Rents are falling in some areas, but home prices remain stubbornly high

BY MATT LEVIN, Cal Matters, JULY 6, 2020

It’s the worst economy since the Great Depression. Nearly 1 in every 6 California workers is out of a job, and those lucky enough to remain employed confront reduced hours, slimmed wages and mounting uncertainty over what the next few months will bring. The state budget is in shambles, and cities and counties are already laying off workers.

And yet California home prices aren’t dropping all that much.

Despite the economic carnage induced by the novel coronavirus pandemic, the state’s stubbornly expensive housing market appears headed for a relatively soft landing. While rents in some markets show signs of a steeper cliff, the value of a California single family home last month — $570,000 — is actually higher than what it was a year ago, according to the real estate data firm Zillow.

Glen Bell – (510) 333-4460 jazzlines@sbcglobal.net

Glen’s SF East Bay Real Estate Market Update April 30, 2020

SF East Bay Real Estate Market Update

April 30, 2020

By Glen Bell (510) 333-4460

Everyone seems to be asking the question of how will the COVID-19 “shelter in place” mandate effect the real estate market and how will we come out of it later in the year. There’s been so much speculation with a number of different opinions coming from a number of sources. Keep in mind that this is “unchartered territory” and we won’t have definitive answers for quite some time. So much has changed. We as agents are very limited in what we can do during this period. A lot will be riding on how long it takes before we’re able to really go back to work, how long it takes for the COVID-19 fears to subside, how will the economy fair and what will the jobs situation looks like by then.

As agents, the market has paused as our lives have. Preparing a home for market has been delayed, and fewer new listings are coming on, due to the many challenges of being able to properly market them. Brokerages temporarily closed their doors with agents primarily working remotely from their homes. There are no open house showings while physical individual showings are discouraged and have come to a crawl. COVID-19 has disrupted all of our lives. The uncertainty and concern for our health and well-being for not only ourselves, but our family and friends, is foremost in all of our minds.

That being said, let’s take a look at how the market stands at the end of April. We haven’t seen dramatic changes just yet. What we have seen is a “mixed” bag. However, I say that only by looking at the numbers up until April 30th. Everyone asks me to pull out your crystal ball and tell us what’s going to happen.

For me, I’ve always been a firm believer in supply and demand concepts. For example, in real estate, the number of houses for sale always represented our supply, while the number of homes that have gone into contract, or pendings, represented our demand. What kind of a market, a buyers’ or a sellers’, is determined based on the relationship of these two numbers at any given time. During the REO days, there was a huge inventory, with few buyers, thus a buyers’ market. For most of the past 6 years, markets experienced a strong sellers’ market with very few listings and lots of buyers. For most of last year, we had moved back towards a more neutral or balanced market. When inventory “fell off the cliff” in November 2019, a month earlier than normal, it set up for a strong sellers’ market again early spring and that’s exactly what happened. Very little to look at with lots buyers trying to take advantage of extremely low interest rates. We saw more competition and increased prices early on. Then COVID-19 hit.

What we’ve seen since COVID-19, is that if sellers did not already have their home listed for sale, many decided to delay or postpone coming onto the market until some of the uncertainty subsides. Many buyers have jumped back on the fence and are holding off. The uncertainty of their job being in jeopardy, a loss in income, health fears, or seeing a “big hit” in their stock portfolio has taken its toll.

The lack of inventory early this year had “flipped” our markets back into a sellers’ market temporarily. However, it seems to be setting up for another big change to come by as early as this summer. There’s a large number of sellers who took a wait and see attitude over COVID-19 who may come back onto the market then. This could come in waves with some wanting to see first how the market is doing before they put their home up for sale. There may even be more who took financial hits and feel that they now “must sell.” So, we’ll probably see a fairly large supply of homes come onto the market over the summer. Many buyers on the other hand have backed off and may not be in a financial position to purchase by then. So perhaps the strong demand that we’re used to seeing in the Bay Area will begin to decrease. This will probably pull us back into a more neutral or balanced market, or possibly even into a buyers’ market for the first time in years.

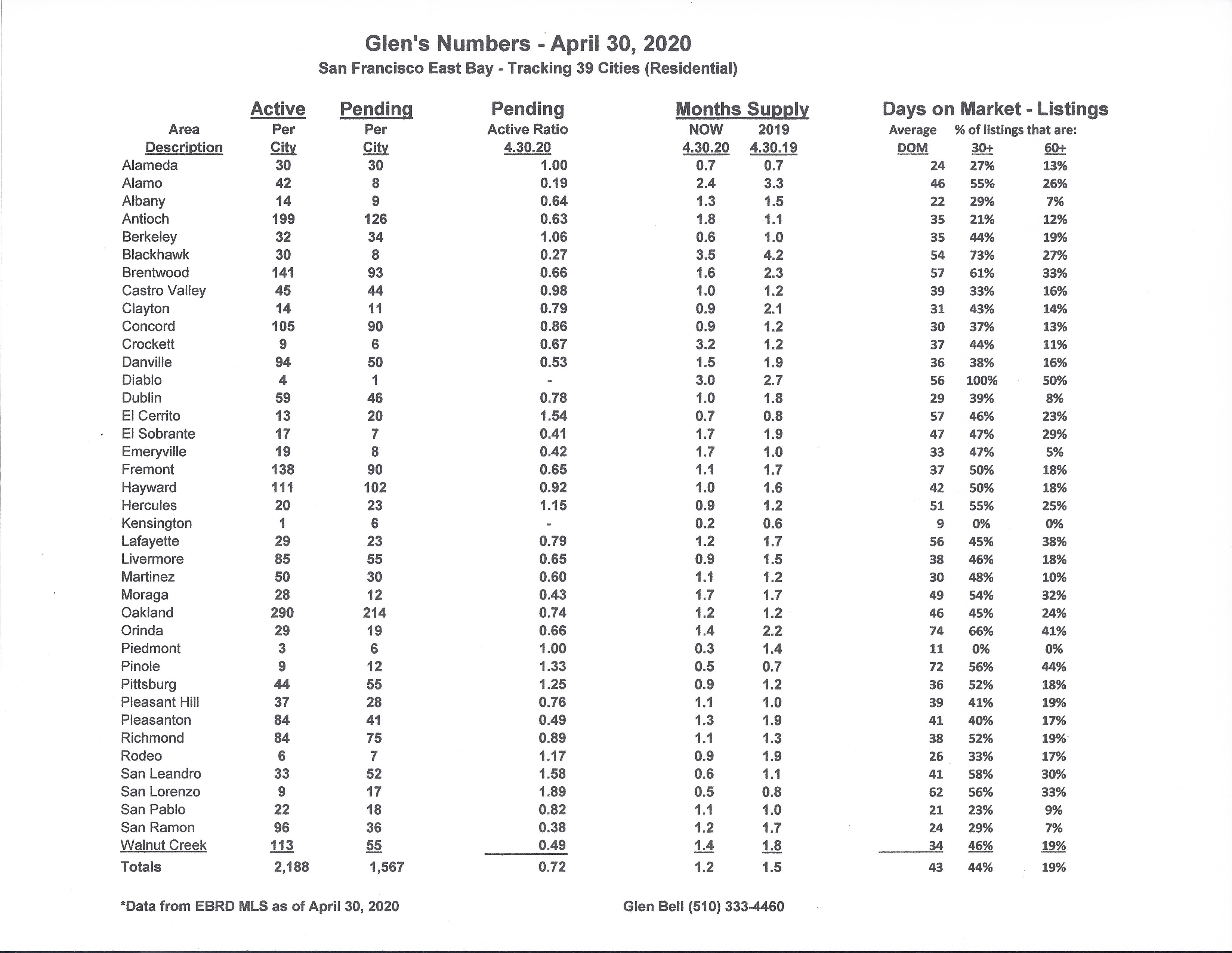

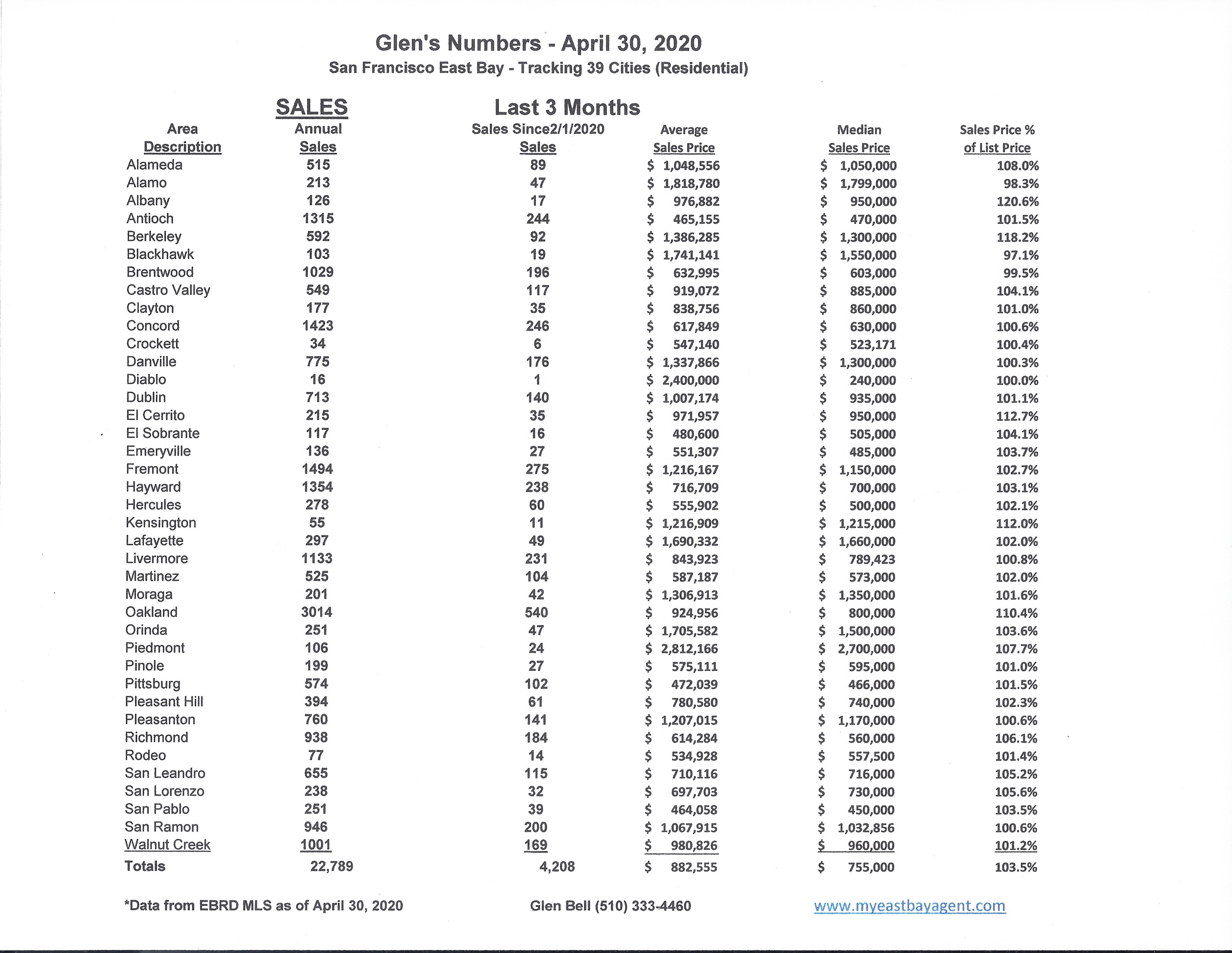

Here are some highlights for the 39 East Bay Cities that I track:

Sales are up slightly, but still 18.5% lower than last year’s numbers. Prices are up slightly as well. However, that looks to be more of a result of our earlier spring influence. This looks to be changing. Now, more homes are “sitting,” taking longer to sell, and we’re seeing more transactions fall out. Fewer buyers are going into contract.

The seasonal drop in inventory followed our normal pattern during the holidays. We watched the number of homes decrease by nearly 60% over November and December. Last year was somewhat unusual because we saw a late season start and early season end. Inventory at the end of December was at its’ 2nd lowest level since I began tracking these 39 cities in 2006, with only 1163 homes for sale at the end of December. Our expectations normally are that new home listings begin to appear on the market as early as mid-January with a steady increase of inventory every month through to September, traditionally our high point.

Inventory increased in April by 41%, however, that’s still 25% lower than what we saw last year at this time. This represents a 36 day supply of homes, compared to a 45 day supply last year at the end of April. The trend with pendings continued to slide, dropping by 21% in April. This is the second decrease in a row during a period of time when we normally see an increase. This is the lowest number I’ve seen since January 2008. This is primarily due to low inventories as well as the influence of the COVID-19 and the “shelter in place” mandate during the last month and a half.

The pending/active ratio saw a huge decrease to .72. This is lower when compared to last years’ number of .92. We were at 1.28 just last month. I can’t remember ever seeing such a large drop in just one month. The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (less inventory with more pendings) favors sellers. A number below 1 favors buyers..

- The month’s supply for the combined 39 city area is 36 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years. Supply is less when compared to last year at this time, of 45 days.

- Our inventory for the East Bay (the 39 cities tracked) is now at 2,188 homes actively for sale. This is fewer than what we saw last year at this time, of 2,915. We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales decreased to 1,567, much lower than what we saw last year at this time of 2,695.

- Our Pending/Active Ratio is .72. Last year at this time it was .92.

- Sales over the last 3 months, on average, are 3.5% over the asking price for this area, slightly higher than what we saw last year at this time, of 2.8%.

Recent News

Zillow Forecasts a Dip in Home Prices, Rebounding By Next Year

By Claire Boeing-Reicher – Matthew Speakman on May. 4, 2020

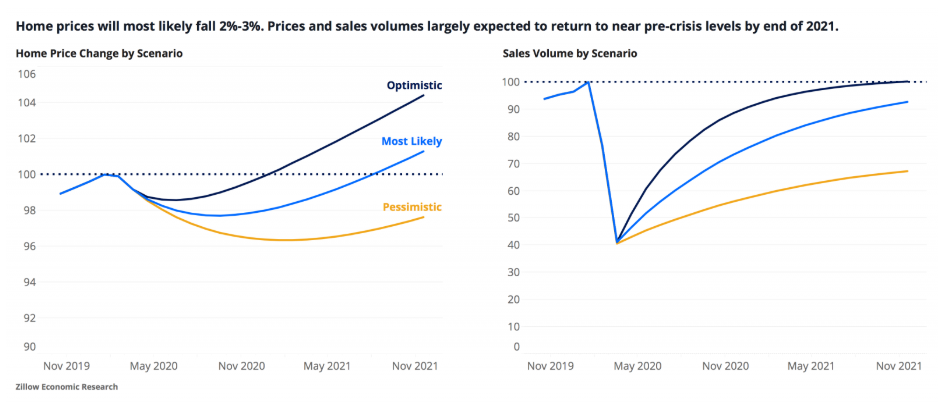

The continued economic fallout from the spread of COVID-19 has introduced immense uncertainty into the housing market as consumers step back from large purchases and social distancing puts a chill on necessary market services. As a result, Zillow expects home prices will most likely fall 2%-to-3% through the end of the year from pre-coronavirus levels, and home sales to fall as much as 60%, before both begin to slowly recover to baseline levels by the end of 2021.

The latest forecasts, based on published and proprietary macroeconomic and housing data, also include more pessimistic or optimistic projections based on the duration of the pandemic and the depth of its impact on the broader economy.

The forecasts center around a baseline prediction of a 4.9% decrease in United States GDP in 2020 and a subsequent 5.7% increase in 2021. Under the baseline scenario, we expect:

- A 2%-3% drop in prices through the end of 2020, followed by a slow recovery throughout 2021. Prices will return to Q4 2019 levels by Q3 2021.

- A 50% decline in home sales from their pre-coronavirus levels, as measured at the end of 2019. Home sales will bottom out in Q2 before beginning to improve near the end of Q2 2020.

- Sales volume will recover to about 97% of Q4 2019 levels by the end of 2021.

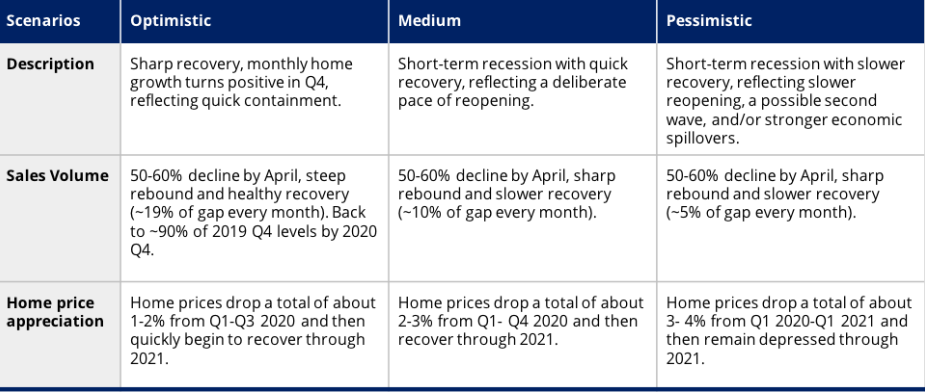

- The pace of recovery is what distinguishes our three scenarios from one another.

Each of our scenarios implies very different paths for home prices and sales volumes. Our optimistic scenario features a small dip in house prices in Q2-Q3 followed by a robust recovery. The baseline medium scenario features a U-shaped trough in Q4 followed by a slower recovery and our pessimistic scenario features continued weakness through all of 2021 (more of a “long U” shape). Under our more-optimistic assumptions, the market could experience a fast, V-shaped “snapback” similar to what happened in the Hong Kong real estate market after the 2003 SARS outbreak. The medium scenario features a “check-mark” shaped recovery and our pessimistic scenario features more of a “wide-U” recovery, with a longer bottom and more gradual pace of improvement.

Overview of Our Scenarios

At time of publication, we believe the medium scenario to be the most likely outcome, followed by the pessimistic scenario and then the optimistic scenario. These scenarios and our assessment of their likelihoods are open to revision and will be revisited periodically as more information regarding the timing, scale and success of relaxed social-distancing measures, among other factors, is released.

How Did We Get Here?

The housing market was beginning to heat up at the end of 2019 and into early 2020. Home price appreciation had begun to reaccelerate after a fairly tepid 2019. Sentiment across most market participants (buyers, sellers, lenders, homebuilders) were all at or near their survey highs. Sales volume and construction levels were both rising at an increased rate. Mortgage delinquency rates were near all-time lows, and record-low for-sale inventory was fueling competition for the few homes on the market.

In addition to a generally strong housing market, the broader U.S. economy was also showing signs of strength, despite some looming concerns. The labor market was riding high: The overall unemployment rate was 3.5%, tied for its lowest level in 50 years; an average of 224,000 jobs were created in the three months ending February 2020; and labor force participation was near a seven-year high. The manufacturing sector, which struggled through much of 2019, was beginning to recover as global tensions (trade war, Brexit etc.) eased and simplified. And consumer spending levels remained steady through February.

Of course, not everything was perfect. Corporate debt levels have risen markedly in recent years, and the quality of debt was beginning to be questioned even before the pandemic. Non-financial corporate debt securities and loans increased to almost 47% of GDP in the last quarter of 2019, up from a post-recession low of 40% in Q4 2010. As of January, only two U.S. companies (Microsoft and Johnson & Johnson) had AAA debt ratings — indicating the highest level of credit-worthiness. Businesses were also scaling back on investments in capital, suggesting they viewed their longer-term prospects as tenuous. Manufacturers’ spending on nondefense capital goods was lower in February 2020 ($68.8B) than it was in February 2012 ($69.7B), despite eight years of economic expansion. And ten years into a record-long economic expansion, the key Federal funds rate as set by the Federal Reserve was very low, leaving the Fed with less wiggle room than usual to stimulate the economy in the case of a downturn.

Even before the onset of the crisis, these factors combined to somewhat dampen our forward-looking outlook. But in general, macroeconomic conditions were sturdy heading into the spring. And this relatively strong economy, coupled with strong demand from home buyers and relatively friendly buying conditions thanks to low mortgage interest rates, meant the housing market was well-positioned for a strong spring selling season.

But over the course of just a few weeks, that all got turned on its head. More than 30 million (and counting) unemployment insurance claims have been filed since the middle of March, representing about one-in-six of all previously employed people counted in the March jobs report. Retail sales levels plummeted in March, falling 8.7% from February, the biggest one-month decline since the Commerce Department began tracking the data in 1992. Industrial production fell 5.4% over the same period, the largest one-month decline since the 1940s.

These and other disruptions have been shocking in both their speed and scale. But even so, we believe many of them to be transitory and will be addressed as the economy opens up again.

Scenario Specifics

In creating this forecast, we relied heavily on macroeconomic forecasts created by Goldman Sachs and the International Monetary Fund, both of which call for a 5%-to-6% decline in GDP in 2020, followed by a 4.5%-to-5.5%% increase in GDP in 2021. A number of high-frequency data points published by Goldman Sachs offering insight into many industries and sectors, including housing, also allowed our team to make frequent updates to our outlook based on hard, industry-specific data.

Our forecast follows a similar structure to Goldman’s, which estimates how much of the gap between actual and potential GDP disappears in the following month for different industries. Our baseline forecast for GDP assumes the same persistence in the gap between actual and potential GDP as Goldman Sachs does. To translate the GDP forecast into a forecast of home prices and transactions, we conducted two separate econometric analyses — relating both long-term home price growth and home sales to GDP — and applied the findings to our GDP scenarios. For home price movements over time we used data from the S&P CoreLogic Case-Shiller home price indices. For sales volume over time we used data from the National Association of Realtors. More information on the specifics of our econometric analysis can be found in the appendix below. We also overlaid scenario-specific factors based on the spread of COVID, the strength of social distancing measures and early signals of recovery in order to come to our conclusions. Specifically, our baseline predicts that about 10% of the gap between actual home transactions and baseline trend disappears in the following month. Differences in the persistence of this gap are what differentiates the three scenarios from one another. The optimistic scenarios for home prices and transactions suggest this gap will recede about twice as quickly as it would in the medium scenarios. The pessimistic scenarios, meanwhile, suggest the recovery rate will be half that of the medium scenarios.

To track the probabilities of these scenarios and to alert us to the need for potential changes (especially to the shape or speed of recovery paths), we are focusing mainly on forward-looking indicators, outside forecasts and empirical studies. On the forward-looking indicator side, we are most-closely tracking survey data and selected financial statistics. The survey data are currently telling us that we should expect much more short-term disruption than longer-term. For instance, the Philadelphia Fed Manufacturing Business Outlook Survey from April 2020 indicated that while most manufacturers view current conditions negatively (worse than 2008-09), they are much more optimistic about future conditions (unlike 2008-09). Similarly, the University of Michigan Surveys of Consumers for April 2020 show a large fall in consumer sentiment reflecting current conditions, while the fall in consumer expectations has been less extreme. Meanwhile, financial data (especially measures of implied volatility such as the VIX, policy uncertainty, mortgage rates and bond spreads) are indicating that financial risks during late March briefly approached the conditions of late 2008, but have since subsided somewhat. That said, we will closely monitor financial data to see if we need to revisit the possibility of creating an even more pessimistic scenario that includes a more fully fledged financial crisis.

Housing-specific data have also validated our assumption of a ~50% decline in sales, while also beginning to offer some clues as to what the next phase of this crisis is going to look like. For-purchase mortgage applications have fallen 31% from a year ago, but have recently shown some signs of stabilization. At their worst, home showings fell as much as 50% since the beginning of the year, but subsequently rose to a level “only” 27.5% below where they were to start the year. Internal measures of newly-pending home sales and new for-sale listings have also shown signs of turning the corner.

Downside Risks and Go-Forward Plan

While our internal and external data currently point to a bottom in real estate transactions at the beginning of April 2020, we are watching for signs of either a renewed contraction or other indicators of a slowing recovery. We are also monitoring the results of ongoing epidemiological studies showing the efficacy of efforts to help curb the spread of the coronavirus and early economic reopening efforts, to help inform us on the likely speed and shape of a recovery. We are also monitoring and commenting on macrofinancial data including corporate bond spreads, mortgage rates, implied volatility and delinquency rates for signs of unexpected weakening. Widespread deterioration in these and other key data risks the economy landing closer to a 2008-style financial crisis scenario, on top of the direct effects of the pandemic.

On top of the broader economic dangers, there are also a number of public health and/or policy risks that, if worsened, might warrant an adjustment of our probability weights and possibly the creation of a more pessimistic scenario to consider. These include:

- A relative lack of coordination between states in their plans to reopen their respective markets, risking the introduction of state-to-state disease transmission, false restarts, risks of new outbreaks and a deeper/longer downturn.

- A continued shortage of testing and personal protective equipment (PPE), limiting the ability to track and contain the virus’s spread and placing continued stress on the health care system.

- Ineffective or insufficient federal fiscal relief efforts, resulting in a larger-than-expected impact to labor and financial markets and threatening state balance sheets.

- As-yet-unquantified risks to the balance sheets of households (people’s ability to pay their debt obligations, willingness to resume normal spending activity) and businesses (how many businesses close and/or resume activity with lower employment?).

- Ineffective relief in the mortgage industry.

Charting the Trends in the Current Housing Market

By Alina Ptaszynski, Redfin, April 30,2010

In our weekly market update, Redfin reported home-buying demand continued to recover last week, as states began making plans to begin to reopen businesses. Here are five additional charts that illustrate the latest developments in the housing market as the world continues to grapple with the coronavirus pandemic. Additional charts and local data are available for download in the Redfin Data Center.

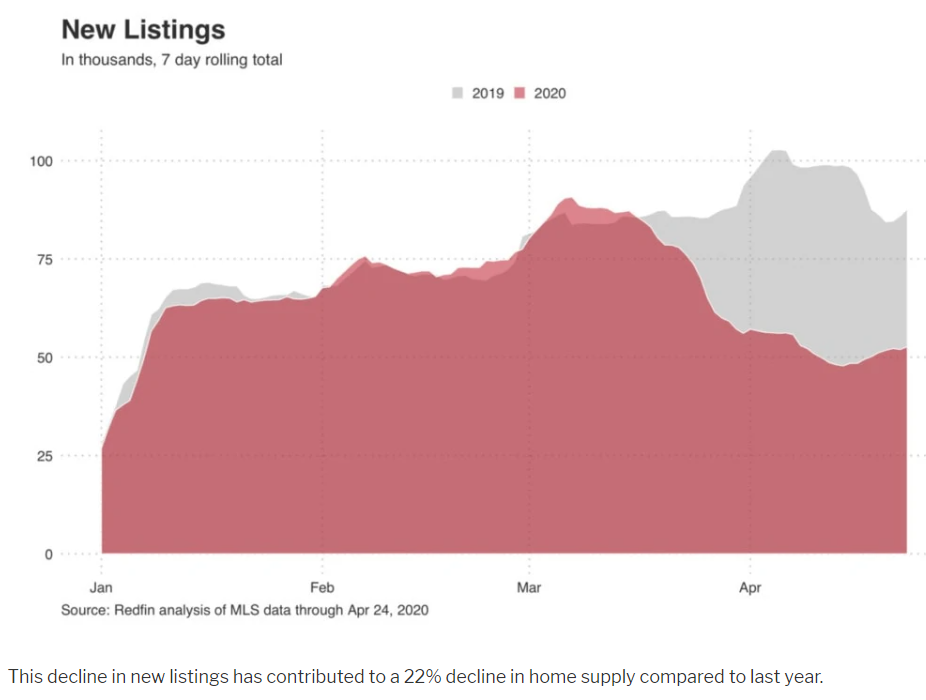

Sellers Continue to Hold Off on Listing

There were almost 53,000 new-home listings last week, down about 40% from a year ago. That’s an improvement from the 50% decline we reported last week. The improvement may be partly due to the Easter holiday falling around this time last year. Looking over the past four weeks, new listings are down 45%, with just 210,000 new homes put on the market. The five preceding years averaged 378,000 new listings during the same period.

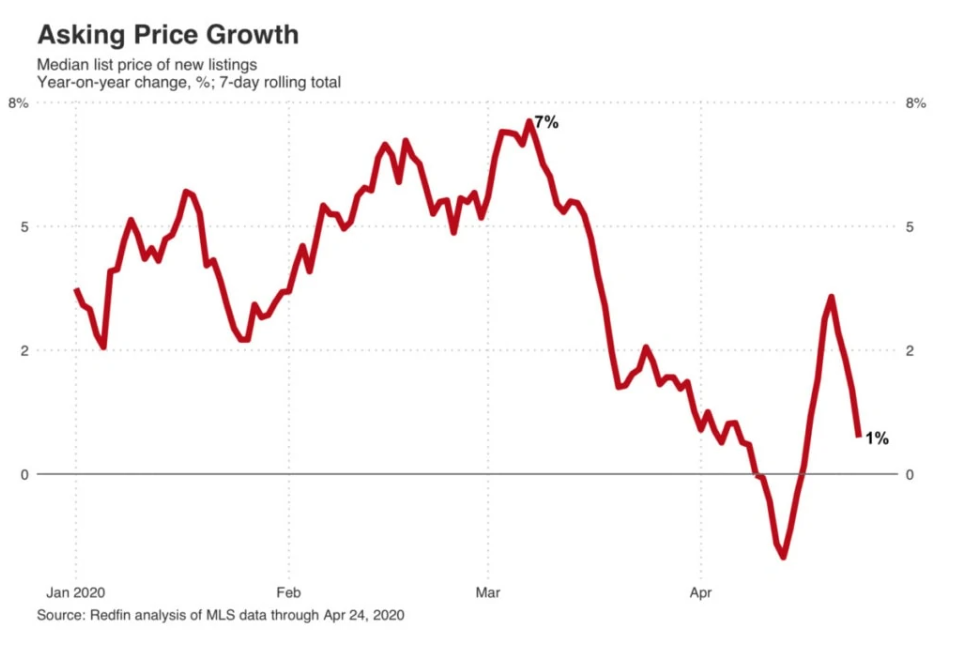

Price Growth is Now Nearly Flat

Last week the median listing price was $308,000, up just 1% compared to the same period the prior year. The week prior, we reported that asking-price growth had stopped its rapid descent and reversed course, increasing 3% year over year. Redfin lead economist Taylor Marr says, “Asking prices may be settling into a flat trend line for now. The primary reason for the shift over the past month though hasn’t been an increase in sellers listing below their Redfin estimate, but instead fewer higher-end properties coming to the market—bringing down the average.”

While Redfin agents are still seeing bidding wars, competition has slowed, giving some buyers a chance to negotiate a better price. In the previously red-hot sellers’ market of Seattle, Redfin agent David Palmer says buyers are now able to be a little more aggressive. “There’s fear on both sides. We have a bunch of buyers who want $40,000 price reductions or credit that really should have been $15,000 to $20,000. We’re calling it the ‘coronavirus credit’. I’d say it is getting a little closer to a level playing field, but sellers know that inventory is low and they’re trying to stick to their guns.”

Sellers Aren’t Dropping Prices

While sellers may be more willing to negotiate, they aren’t dropping their prices. Just 3% of homes on the market had a price drop last week, which is the same as last year and below the average in January and February of 4%.

“Sellers are opting to delist and wait for a more favorable market rather than take a haircut on the price,” says Marr. Sellers who do reduce the price are dropping it by an average of just 1.6% compared to 3.3% last year. “This may be a sign that sellers are using a price drop as a strategy to drum up new interest in the home. They worry buyers overlooked their home in the early coronavirus panic and know that a price drop triggers a notification to be sent to buyers who have a saved search.”

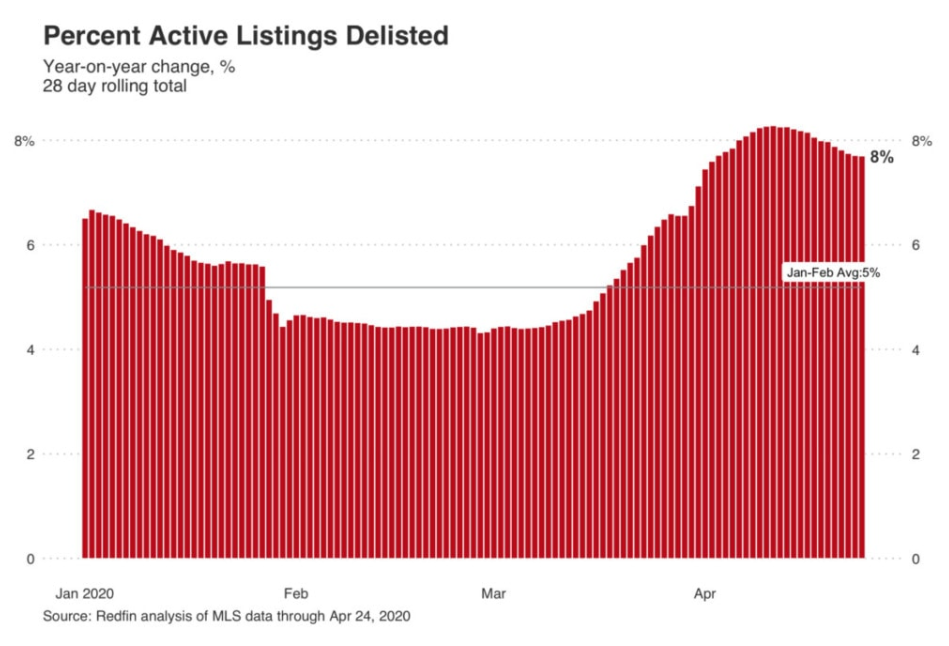

Sellers Continue to Pull Homes Off the Market

In the four weeks ended April 24, 8% of active listings were pulled from the market. While we appear to be past the peak of delistings, sellers are still removing their homes from the market at a significantly higher rate than they were at this time last year. During the week ended April 24, delistings rose 56% year over year to 15,900 homes, down from the peak of over 100% during the final week of March.

Pending Home Sales Drop to Lowest Level Since 2011 as Coronavirus Takes Its Toll

By Jacob Passy, Realtor.com, Apr 29, 2020

The numbers: The index of pending home sales dropped 20.8% in March as the coronavirus pandemic took a significant bite out of real-estate activity, the National Association of Realtors reported Wednesday.

This represented the lowest level of pending sales since 2011.

The index measures real-estate transactions where a contract was signed but the sale had not yet closed, benchmarked to contract-signing activity in 2001. It serves as an indicator for existing-home sales reports in the coming months.

What happened: Compared with March 2019, signings were down 16.3% nationally.

On a monthly basis, pending sales dropped in every region with the West seeing the largest decline at 26.8%, followed by the Midwest (down 22%) and the South (19.5%). In the Northeast, contract signings only decreased 14.5%.

The big picture: While the coronavirus outbreak has not caused real-estate activity to stop entirely, it has put a major damper on what economists had anticipated would be a strong spring home-buying season thanks to low mortgage rates and pent-up demand among buyers. Without the spring home-buying season, home sales are expected to drop 14% in 2020.

“As consumers become more accustomed to social distancing protocols, and with the economy slowly and safely reopening, listings and buying activity will resume, especially given the record low mortgage rates,” said Lawrence Yun, chief economist at the National Association of Realtors. “The usual spring buying season will be missed, however, so a bounce-back later in the year will be insufficient to make up for the loss of sales in the second quarter.”