September 30, 2021 – Real Estate Market Numbers

By Glen Bell (510) 333-4460

We’re beginning to see a change in the market place. So, I’d like to start by quoting an article posted by Realtor.com on September 30, 2021;

“After a wild year of unprecedented price increases, a worsening shortage of homes for sale, and cutthroat bidding wars where offers six figures over the ask price weren’t uncommon, conditions are finally normalizing. More homes are expected to go up for sale this season just as many would-be buyers are either priced out or so fed up after losing out on home after home that they’re dropping out of the running.”

“With more folks sidelined, some of the steam has been let out of the market. Prices aren’t rising by as much as competition is down and homes are taking a little longer to sell, giving buyers some breathing room.”

“It’s not like the market is soft,” says Lawrence Yun, chief economist of the National Association of Realtors. “It’s just moving away from that extreme frenzy.”

My current statistics are supporting these comments. We’re still seeing a strong sellers’ market. Just not as crazy as what we were seeing February through May. We’ve seen a 48% increase in our inventory since the end of May and yet a 9.2% drop in pending sales.

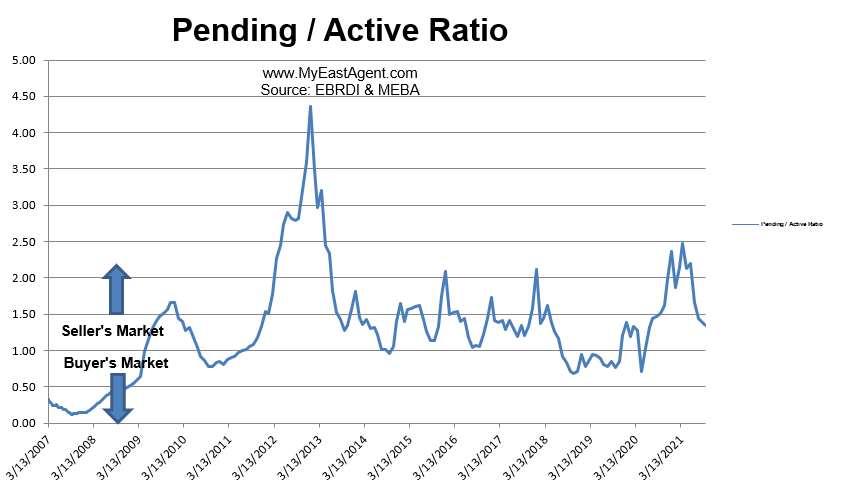

The pending/active ratio has been a benchmark that we’ve used as a measure of supply and demand to determine whether we’re in a buyer’s or a seller’s market. Typically, a number well above 1, (more inventory, or supply, with fewer pending sales, or demand) favors sellers. A number below 1 favors buyers. I rarely see this ratio go over 2 and yet it’s remained above 2 February through May, (during the height of our crazy, competitive and frenzied market this year). The pending/active ratio is currently at 1.34 still indicating a strong “sellers’ market. However, this ratio has been steadily coming down from its’ high in March of 2.47.

“Things are settling down. There will still be some multiple offers, but it will be less tense,” says Lawrence Yun, chief economist of the National Association of Realtors®. He expects the days of homes receiving 20 to 30 offers are becoming a thing of the past. “And some homes are lingering on the market for a week or two without an offer.”

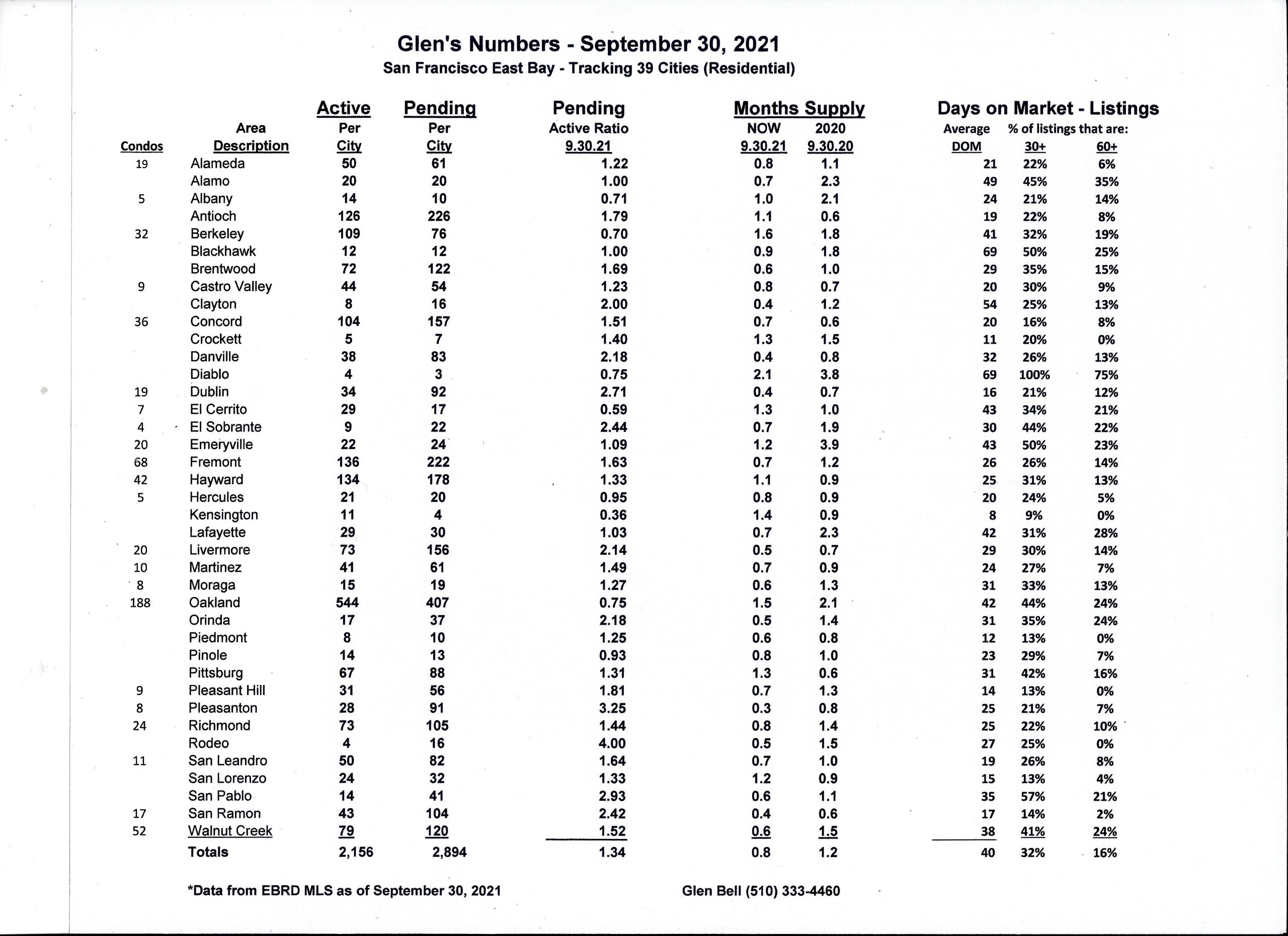

The average days on market are now up to 40 days for the East Bay listings, up considerably from its’ low in April of 16 days on market. The per centage of homes “sitting” for 30 days or longer is now 32%, up from it’s low in April of 17%. The bottom line is that homes are taking longer to sell and more are sitting.

Asked “Will home prices fall?

The question on the minds of sellers, buyers, homeowners, and just about everyone else is whether prices might actually fall. Sorry, buyers, that likely won’t happen anytime soon.

“You’ve still got a lot of young people who have still not bought a home but who would like to,” says Realtor.com Chief Economist Danielle Hale. “Anytime the market starts to cool, you’ve got people on the sidelines waiting for their chance to get in. That keeps both home sales and home prices from declining too much.”

She expects more homes to hit the market in October and through the end of the year. But it won’t be enough to ameliorate the problem of demand.

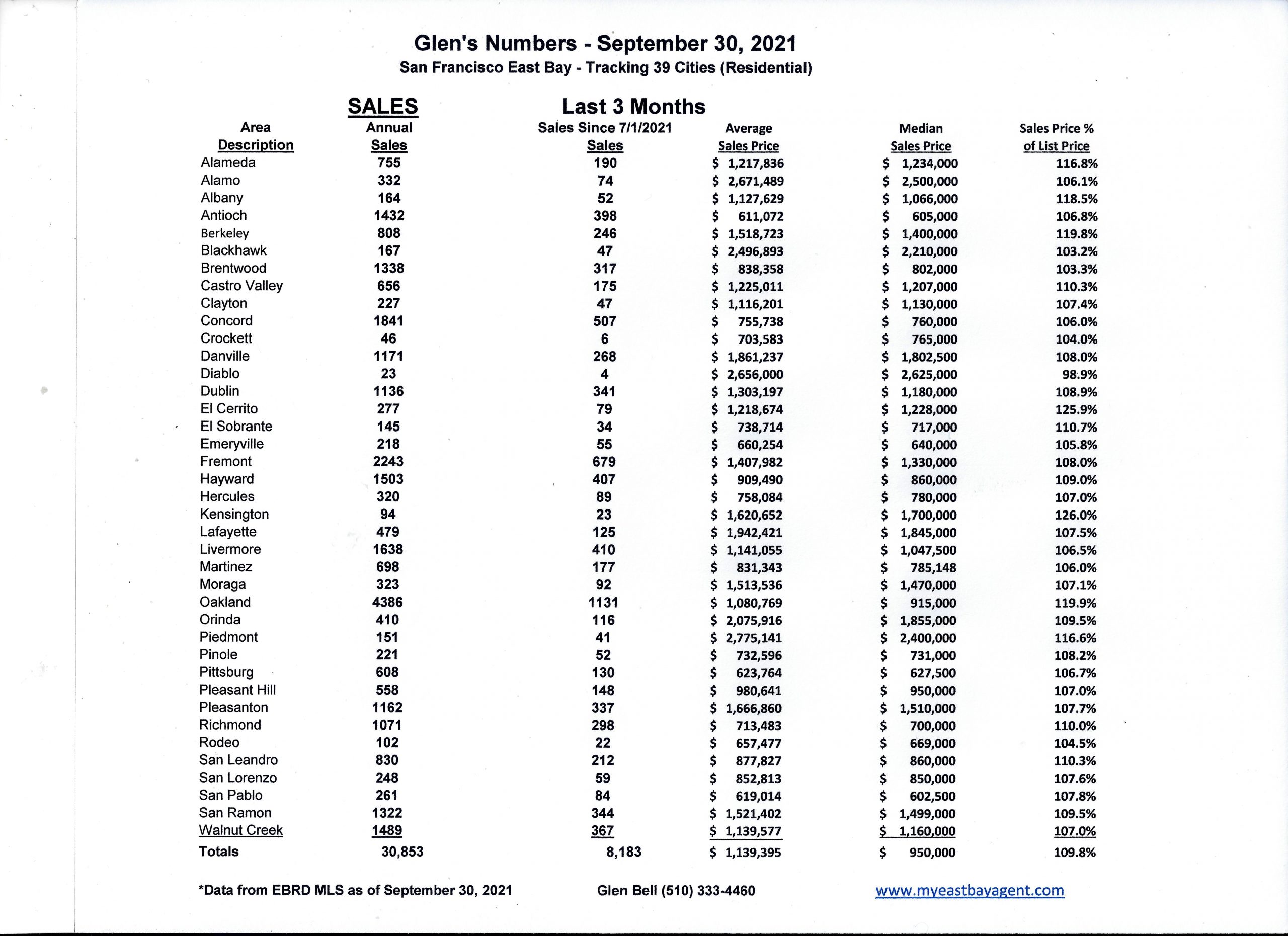

Here are some highlights for the 39 East Bay Cities that I track:

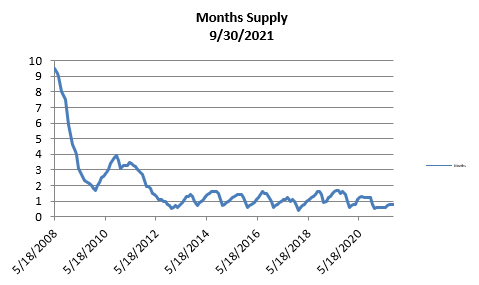

- The month’s supply for the combined 39 city area is 24 days. Historically, a 2 to 3 months’ supply is considered normal in the San Francisco East Bay Area. As you can see from the graph above, this is normally a repetitive pattern over the past four years.

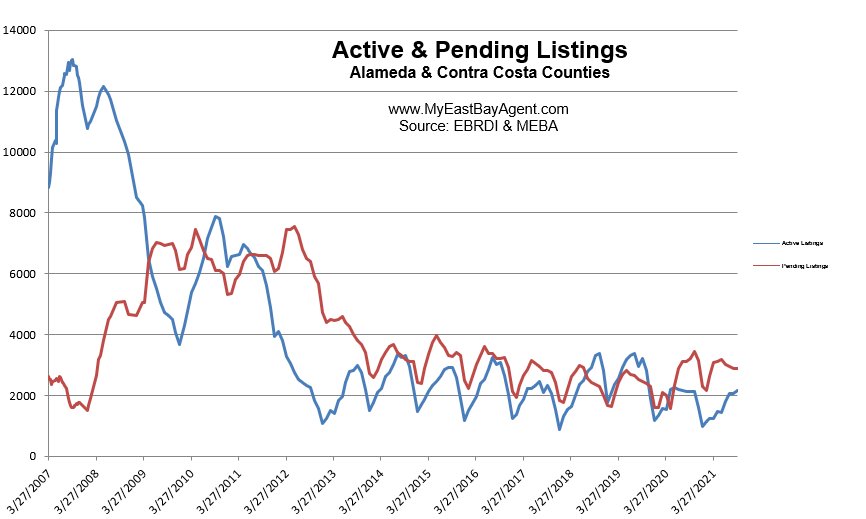

- Our inventory for the East Bay (the 39 cities tracked) is now at 2,156 homes actively for sale. This is roughly what we saw last year at this time, of 2,129. We’re used to seeing between 3,000 and 6,000 homes in a “normal” market in the San Francisco East Bay Area. Pending sales decreased to 2,894, lower than what we saw last year at this time of 3,205.

- Our Pending/Active Ratio is 1.34. This is down from our high of April of 2.47. Last year at this time it was 1.51

- Sales over the last 3 months, on average, are 9.8% over the asking price for this area, much higher than what we saw last year at this time, of 3.1%.

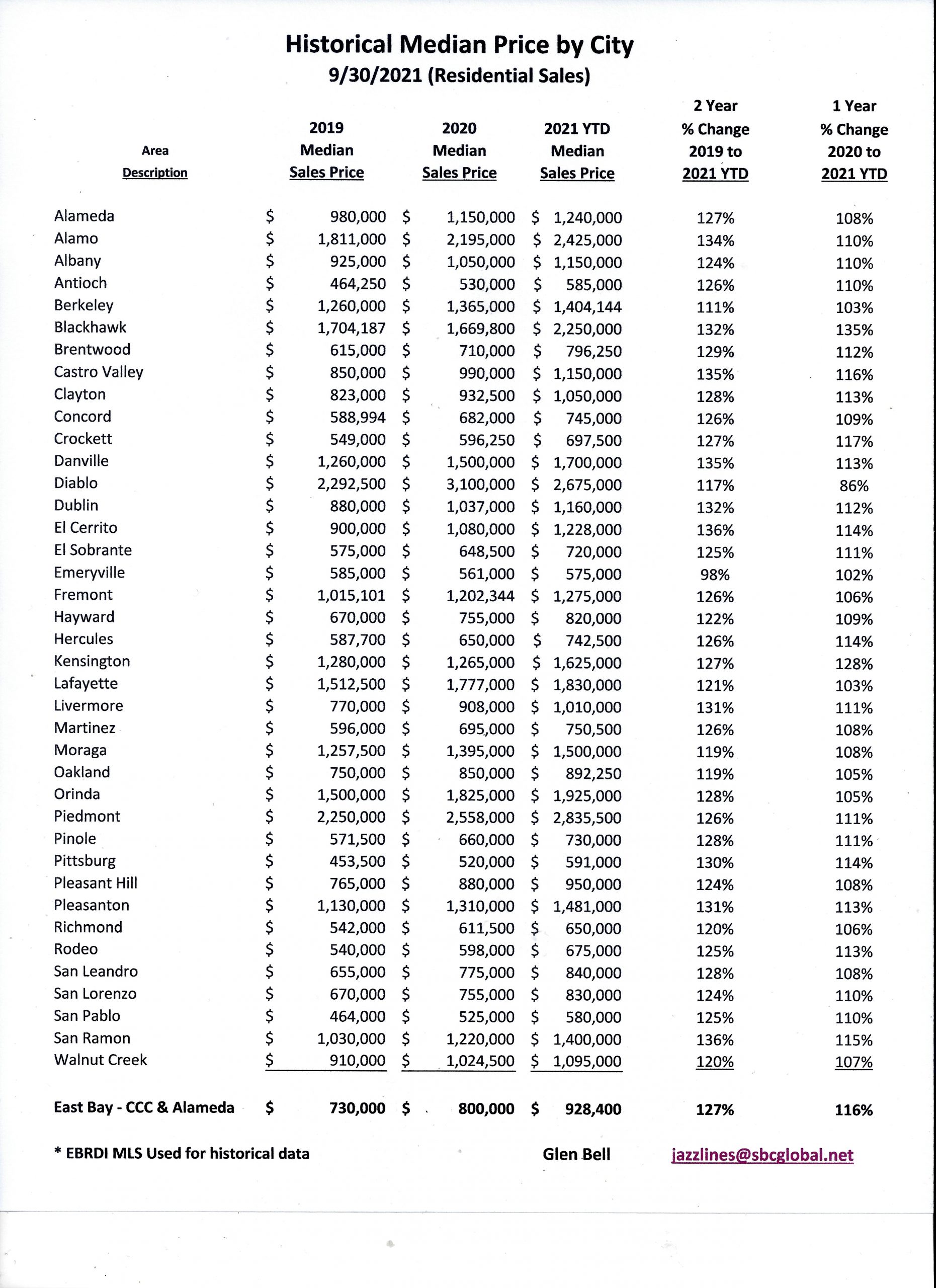

We’ve experienced such a big price increase this year, that I had to ask myself by how much. So, to give us an idea, here’s a spreadsheet showing the historical annual median price broken down by city. 2021 shown is year to date, through September 30th of this year. Keep in mind that these numbers will probably come down some due to seasonal influences where median price typically lowers as we approach the holidays.

Recent News

The Fever Has Broken’: Is the Housing Market Frenzy Really Going To Cool Off This Fall?

By Clare Trapasso, Realtor.com, Sep 30, 2021

Over the next few weeks and months, the long-overheated U.S. housing market is expected to continue to cool off in the bracing chill of autumn.

After a wild year of unprecedented price increases, a worsening shortage of homes for sale, and cutthroat bidding wars where offers six figures over the ask price weren’t uncommon, conditions are finally normalizing. More homes are expected to go up for sale this season just as many would-be buyers are either priced out or so fed up after losing out on home after home that they’re dropping out of the running.

“The fever in the housing market has broken,” says Ali Wolf, chief economist of building consultancy Zonda. “There have been buyers that have just been beat down for the last six months—and after losing so many homes and going through the emotional roller coaster, they’ve decided to stop searching for now. There are more homes on the market than there were six months ago.”

During the COVID-19 pandemic, record-low mortgage interest rates, below 3%, helped many homebuyers to absorb prices that reached all-time highs in the spring and summer. But prices rose so high so quickly that even bargain mortgage rates couldn’t offset them enough to give buyers some needed financial relief.

With more folks sidelined, some of the steam has been let out of the market. Prices aren’t rising by as much as competition is down and homes are taking a little longer to sell, giving buyers some breathing room.

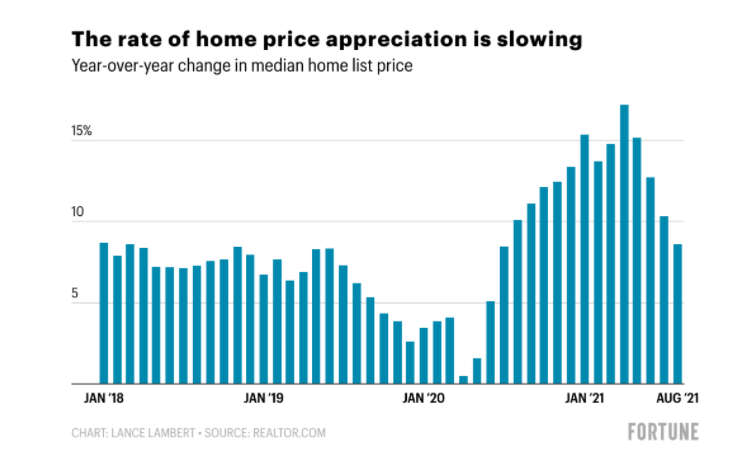

In September, the rate of year-over-year growth was halved, to 8.6%, down from its peak of 17.2% in April, according to Realtor.com® data. This means the median list price of a home grew half as fast as in the spring. Homes also took a bit longer to sell, at about 43 days. While that’s down 11 days from the same month last year and 22 days from 2019, it’s up 6 days from June.

“Things are settling down. There will still be some multiple offers, but it will be less tense,” says Lawrence Yun, chief economist of the National Association of Realtors®. He expects the days of homes receiving 20 to 30 offers are becoming a thing of the past. “And some homes are lingering on the market for a week or two without an offer.”

This fall, buyers may once again be able to include contingencies in their offers, such as requiring home inspections and appraisals, and still win out bidding wars. They may even—gasp—get homes at the list price.

All-cash offers could also dip if buyers don’t need to cash out their savings, stocks, and cryptocurrency stashes to stand out from the competition.

“It’s not like the market is soft,” says Yun. “It’s just moving away from that extreme frenzy.”

The changes in the housing market may be coinciding with the seasonal slowdown. Typically, competition is fierce in the summer as families battle over larger homes in the suburbs, hoping to secure residences and settle in before the kids start school. Then the market slows down with less competition for the smaller homes that traditionally go up for sale.

Yun expects annual price increases will slow to a more normal level, around 5%, versus the double-digit price hikes that reigned earlier in the year. But this may not be true for every home in every part of the country.

“If you want a reasonably priced home in a desirable area, be ready to still face stiff competition,” says Zonda’s Wolf.

Will home prices fall?

The question on the minds of sellers, buyers, homeowners, and just about everyone else is whether prices might actually fall. Sorry, buyers, that likely won’t happen anytime soon.

The nation is still suffering from a severe housing shortage resulting in more buyers than there are abodes for sale. This is a continuing hangover from the Great Recession’s aftermath, when builders largely held off on building while investors bought up single-family homes and turned them into rentals. Meanwhile, the millennial generation is larger than the previous one, meaning there are more prospective buyers than there were a decade or so ago.

There’s plenty of pent-up demand for homes.

“You’ve still got a lot of young people who have still not bought a home but who would like to,” says Realtor.com Chief Economist Danielle Hale. “Anytime the market starts to cool, you’ve got people on the sidelines waiting for their chance to get in. That keeps both home sales and home prices from declining too much.”

She expects more homes to hit the market in October and through the end of the year. But it won’t be enough to ameliorate the problem of demand.

The nation is still short about 5 million homes, Hale says. As builders can’t get them up fast enough, she expects it will take between five and six years before there are enough homes for sale to meet demand.

New construction is beginning to pick up after months of builders contending with shortages in lumber, labor, materials, and appliances. While there are still delays compared with before the pandemic, there was about a 5% uptick in construction in August compared with July, says Zonda’s Wolf.

“Inventory is still very, very tight,” says Wolf. But “we’re up from the bottom. We expect to see a little more inventory trickle onto the market through the end of this year and into next year.”

Rising mortgage rates will likely keep high prices under control

Rising mortgage interest rates are expected to keep price growth in check: After all, buyers can afford to fork over only so much for their monthly housing payments. So if rates rise, buyers won’t be able to afford more expensive properties.

This could result in lower price growth, or prices going flat or even dipping a little in certain markets.

“Once mortgage rates push up a little bit, it’s going to combine with higher home prices to price people out of the market,” says Mark Zandi, chief economist of Moody’s Analytics. “Some markets could see prices go down a little, like in the most juiced markets. … [But] it’s not a crash.”

Rates are expected to top 3% by the end of the year and reach 4% by the end of 2022, says Joel Kan, an economist at the Mortgage Bankers Association. They averaged 2.88% for a 30-year fixed-rate loan in the week ending Sept. 23, according to the most recent Freddie Mac data.

Historically speaking, even 4% is still low. Over the past 20 years, mortgage rates averaged about 5%, according to MBA. The difference between a 3% and a 4% rate on a $380,000 home (the median list price nationally) was about $169 a month on a 30-year fixed-rate loan. That adds up to nearly $61,000 over the life of the loan.

“We’re expecting rates to increase moderately over the next 12 months,” says Kan. “As the economy improves, as the job market improves, typically that pushes rates higher. [But] there is a little bit more uncertainty now, given that we’ve seen the pandemic linger longer than we expected.”

How will the fall market affect home sellers?

While experts predict the housing market will remain firmly in the seller’s court, the days of picking prices out of thin air are likely coming to an end. The same goes for not making any improvements to a property (let alone having it properly cleaned) before listing it.

“Some sellers got a little too greedy or had a misconception about the market conditions,” says NAR’s Yun.

Zonda’s Wolf recommends sellers look at comps of other homes in their neighborhoods that have recently sold to get a realistic idea of what they can charge for their properties. They should also get their homes in tiptop shape. And while they may not get 20 offers like their neighbors may have received a few months ago, well-priced, move-in ready homes are in high demand.

“If you’re a seller today, you’ll likely still get top dollar, but you’re still going to have to put in the work,” adds Wolf. “Dust for cobwebs, stage the home, put on a fresh coat of paint.”

Where home prices are going next, according to forecast models

BY LANCE LAMBERT, Fortune, September 21, 2021

The COVID-19 housing market—underpinned by remote work, pandemic-induced low mortgage rates, and a demographic wave of first-time homebuyers—has been among the hottest in the nation’s history. Since the onset of the crisis, median home list prices are up 23%.

Recently, some of that exuberance has finally left the market. Indeed, since bottoming out this spring, housing inventory is up 30% as some homebuyers start to balk at record prices, and more sellers—who fear losing out on big gains—are listing. While the market is clearly still a seller’s market, it has inched a bit in buyers’ favor in recent months.

But what does softening in the housing market mean for home price growth?

The consensus among the industry’s forecast models is that we’re headed for slower growth, albeit still positive. The weakest projection comes from real estate research firm CoreLogic, which is forecasting just a 2.7% appreciation in the coming 12 months. Meanwhile, John Burns Real Estate Consulting and Freddie Mac—which do calendar year forecasts—project home price growth of 4% and 5.3%, respectively, in 2022.

“Annual home price growth was the most that we have ever seen in the 45-year history of the CoreLogic Home Price Index. This price gain has far exceeded income growth and eroded affordability, wrote Frank Nothaft, chief economist for CoreLogic, in his latest market outlook report. “In the coming months this will temper demand and lead to a slowing in price growth.”

Already, we’re starting to see this slowing appreciation materialize in the market. Between April 2020 and April 2021, median home prices on Realtor.com skyrocketed 17.2%. But over the most recent 12-month period, that rate was just 8.6% year over year. While this represents numerical “softening,” it’s easy to imagine how it might not feel like it to the typical homebuyer. After all, 8.6% is still well above most Americans’ annual pay bump.

How can home prices keep rising after posting such large gains? It all comes down to supply and demand. As Fortune has previously reported, we’re in the middle of the five-year period during which the largest chunk of millennials, those born between 1989 and 1993, are hitting their thirties—the age when first-time homebuying really kicks into gear. Meanwhile, housing supply is simply outmatched: Reeling from the 2008 housing bust, homebuilders spent the past decade playing it safe rather than aggressively building what this demographic wave would need. As a result, the U.S. is now under-built by around 4 million homes, according to a recent analysis by Freddie Mac.

But strong fundamentals don’t mean the market is free of risk.

The biggest wild card is Federal Reserve Chair Jerome Powell. If inflation-concerned central bankers raise interest rates sooner than expected, it would translate into downward pressure on real estate prices.

The second unknown is tied to the end of federal pandemic protections. At the end of September, the mortgage forbearance program—which currently protects 1.5 million homeowners—will begin to wind down. Some of those struggling borrowers could opt to sell their home. The latest forecast by Zillow estimates 25% of those forbearance mortgage holders will list their home. While that would certainly increase housing inventory, it wouldn’t fundamentally change the current market. However, Zillow researchers write if they’re wrong, and it’s actually 50% of forbearance borrowers who list their homes, then the market would see “a significant deterioration from current conditions.”

Zillow Market Pulse:

By Matthew Speakman on Sep. 17, 2021

The housing market remains very competitive but slowing home value appreciation indicates that the frenzy from earlier in the year is quieting down. An increase in for-sale inventory reinforces this narrative and looks to be increasing home shopper confidence. Interest rates remain low, but trended firmly upward toward the end of the week in anticipation of a Fed announcement.

Home value growth cools even as annual appreciation sets new records

- The national Zillow Home Value Index (ZHVI) increased by 17.7% in August from a year ago.

- Monthly ZHVI appreciation cooled 0.22 percentage points from July to 1.75%.

Inventory levels grow for a fourth straight month, coinciding with an uptick in home purchase applications

- More than 1.1 million homes were for sale in August, up 4.1% from July.

- Applications for home purchase mortgages increased by 7.6% last week from the week before, according to the Mortgage Bankers Association.

Mortgage rates end the week higher in anticipation of a key Fed announcement

- Mortgage rates now sit at their highest level in about two months.

- Investors believe that the Federal Reserve could announce plans next week to tighten monetary policy.

So what?

- As the summer nears its end, the housing market remains very warm, but it has gotten distinctly cooler from earlier in the year. Home values continue to grow at a record-fast annual pace: The nation’s typical home value – as measured by the Zillow Home Value Index (ZHVI) – grew 17.7% in August from the same month in 2020, setting a new all-time high annual growth rate for the fourth straight month. The typical home value in the US in August has increased by more than $45,000 from a year ago. But while the annual appreciation continues to set new records, monthly home value growth has begun to soften. National ZHVI increased by 1.75% in August from July, a slower monthly pace than the 1.97% monthly clip registered in July. While monthly ZHVI appreciation in August was the third strongest month-over-month reading in Zillow data history, the one-month deceleration from July the sharpest since July 2020. Taken together, the figures illustrate that the housing market remains very competitive, but that it is also actively cooling from its white-hot state. Leading indicators of home price growth reinforce this dynamic. Of the for-sale listings that went pending last week, 78% of them did so after being on the market for fewer than 30 days. That’s down from a high of more than 85% earlier in the year, but still more than 25 percentage points higher than the shares in the same weeks in 2018 and 2019.

- The softening home price pressure is due in part to increasing levels of for-sale inventory. After consistently plumbing new lows for almost a year, the number of for-sale homes on the market has risen for four consecutive months. While inventory levels are still down significantly (22.7%) from a year ago, the recent uptick in listings has afforded eager home shoppers more options and appears to have assisted in boosting their confidence. The share of people who believe it is a good time to buy a home – as measured by Fannie Mae – ticked up four percentage points in August from July, the first monthly improvement since March. The measure remains near all-time lows, but the monthly improvement was an encouraging sign for the market. And this increased optimism is also showing signs of materializing into home purchases. The Mortgage Bankers’ Association’s index of home purchase mortgage applications increased by 7.6% last week from the week prior. The measure – a leading indicator of home sales in the coming months – has improved in six of the last eight weeks and now sits at its highest level since April.

- One trend that could threaten this budding momentum in home sales activity are recent increases in mortgage rates. Rates had stayed relatively flat for the last few weeks, but they ended the week by making some sharp upward moves and now sit at their highest level since July. The upward momentum came even as a key reading on inflation showed price growth slowed last month, indicating that sky high inflation may finally be starting to cool (though other measures of inflation suggest that price growth may be accelerating and broadening beyond a few select industries). Inflation is a key factor for mortgage rate movements, as rising prices weaken the value of bonds, causing yields to rise and, usually, mortgage rates to follow suit. Whether or not mortgage rates will continue this upward momentum or revert to recent lows will depend more heavily on a key policy announcement next week from the Federal Reserve. The Fed has hinted they may announce a planned shift toward tighter monetary policy this month, but recent weaker-than-expected reports on the labor market and other key sectors, as well as the ongoing surge in COVID cases across the country, may have weakened their case. For now, mortgage rates remain very low and will likely continue to offer attractive financial conditions for housing market shoppers looking to buy their home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link